Indian IT majors kicked off a sombre earnings season, where their comments highlighted an uncertain demand environment, cuts in discretionary spending, project delays and a decline in people addition.

The IT industry is bearing the brunt of global macroeconomic challenges, as customers are coming out of a banking crisis, grappling with an impending recession in the US and a slowing economy in Europe.

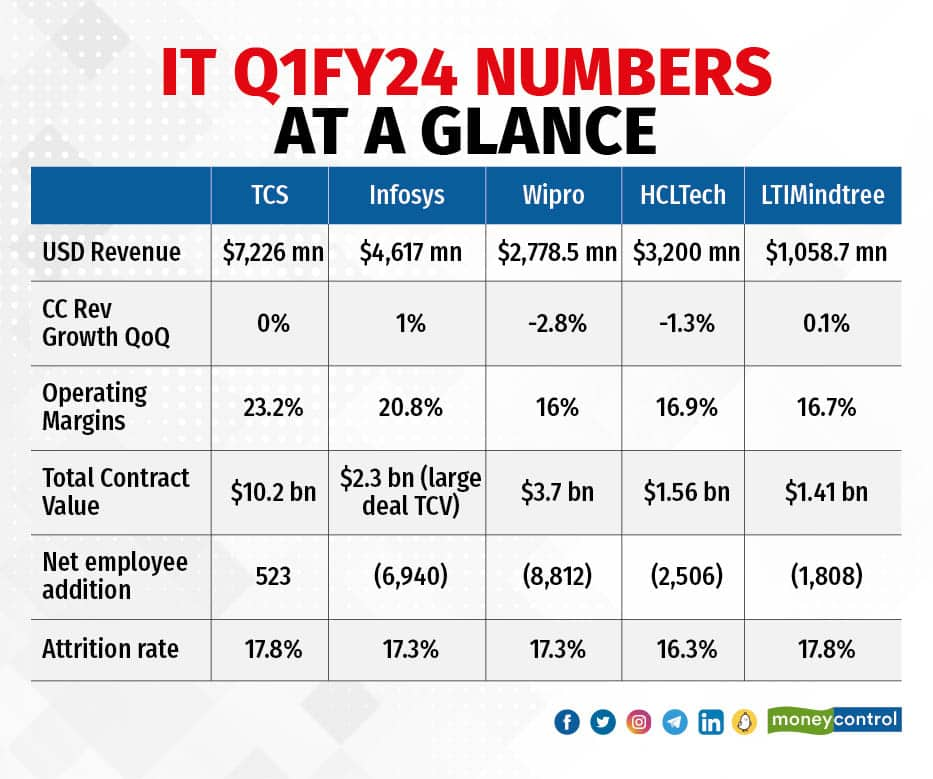

The top five Indian IT companies (by market capitalisation) have seen their sequential revenue growth on a constant currency basis at anywhere between -2.8 percent and 1 percent, a far cry from the high single-digit and double-digit growth seen last year. The biggest shocker, however, was Infosys’ sharp guidance cut for the year from 4-7 percent to 1-3.5 percent.

The green shoots this quarter may have been companies talking about possibilities around generative AI with regard to client demands and efficiency within the organisation, but it may have to do more with bluster than substance at the moment.

Revenue guidance updates

Revenue growth for the quarter was hit after a period of frenzied activity last year. Wipro reported the biggest fall at -2.8 percent in constant currency terms, HCLTech at -1.3 percent, Tata Consultancy Services (TCS) at 0 percent and LTIMindtree at 0.1 percent, with Infosys leading the pack at 1 percent.

In a note, Kotak Institutional Equities said that the slowdown is industrywide, and that TCV or total contract value wins are not translating into revenues “due to tardy pace of decision making, discretionary spending cuts and delay in ramp-ups. Infosys has taken the upfront hit in its guidance.”

It also expects revenue growth downgrades from other IT majors.

“HCLT has maintained revenue growth guidance of 6-8%, which in our view is difficult to achieve, noting high hurdle rate for growth in the next three quarters. TCS does not guide but had indicated caution. Wipro has guided for a weak quarter. We do expect revenue growth downgrades for other Tier 1 IT,” it read.

