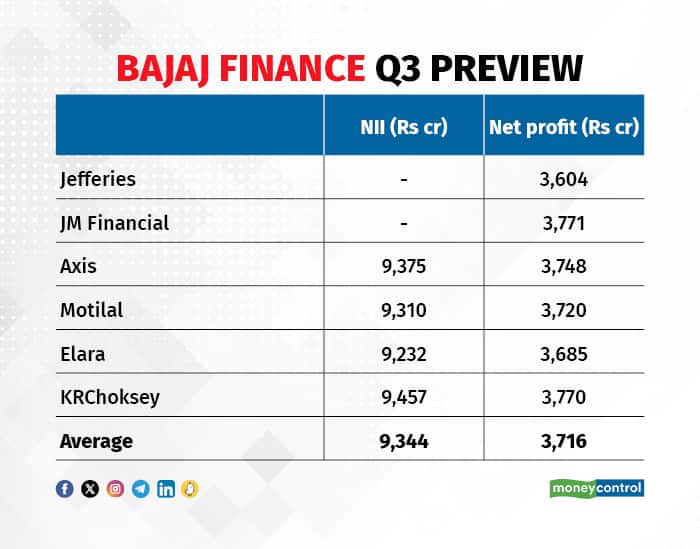

All eyes will be on Bajaj Finance today, January 29, as the non-banking financial company (NBFC) will declare its December quarter results. As per a poll of six brokerages, the lender's consolidated net profit is expected to rise 25 percent year-on-year to Rs 3,716 crore.

An average of four brokerages shows that net interest income is expected to rise 26 percent YoY to Rs 9,344 crore. Stable asset quality and strong AUM (assets under management) growth will drive earnings, as per analysts.

Bajaj Finance, on January 3, declared provisional numbers for the December quarter AUM. On the back of a strong festive season, the company's AUM crossed the Rs 3-lakh-crore mark for the first time in the quarter gone by, surging 35 percent YoY.

As per the Q3 update, its deposit book grew by 35 percent to Rs 58,000 crore. During the quarter, it booked 98.6 lakh new loans, a YoY growth of 26 percent.

Margins and costs of fundsAccording to domestic broking firm Motilal Oswal Financial Services margins and spreads are likely to decline sequentially by ~25 basis points and 15 basis points, respectively. Credit costs are expected to rise ~10 basis QoQ to ~1.7 percent.

Axis Securities also sees margins declining by ~10-15 basis points QoQ owing to an inch-up in cost of funds. Inching up of the cost of funds is an industry-wide trend, noted Jefferies, due to the lagged repricing of MCLR-linked loans.

One basis point is one-hundredth of a percentage point.

Also Read: HDFC Bank, Reliance, Bajaj Finance in fray to be India's first trillion-dollar company by 2032

Meanwhile, cost-to-income ratio is expected to remain steady. Analysts at KRChoksey Research have pegged the cost-to-income ratio at 34.2 percent versus 34.7 percent in Q3 FY22.

Factors to watchIn November 2023, the Reserve Bank of India asked Bajaj Finance to stop issuing new loans through its “eCOM” and “Insta EMI Card” for non-compliance with digital lending guidelines. It is important to watch out for management commentary on the same.

Bajaj Finance Q3 results also come after RBI's caution against unsecured lending and risk-weightage increase for consumer credit. While analysts are confident of Bajaj Finance's liquidity position on the back of Rs 10,000 crore fundraising, it will be crucial to monitor management commentary on how Bajaj Finance's borrowing mix will change going ahead as banks' lending to NBFCs slows down.

Apart from that, the Street will also be monitoring how new products are scaling up and if any segments are showing signs of stress.

Also Read: Analyst Call Tracker: Banks, infra dominate Dec ‘buy’ lists; Bajaj Finance in top bets of 2023

Stock performanceIn the December quarter, Bajaj Finance shares fell over 8 percent while Nifty gained over 11 percent. In 2024 so far, the stock is down 2.8 percent while Nifty is down 1.8 percent.

On January 26, the stock closed flat on the NSE at Rs 7,091.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.