Fundraising through corporate bonds is likely to rise by an over 10 percent annualised rate in 2024-25 due to expectation of lower borrowing cost amid increased demand from foreign as well as domestic investors, experts said.

“We expect a 15 percent to 20 percent increase compared to FY24. Trends suggest potential growth driven by increased investor demand and companies issuing bonds to secure lower borrowing costs amid expected rate cuts,” said Nagesh Chauhan, Head - DCM, Tipsons Group.

Further, Venkatakrishnan Srinivasan, founder and managing partner of Rockfort Fincap, said the heightened investor demand (from both foreign portfolio investors and domestic ones) could make it more attractive for companies and banks to tap the bond market for their funding needs.

In the last few months, demand from long-term domestic investors picked up, which helped corporates and banks to raise more funds at affordable rates in the debt market. This was in tandem with rising demand from foreign players too, experts said.

The surge in foreign investors' demand was also seen in the government securities market, especially after the announcement that Indian bonds would be included in global bond indices. In FY25, FPI flows are likely to increase in the bond market, experts added.

Also read: After 'globally feted' blockchain platform for bonds, NSDL launches similar product for loans

Issuance in FY24

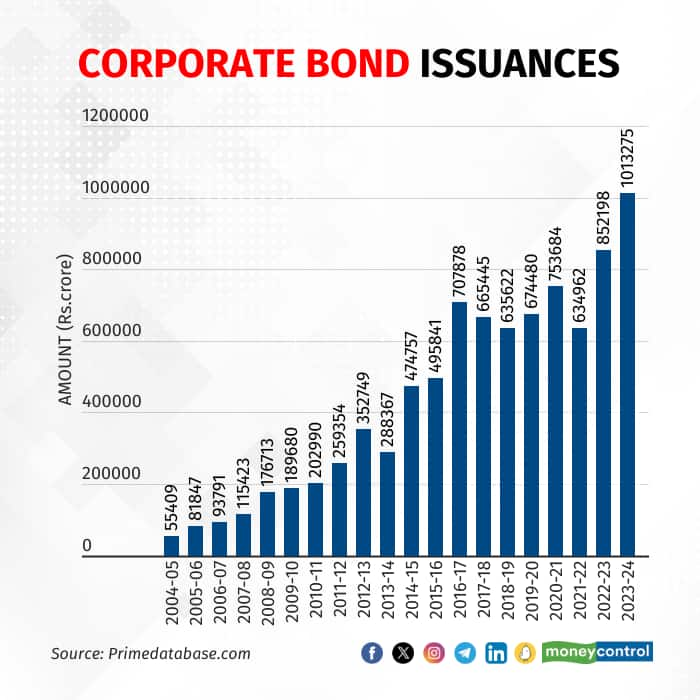

In 2023-24, Indian corporates and banks raised Rs 10.13 lakh crore through bonds, marking a near-19 percent growth on-year, data from Prime Database showed. In FY23, corporate bond issuances stood at Rs 8.52 lakh crore.

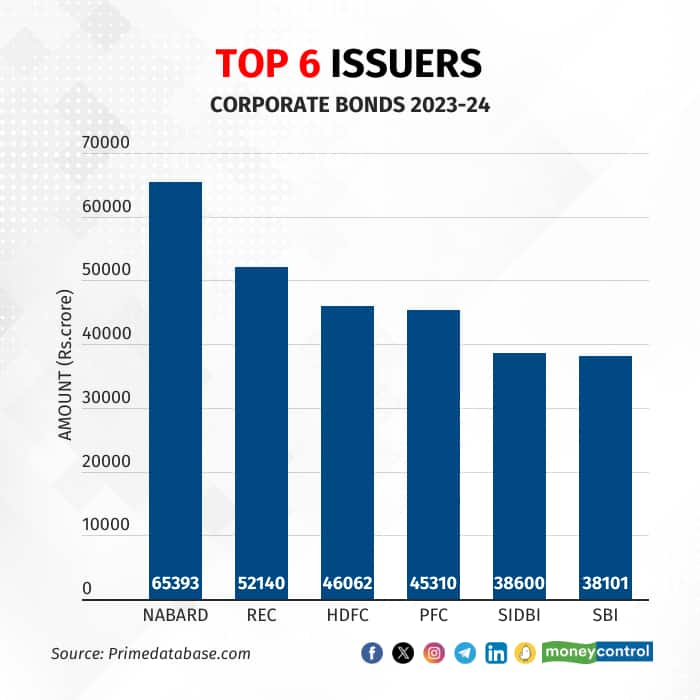

National Bank for Agriculture and Rural Development, REC, Housing Development Finance Corporation (HDFC), Power Finance Corporation, Small Industries Development Bank of India and State Bank of India were the top six issuers in FY24. These six entities raised Rs 3.86 lakh crore, or around 29 percent of the total issuance in FY24, data showed.

Chauhan said large one-time issuances from companies like HDFC before its merger with HDFC Bank and Reliance Industries have contributed to this trend. Both market conditions and individual company activity play a significant role in this surge.

Also read: Bonds trump IPOs: Private debt fundraising in FY24 at nearly 5 times equity

Yield movement

Yields on corporate bonds eased around 20 to 25 basis points (bps) in FY24, considering the strong demand from investors, experts said.

According to Bloomberg data, yield on three-year AAA-rated corporate bonds that were trading at 7.8049 percent on March 31, 2023, fell to 7.6627 percent on March 29, 2024.

Five-year AAA-rated bond yields fell to 7.6068 percent on March 29, 2024, from 7.8460 percent on March 31, 2023.

Similarly, yield on 10-year AAA-rated corporate bonds eased to 7.5200 percent on March 29, 2024, from 7.8080 percent on March 31, 2024, data showed.

“With consistent economic growth followed by moderate inflationary pressures, bond market yields moved southward as investors perceived less risk of default, stable currency and inflation eroding returns,’ Srinivasan said.

He added that increasing demand as Investor seeking assets with relatively stable returns could keep downward pressure on corporate bond yields.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!