HCLTech’s CEO and MD C Vijayakumar told Moneycontrol that his confidence in maintaining the company’s revenue guidance stems from a “very strong pipeline” which is at an “all-time high” in the ongoing quarter. Meanwhile, LTIMindtree’s CEO and MD Debashis Chatterjee said that given the uncertainty and delays in deal closures despite a strong demand, the company’s aspiration to achieve double-digit growth in FY24 will be challenging.

TCS’ quarterly growth this quarter was the slowest in a decade excluding the Covid period, and CEO K Krithivasan told Moneycontrol that achieving double-digit growth in the current business environment won’t be an easy task.

Operating margins

TCS, Infosys, Wipro and HCLTech reported a decline in quarterly operating margins, while LTIMindtree reported an increase of 30 basis points (bps). LTIMindtree expects further expansion in margins, to reach the 17-18 percent range.

Infosys’ margins decreased 20 bps sequentially and came in at 20.8 percent. “70 bps benefit from cost optimisation including increase in utilisation and automation efforts was offset by 90 bps QoQ (quarter-on-quarter) headwinds from higher variable pays and promotions. Company retained its EBIT (earnings before interest and taxes) margin guidance of 20-22% for FY24,” analysts at ICICI Securities said in a note.

Wipro’s margins dropped from 16.3 percent in the previous quarter to 16 percent in Q1, and the management expects it to remain in the same range in the near future, according to an HDFC Securities note. Analysts at Axis Direct said rising subcontracting costs and cross-currency headwinds may impact the company’s operating margins negatively.

TCS and HCLTech became the biggest losers in terms of operating margins. TCS’ margins were down 130 bps to 23.2 percent in Q1, mainly due to wage hikes and promotion cycles kicking off in April. HCLTech’s margins fell to 17 percent, down by 120 bps on-quarter.

Deal pipeline

With the exception of HCLTech, all the companies mentioned here have reported strong deal wins this quarter. While customers re-evaluate discretionary spending, cost takeout, efficiency deals, digital transformation deals and excitement around exploring generative AI continue to drive demand.

Several large deals and deal renewals were reported in Q1 across companies. For cost take-out deals, however, margins are lower, especially in the initial transition phases. Like LTIMindtree’s Chatterjee points out, the revenue acceleration starts only after the transition is completed. “Because of the delayed decision-making, the transitions are also getting delayed. And that's why the revenue realisation is also getting delayed,” he said.

LTIMindtree’s order book for Q1 stood at $1.41 billion, up from $1.35 billion last quarter.

Read: Do Infosys, TCS deal wins show large contracts are making a comeback in the IT sector?

In the second quarter of the calendar year 2023, too, customer sentiment shifted decisively to a more-for-less orientation with discretionary spend taking a significant step backwards and firms looking to adopt strategies to save money, said Peter Bendor-Samuel, founder and CEO of global research firm Everest Group.

He added, “The increase in cost saving-oriented transactions was not sufficient to offset the reduction on discretionary spend with existing transformation projects being cancelled, trimmed back, and new ones postponed or eliminated.”

TCS at $10.2 billion has actually crossed its quarterly guidance band of $7-9 billion TCV, for the second consecutive quarter. The company reported at least five to six mega deals of $700 million-plus in the UK in 2023, apart from a $1.8-billion deal from the government-owned telco Bharat Sanchar Nigam Limited (BSNL) won through a consortium.

Wipro reported large deals to the tune of $1.2 billion. According to CEO and MD Thiery Delaporte, this was a 9 percent year-on-year growth and the highest bookings for the company in eight quarters.

Infosys’ shocking revenue growth guidance cut came despite the company reporting healthy large deal wins for the quarter coming in at $2.3 billion, which was up both on a quarterly and annualised basis.

HCLTech’s quarterly order book for Q1 dropped to $1.56 billion, following seven consecutive quarters of holding at $2 billion-plus in deal wins.

Dip in hiring and attrition

After frenetic hiring, it's now the time for the numbers to trend downward. Of the companies that have reported their numbers thus far—TCS, Wipro, HCLTech, Infosys and LTIMindtree—TCS is the only one to add employees on a net basis, 523 on its employee base of 6.15 lakh.

