Analysts expect Infosys to post one of the strongest revenue growth figures among Tier-I IT services companies when it reports its number for the fiscal second quarter on October 17.

A strong deal pipeline, stable demand and the Bengalur-based firm’s cost management initiatives are expected to aid the September quarter performance, especially operating margins.

Here are the top five themes to watch out for in Infosys’ Q2 earnings:

Revenue growth & guidance

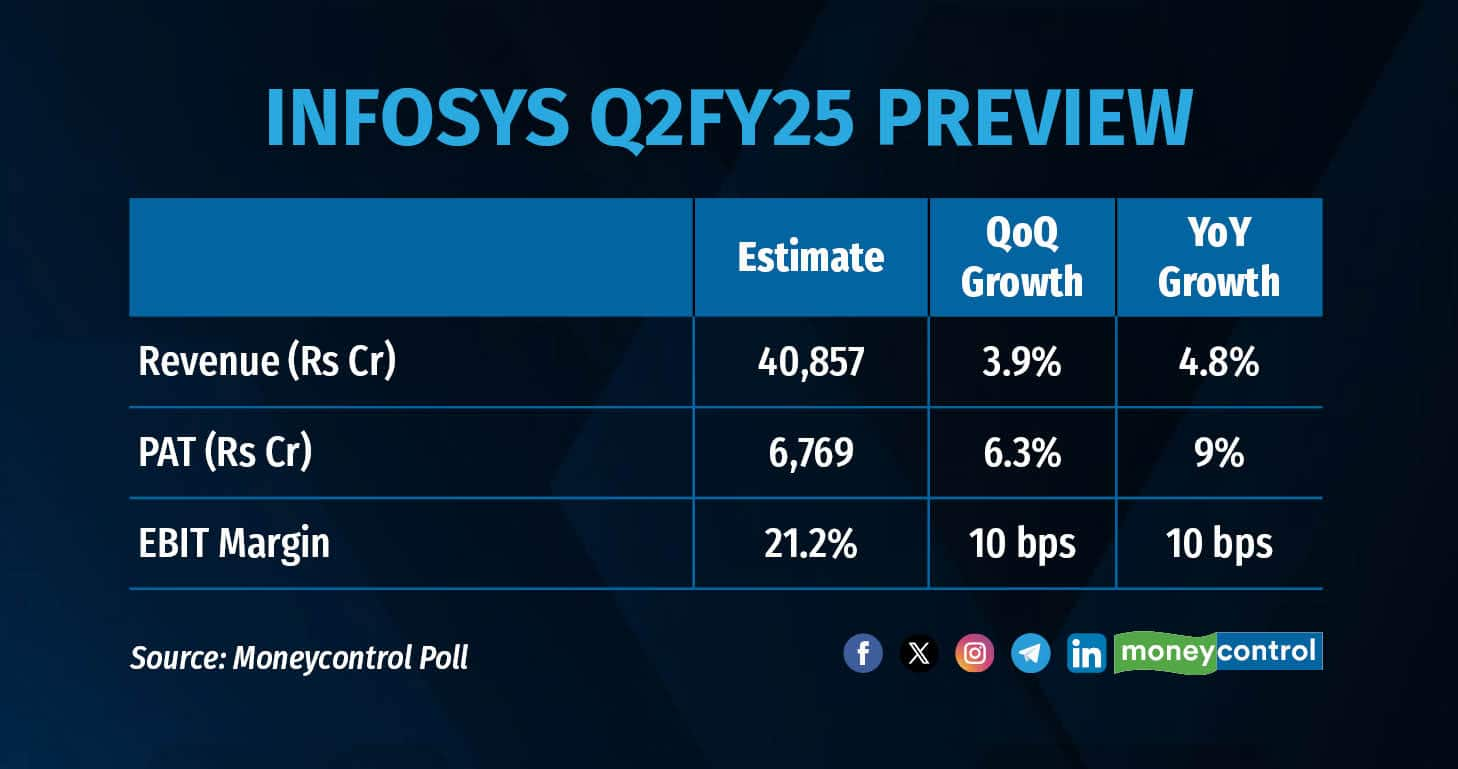

Infosys is expected to deliver strong revenue growth, outpacing many of its peers. Brokerages foresee a 3.9 percent sequential revenue growth at Rs 40,857 crore, on the back of large deal ramp-ups and robust demand in key sectors such as banking, financial services and insurance (BFSI).

