The key performance metrics of the six banks for the third quarter of FY22 show that India’s lenders may just be able to deliver on the street’s earnings expectations. In that, the 4.5 percent gain in the Bank Nifty over the past month does not seem out of place.

Six banks of varied balance-sheet size and market capitalisation have released their December quarter growth numbers over the past three trading days.

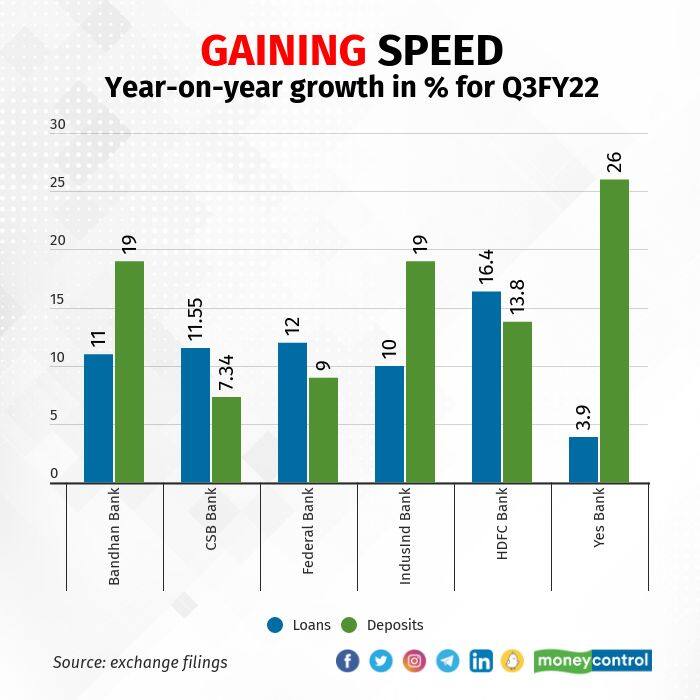

India’s youngest lender Bandhan Bank Ltd reported a healthy 11 percent year-on-year loan growth.

The most valuable lender HDFC Bank Ltd reported strong year-on-year loan growth of 16.4 percent, buttressed by a broad-based pick-up in disbursements.

Mid-sized Federal Bank Ltd reported a healthy 12 percent and IndusInd Bank Ltd a slower 10 percent loan growth.

Yes Bank Ltd struggled to shore up its numbers. It reported a mere 3.9 percent loan growth.

Analysts point to a phase of consolidation in the wake of the coornavirus pandemic wherein large lenders are eating away at the market share of small ones. Balance-sheet heft has never mattered more.

On deposits, banks have shown stronger performance.

Yes Bank may have stumbled on loan growth but reported a stellar 26 percent year-on-year deposit growth. Even on a sequential basis, the lender’s deposit growth was the fastest among the six banks.

Most lenders are expected to have witnessed a high double-digit deposit growth in the quarter. CSB Bank Ltd, however, has been unable to show a healthy performance with deposits growing just about 7.3 percent. The bank’s deposits were flat on a sequential basis

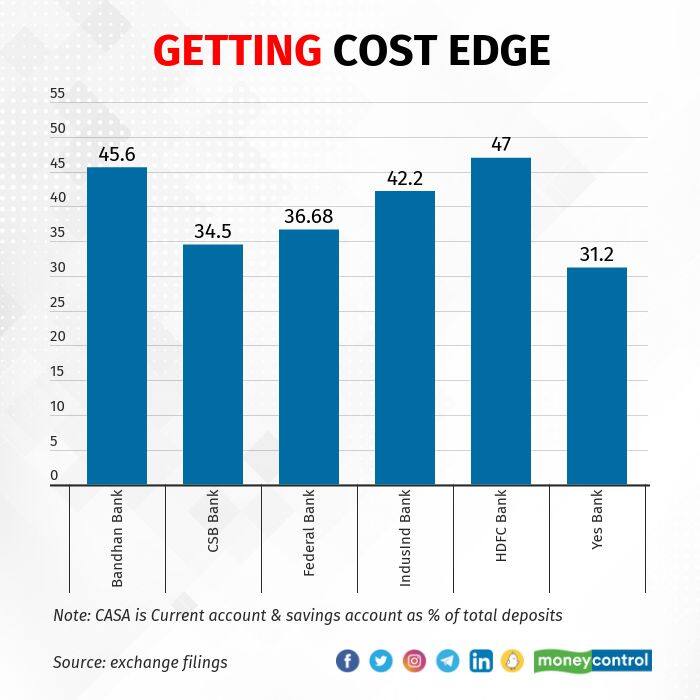

Low-cost current account and savings account have also shown decent growth for most lenders. This augurs well for margins.

While balance-sheet numbers seem to meet expectations, the valuations of these lenders haven’t captured the expected earnings improvement yet.

For instance, HDFC Bank’s shares have hardly gained after the release of the numbers. The share underperformed the broad market in 2021 despite showing sharp improvement in growth.

The HDFC Bank share trades at three times the estimated book value for FY23, according to analysts at Jefferies India Pvt Ltd. This is lower than that of Kotak Mahindra Bank, whose shares trade at 4.4 times estimated FY23 book value. Yes Bank shares, on the other hand, have gained 8 percent, so far, this week.

A key metric that may swing the fortunes is the delinquencies and the performance of restructured loans. Restructured loan pile had risen for most lenders in Q2FY22.

How lenders manage the restructured pile and their provisioning cushion will determine valuations going ahead.

“Improved growth, stable asset quality and manageable Omicron impact will aid rerating. Lenders should avoid self-goals to reduce noise,” Jefferies’ analysts wrote in a January 4 note.

That said, analysts believe that the valuations of most banks are reasonable despite the recent spike in share prices.

Analysts expect lenders to report an improvement in earnings for Q3FY22 and for the full financial year. “Earnings are likely to pick up, led by recovery in business growth / fee income and a gradual reduction in credit costs,” said analysts at Motilal Oswal Financial Services Ltd in a preview report.

A valuation boost may be imminent for banks but investors would do well to wait for the details of bad loans in the coming weeks.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.