The other four have seen their headcount reduce cumulatively by over 20,000. Wipro makes up the biggest chunk of this pie, with its headcount on a net basis reducing by 8,812. This is concerning as hiring has for long been a lead indicator of demand in the people-dependent sector.

Attrition, while having dropped, continues to be at a band higher than companies are comfortable with. Most companies have seen attrition reduce to the 17-18 percent range on a trailing 12-month basis.

Over the headcount decline, companies say that they hired ahead of time in previous years, and are currently looking to make their fresh hires productive, utilise the bench strength and upskill existing talent than go out to the market to recruit.

Staffing industry experts had expected negative headcount movement this quarter, and given the lack of visibility on the road ahead in the commentary of IT companies, they do not expect things to get much better in the next two quarters.

Ray Wang, CEO and principal analyst at Constellation Research, told Moneycontrol that attrition not being backfilled has led to headcount being adjusted, but the same is a short-term fix. “Readjustment of skills was needed but we won’t know that until we see the hiring and retention of younger workers with newer skills. That second part is critical in the mid to long term,” he said.

Everest’s Bendor-Samuel said every tech and tech services company over-hired last year, and now that demand has moderated significantly and attrition is down, tech services have large benches. This, he said, is an excellent time for companies to improve quality of talent in organisations and move out lower-performing talent.

“This also comes at a time when the skills that are needed to serve the new digital marketplace are significantly different and hence these firms are also taking the opportunity to rebalance their skills inventory. All that said, we expect growth to continue but at a significantly reduced rate and likely accelerate next year unless we enter a significant recession,” he added.

Promises in generative AI

Amid caution in demand and tepid numbers, generative AI was probably the most used and bankable term during the IT earnings season in Q1. From TCS and Infosys to HCLTech and LTIMindtree, all the companies shared major updates.

Everest Group’s Bendor-Samuel said, “The AI wave which is building is expected to accelerate tech services growth next year and we will likely see growth ranging between 5 and 9 percent provided we do not enter a significant recession. It is too early in the AI wave maturity to expect this to affect revenues in the next two quarters to a significant degree.”

TCS, the country’s largest IT services firm, is working on 50 proof of concepts (PoCs) and has over 100 generative AI deals in its pipeline. It plans to train a talent pool of over 100,000 associates in generative AI. Infosys announced that it has 80 active generative AI projects in the pipeline and has trained 40,000 associates in AI/machine learning skills so far. Some of its recently signed mega-deals and extensions involved deploying generative AI capabilities.

HCLTech has over 140 external and internal generative AI projects at various stages of maturity, from PoCs to implementation. Vijayakumar also told Moneycontrol, that the company will be training around 20,000 associates in generative AI skills over the next 18 months and has set up three global labs.

Wipro is investing $1 billion over the next three years to strengthen its AI capabilities, and is training all its employees.

Despite all the hype and announcements, industry analysts and experts believe that it is still too early for IT companies to start seeing actual significant revenue conversion from generative AI, as most of the projects are still in PoC stages.

Read: Indian IT sector’s Gen AI push is more FOMO than actual revenue conversion: Industry experts

The way forward

According to Bendor-Samuel, the sector is growing but at a significantly reduced rate. He estimated that industry growth has fallen from a high of 13 percent last year to 4 percent this year.

“As we look forward to the rest of the year, we are observing a slight uptick in customer sentiment. At this time it does not appear that this uptick is sufficient to reverse the sentiment away from more for less. However, it does appear that there is a little more available. Hence, we believe that the industry has likely achieved a new normal with growth ranging from 4-6 percent for the rest of the year,” he said.

Bendor-Samuel also highlighted that the new normal of slowing growth in the industry will cause most firms to downgrade guidance like Infosys. Though some firms are better positioned and will have a less dramatic reset, in the case of Infosys they are also dealing with the lumpiness of the mega deal cycle and have also had to do some adjustments for mega deals already signed.

CFOs are in general being cautious as they should be, but they seem to be slightly optimistic for a better fiscal year Q2 and Q3 in general, said Wang.

He said, “As mentioned, the scenario will get better in Q2 (of FY24) as we are close to the end of calendar year contracts. The summer has been slow in general for all the majors. However, there were interesting pockets of growth from companies like Persistent Systems.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.