Madhuchanda Dey

Moneycontrol Research

Axis Bank reported a satisfactory Q1 FY19, in line with what the management had guided earlier. The key highlights were: strong core performance, growth making a comeback, stable margin and improving asset quality with much lower slippage. With the stressed pool now closely scrutinised and well defined, asset quality woes should stop haunting the bank from the second half of FY19. The coming fiscal could be a promising for this well-capitalised entity, backed by a robust low-cost deposit profile, as it aggressively captures market share vacated by its state-run peers. While the top management change is a near term uncertainty, it is unlikely to derail the journey. We see value in the stock, which is trading at 1.9 times FY20e book.

Quarter at a glance

The reported number masks strength in the result. Net interest income (the difference between interest income and expense) grew 12 percent year-on-year (YoY) driven by 14.4 percent growth in advances and a 37 basis points (bps) reduction in interest margin to 3.46 percent.

Margin improved sequentially (quarter-on-quarter) thanks to interest realisation (17 bps impact) from recovery on list 1 accounts (Rs 249 crore) in the Insolvency & Bankruptcy Code (IBC). As the marginal cost of lending rate (MCLR) linked credit book reprices itself, the bank sees stability in margin going forward.

Result snapshot

Reported non-interest income (NII) was soft on account of a marked drop in treasury income from Rs 824 crore in the year-ago quarter to Rs 103 crore. Core fees grew 6 percent, supported by granular retail fees that now forms 61 percent of total fees. Non-interest income received a huge boost from recovery in written-off accounts. Operating expense growth was well contained.

Adjusting for treasury income, core operating profit rose 23 percent YoY to Rs 4,269 crore, although the reported pre-provision profit grew a modest 2 percent.

Provision was elevated YoY as the bank fully provided for the mark-to-market loss on its bond portfolio due to hardening of bond yields (impact Rs 135 crore). It improved its provision cover (provision on total non-performing assets) to 69 percent from 65 percent in the preceding quarter. The bank intends keeping provision cover at this level, but as slippages decline, credit cost should move towards normalcy (likely in H2 FY19).

Reported profit after tax of Rs 701 crore was lower by 46 percent from the year-ago quarter.

Asset quality: End near

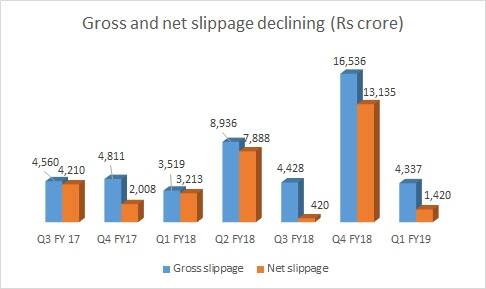

Asset quality that had been a pain point for a while showed marked improvement with the gross slippage declining to Rs 4,337 crore.

Source: Company

Of this, close to 51 percent (Rs 2,218 crore) was corporate slippage. It is worth noting that 88 percent of the corporate slippage was from erstwhile declared BB and below book. Gross slippage from the non-corporate book was Rs 2,219 crore, suggesting a delinquency rate of close to 3.3 percent. The management clarified that this was due to stringent recognition norms in retail accounts and much lower net slippage in retail and small and medium enterprise (SME) segments.

The management carried out a closer scrutiny of its books, which resulted in fresh asset downgrade to the tune of Rs 4,609 crore to the pool of BB and below book. The management believes the rating downgrade cycle has now normalised.

Consequently, the total asset pool below BB has shown a sequential increase to Rs 10,396 crore (2.1 percent of gross customer assets). The total stressed asset pool (that also includes restructuring) now stands at Rs 12,236 crore (2.5 percent of net customer assets), a sequential increase of Rs 3,130 crore.

While the downgrade cycle is largely over, the management expects another quarter of elevated slippage and has guided to credit cost normalisation to its historic average of close to 110 bps in H2 FY19.

Strong business growth

Business growth numbers remain strong. Deposits and credit have both grown in teens. The bank has managed to maintain its credit-to-deposits (C/D) ratio when competitors have been running a higher ratio, which normally exerts pressure on margin.

In the past one year, it has improved its absolute market share in deposits and advances to 1.7 percent and 2.1 percent from 1.5 percent and 1.9 percent, as its incremental market share was strong at 3.3 percent and 3.5 percent, respectively.

While growth in low-cost current and savings accounts (CASA) lagged overall deposit growth in the quarter under review, leading to a sequential decline in CASA ratio to 47 percent, the bank saw a smart growth in term deposits. The share of CASA and retail term deposits in total deposits stood at 81 percent. Given that 50 percent of its book follows MCLR, with 63 percent getting re-priced after 6 months, rising rates will positively impact lending yields going forward. Hence, the rise in term deposits should not impact margin negatively.

De-risking the lending bookThe lending book is well diversified with the share of corporates at 39 percent and has grown slower than overall advances. The book itself is de-risked with working capital loans growing much faster. Around 78 percent of its corporate exposure and 94 percent of incremental lending is rated A or above.

Overall loan growth was driven by SME and retail segments. The SME book is dominated by working capital (78 percent), with 88 percent of exposure rated at least SME3, which indicates above average creditworthiness.

Improvement in the quality of incremental lending is borne out by slower addition to risk weighted assets. The ratio of risk weighted assets to total assets has fallen 600 bps in the past one year.

After a troubled past, Axis Bank appears to be staring at a much better FY20 that will see a huge spurt in earnings from normalisation of credit costs. With a strong liability profile giving it a cost of funds advantage, the bank is ideally placed to capture market share in advances thanks to the void created by state-run banks. Strength of its liability profile will allow it to grow without compromising on margin or quality. The bank is extremely well capitalised (capital adequacy ratio of 16.71 percent) to profit from this opportunity.

We see a profitable journey for this bank and hence recommend buying into the stock as it has potential to re-rate from the current valuation of 1.9 times FY20e book.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!