The profit after tax (PAT) for fast-moving consumer goods (FMCG) giant Hindustan Unilever Limited (HUL) is expected to increase marginally between 1 and 10 percent during the quarter ended March 2022 from a year ago. On a sequential basis, however, PAT is likely to remain flat. But some brokerages expect a mid-single-digit decline in PAT. The decline is attributed to the slide in rural and urban demand due to inflationary pressures which were made worse by the Ukraine crisis, while price hikes taken by the company to offset the input costs have resulted in diminishing of demand.

Brokerages expect HUL to report a standalone PAT of between Rs 2,050 crore and Rs 2,300 crore on April 27, when it will declare its results for the quarter ended March 2022.Revenues for the owner of some of the best brands in India are expected to increase by 6-10 percent on-year but are likely to remain flat on sequential basis.The company is expected to register standalone revenues of around Rs 13,000 crore.It had recorded a PAT of Rs 2,143 crore on revenues of Rs 12,132 crore in the corresponding quarter last year. Profit in the previous quarter came in at Rs 2,243 crore when its revenues stood at Rs 13,092 crore.Brokerage viewsExperts expect consumption to have seen some de-growth due to price hikes, with rural consumption seeing more impact than urban.Edelweiss Research anticipates the company’s revenue, earnings before interest, tax, depreciation and amortisation (EBITDA) and PAT to grow on-year at 7 percent, 4.5 percent and 0.9 percent respectively. The growth in revenues has been 22 percent in the last two years. “We expect 2 percent YoY volume decline on a base of 16 percent YoY (Q3FY22 saw 2 percent volume growth on base of 4 percent YoY),” Edelweiss said in a report.It estimates revenues of Rs 12,980 crore for the quarter, rising by 7 percent on-year but declining marginally by 0.8 percent sequentially.The company and the industry as a whole have been facing raw material price challenges, and crude oil and food inflation was further exasperated by the Ukraine crisis.According to Edelweiss, “HUL has taken three rounds of price hikes in Q4FY22 amounting to ~9 percent and will be taking more hikes, but crude oil at $115 is too sharp and quick. So, near-term margins for the entire sector will be under pressure.”The brokerage expects consumption to have seen some de-growth due to price hikes and the impact was more evident in rural consumption compared to urban. “Overall, we expect EBITDA margins to fall this quarter by 60 bps YoY and fall by 120 bps QoQ due to inflation to 23.8 percent,” Edelweiss said in its report.“We model 8 percent YoY revenue growth (+6 percent 3-year organic CAGR) with 2 percent YoY decline in UVG (underlying volume growth) (+1.6 percent 3-year CAGR),” a report from Kotak Institutional Equities said.It pegs the revenue at Rs 13,086 crore for the quarter, growing by 8 percent on-year and remaining flat on quarter.Kotak expects deterioration in rural and urban demand, weakness in beauty & personal care (BPC) and nutrition portfolio, market share gains for HUL and continued inflationary pressures partly offset by pricing. “We forecast – (1) 14 percent YoY growth in home care (+7.5 percent 3-year CAGR), (2) 6 percent YoY growth in BPC (+3 percent 3-year CAGR), and (3) 10 percent YoY revenue growth in foods & refreshments (F&R) portfolio.”EBITDA at Rs 3,159 crore is likely to improve 6.8 percent YoY but decline 3.7 percent sequentially.Kotak models a 160 bps YoY and 115 bps QoQ contraction in gross margins (GM) due to broad-based inflationary pressures. “We build in 24.1 percent EBITDA margin, down 90 bps QoQ and 25 bps YoY, led by GM decline and higher other expenses, partly offset by lower YoY media intensity (advertising expenses).”It forecasts a PAT of Rs 2,215 crore for the quarter, at an annualised growth of 5.3 percent, compared to the same period a year ago but a sequential decline of 3.4 percent.Emkay Research expects the company to witness a YoY revenue growth of 10 percent to Rs 13,290 crore. On sequential basis, the growth in revenue is seen at 1.5 percent. The growth in revenue is primarily due to pricing.Emkay expects “home & personal care to grow by 17 and 7 percent each, F&R and exports should grow by 5 percent each.”EBITDA at Rs 3,310 crore is seen improving by 12 percent on-year and 1 percent sequentially, while EBITDA margin at 24.9 percent is better by 55 bps on-year but is flat on sequential basis.“EBITDA margin is expected to improve by 55 bps YoY on the back of lower comparables and lower advertising and promotion spends,” Emkay added in its report.It pegs the PAT to jump 11 percent on-year and 1 percent sequentially to Rs 2,330 crore.

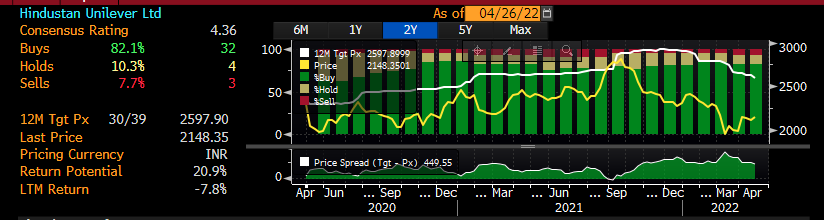

As per the above chart from Bloomberg, 32 brokerages have a 'buy' rating for the stock compared to 4 'holds' and 3 'sells'. The stock has a 12 month target price of Rs 2,597.90 with a return potential of 20.9 percent.

Disclaimer: The views and investment tips of investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.