“Revenue growth is expected to be 3% QoQ CC, on account of ramp-up of large deals won last year,” brokerage Motilal Oswal Financial Services said in its pre-earnings note. Most analysts have also included about a percent of revenue from the Intech acquisition.

On April 18, India’s second-largest IT services company announced the acquisition of In-tech, an engineering R&D services provider with a focus on the German automotive industry.

Almost all brokerages expect Infosys to increase its FY25 revenue growth guidance to 4-5 percent from 3-4 percent.

In a surprising move in Q1, the Infosys revised its FY25 revenue guidance to 3-4 percent from 1-3 percent. It has revised its revenue growth guidance six times in the last seven quarters.

Margin expansion

The Street believes that Infosys' margin performance will improve in July-September, driven by cost optimisation efforts. Infosys’ operating margin is expected to improve by 10 basis points (bps) to 21.2 percent, an average of estimates provided by 11 brokerages show.

It has been largely attributed to lower onsite costs, improved utilisation rates, and better operational efficiencies. “EBIT margin is likely to improve ~35bp QoQ driven by operating leverage and Project Maximus,” Nuvama said.

Project Maximus is a margin improvement plan introduced by Infosys to optimise costs by offsetting headwinds and driving profitability in the medium term.

In Q1, Infosys said several pillars of Project Maximus contributed to margin improvements.

Margins are also likely to improve as a result of salary hikes being deferred to the December quarter.

As reported by Moneycontrol, several IT companies have shifted wage hikes to the third quarter to manage costs and sustain profitability amid a sluggish demand environment.

Apart from Infosys, HCLTech, LTIMindtree and L&T Tech Services, too, have deferred hikes.

Demand environment, deal momentum

The Street would be tracking the management commentary on the demand environment, especially on the discretionary spending front.

In the June quarter, chief executive officer Salil Parekh said discretionary spending was still low from where it was several quarters ago. "We don't have a view... what will happen at the end of the financial year," he had said.

Infosys’ bigger rivals Accenture and Tata Consultancy Services have both highlighted that discretionary demand is yet to see a meaningful recovery, while HCLTech has seen some signs of improvement.

“Spending has been weak for close to 18 months with no clear signs or catalysts for increase. Expect investor focus on the same,” Kotak Institutional Equities said.

Deal momentum continues to be a key driver of growth for Infosys and analysts expect this to be reflected in its Q2 performance. Brokerages point to likely strong deal wins, particularly in the BFSI and manufacturing verticals.

Kotak, however, expects large deal Total Contract Value (TCV) at $3 billion, a sharp drop from previous quarter’s $4.1 billion. In the year-ago quarter, the company posted $7.7 billion in TCV on the back of three large deals.

“YoY decline is due to high base that included mega-deals. QoQ decline is largely normalisation of deals after bumper announcements in earlier quarters,” Kotak said.

Third-party/pass-through revenues

Infosys' third-party and pass-through revenues have gained attention from analysts, especially in the context of vendor consolidation and outsourcing trends.

Pass-through revenue refers to income that is collected on behalf of clients and typically arises when IT firms include third-party costs such as software licences, cloud services, etc., in their billing to clients.

Kotak said it would monitor revenue composition of third-party items. One of the factors contributing to the improved performance of India's second-largest IT company in Q2 could be higher revenues from the sale of third-party software, it said.

Infosys stands to benefit from larger, more comprehensive outsourcing deals with clients increasingly consolidating their vendor lists, analysts say.

They, however, caution that rising subcontractor costs could impact margins in the coming quarters if not managed effectively. “We forecast sequential revenue growth of 3.2 percent led by…marginally higher revenues from the sale of third-party software, after a sharp dip in June 2024 quarter,” Kotak said.

Investors would want to understand how Infosys plans to manage its third-party and pass-through costs, safeguard its margins and its subcontractor strategy.

Employee metrics

Attrition and wage management are expected to be key discussion points, as the company deals with ongoing talent retention challenges.

Analysts say Infosys' attrition rates have been stabilising, thanks to competitive compensation packages and internal mobility programmes.

However, wage hikes remain a concern for margins and analysts will be keen to hear how the company plans to balance compensation with profitability in Q3, which is when the company plans to roll out increments.

"Most companies have deferred wage hikes to Q3 and beyond, which means H2FY25 margins would see headwinds from the wage front as well as furloughs," Motilal Oswal Financial Services said.

Another factor that has been troubling Infosys is the delay in onboarding freshers from the 2022 batches. The company has given at least 2,000 such offers, honouring its commitment when two years ago the company had to defer onboarding due to broader challenges.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.