Rakesh Damani-led Avenue Supermarts (DMart) is set to present its earnings report for the second fiscal quarter of FY25 on October 12. The base quarter saw low sales as a result of changing festive season dates, which will result in DMart seeing optically higher growth for this quarter.

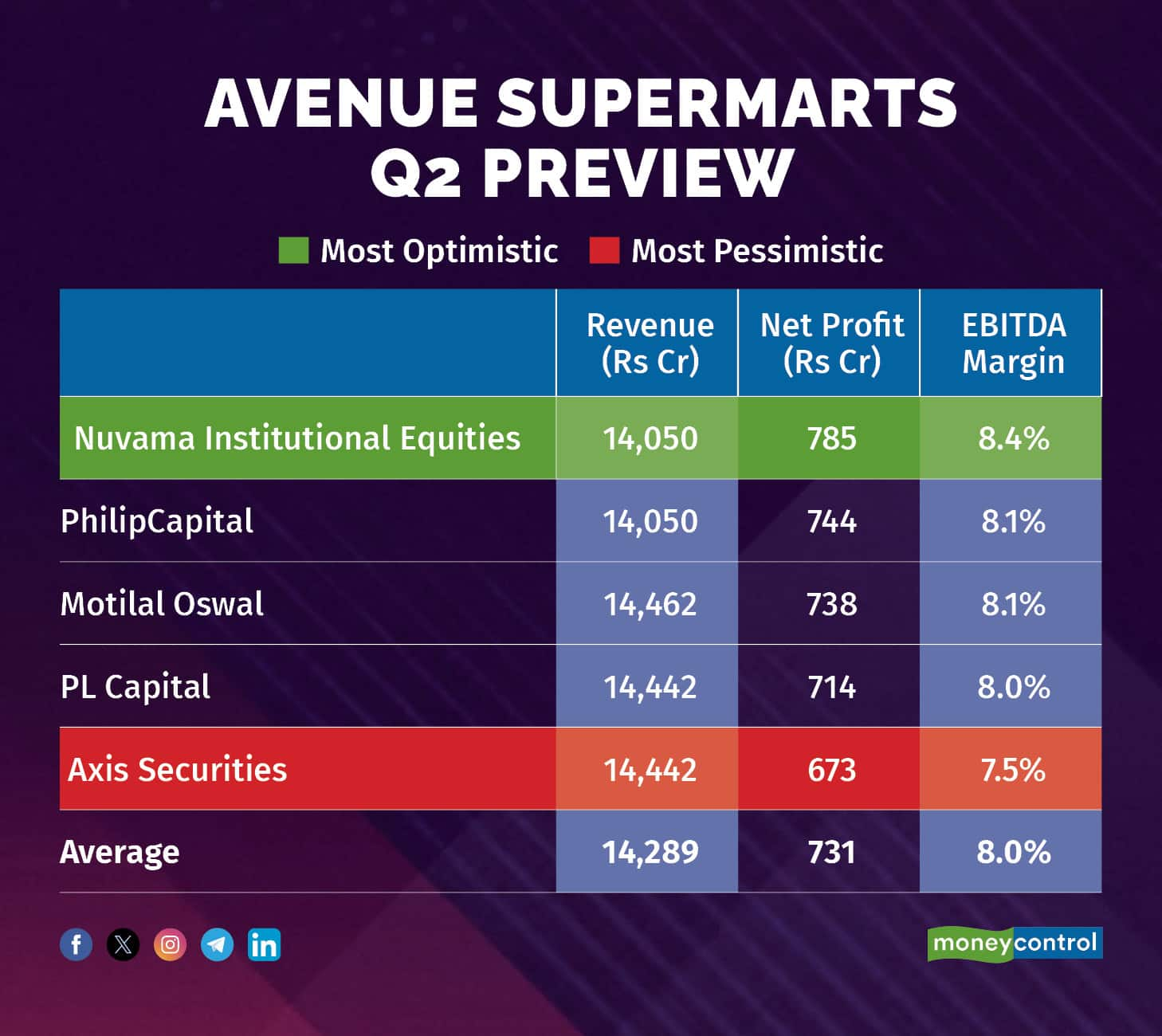

According to a Moneycontrol poll, the DMart parent is expected to record a 13.2 percent on-year rise in revenue to Rs 14,289 crore. However, in its business update for the quarter, DMart has already announced that revenues have risen 14 percent on-year.

Net profit is likely to surge 17.3 percent from Rs 623 crore in the corresponding quarter in the previous fiscal to Rs 731 crore.

Earnings estimates of analysts polled by Moneycontrol are in a narrow range, so any positive or negative surprises may elicit a sharp reaction in the stock.

What factors are driving the earnings?The factors driving the earnings will be store additions for the quarter, along with stable margins. However, revenue growth is expected to slow since sales growth seems affected due

to rains and delayed festival season.

Consumers Down-trade: Brokerages expect that value retailers are likely to perform better than premium retailers, as rural demand continues to improve. Additionally, high food inflation has caused consumers to down-trade to cheaper alternatives. As a result, DMart is

Store additions: During the quarter gone by, Avenue Supermarts added six stores over the quarter, taking its total store count to 377 stores across the country. In the same quarter of the previous financial year, DMart added 9 stores.Therefore, Q2FY25 saw lower openings compared to the base quarter.

Margins: According to Axis Securities, EBITDA margins are likely to contract as revenue growth slows, and employee costs along with other expenses weigh. However, according to the Moneycontrol poll, the EBITDA margin is likely to be flat at 8 percent.

What to look out for in the quarterly show?Analysts will likely focus on same-store sales growth (SSSG) and changes in revenue per square foot. Additionally, they will keep an eye on the difference between overall store revenue and revenue per square foot.

Further, for DMart, its store opening guidance in this challenging environment for retail companies will be watched.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.