Vedanta is said to be looking for a buyer for its lossmaking steel business for a valuation of as much as Rs 12,000 crore, according to a report.

Deleveraging the balance sheet of Electrosteel Steel, which it acquired about four years ago, has been cited as one of the key reasons for the sale. One other reason could be its focus on the new semiconductor venture.

Volatility in the commodity sector could arguably be another reason for the potential sale. Significant losses for Vedanta’s steel business could have nudged Vedanta to sell the unit, which needs to expand to become competitive.

However, the Vedanta Group said exiting the steel business is “not a topic for us”, the Press Trust of India reported on November 15, citing CEO Sunil Duggal. The only priority is to raise production capacity to 3 million tonnes, according to the report.

About Electrosteel

Electrosteel Steel, now known as ESL Steel, was incorporated as a public limited company in 2006. Anil Agarwal-promoted Vedanta took control of the bankrupt company in June 2018 for a consideration of Rs 5,230 crore, with lenders forfeiting more than 55 percent of the outstanding debt.

ESL’s total secured outstanding debt was Rs 12,376.61 crore as of March 31, 2017, according to its annual report.

When Vedanta acquired ESL, it had a manufacturing capacity of 1.5 million tonnes. The proximity of its plant in Jharkhand to one of Vedanta’s iron ore mines made it a “good match” for vertically integrating the asset.

In 2019, Vedanta said it plans to scale up its steel manufacturing capacity to 3 million tonnes by the end of FY23 and 10 million tonnes five years after that. With 12 million tonnes per annum of iron ore, an ingredient in making steel, the focus has been on value-added products for margin expansion.

Vedanta has invested $348 million in growth capital expenditure.

Financials

ESL contributed 6.6 percent of Vedanta’s net debt and accounted for 1.5 percent of its cash and cash equivalents at the end of September, according to a company presentation.

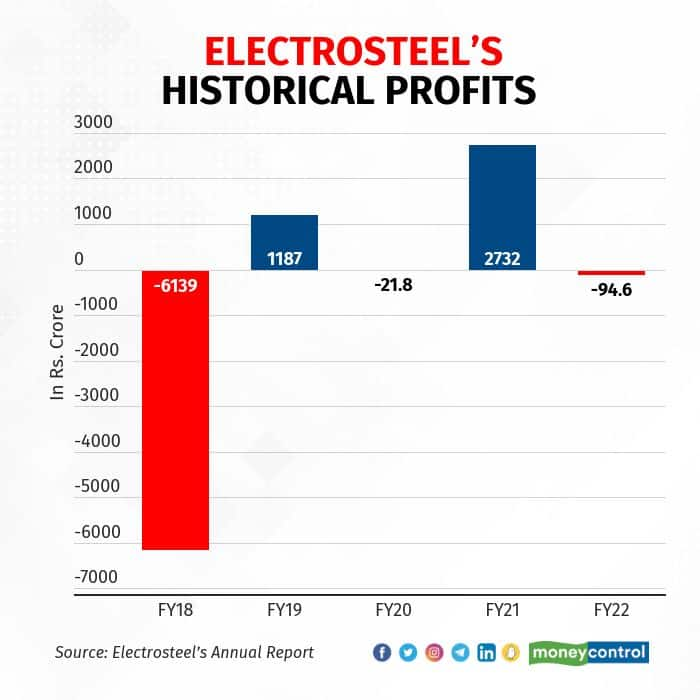

ESL made losses in three of the past five financial years, reporting a profit on FY19 and FY21.

The company’s cashflows peaked at Rs 356.9 crore in FY19 and have receded since then.

The global economic slowdown, the Russia-Ukraine war, demand-supply forces and government spending and policies were cited as some of the reasons behind the hit on the company’s performance.

Peer group comparison

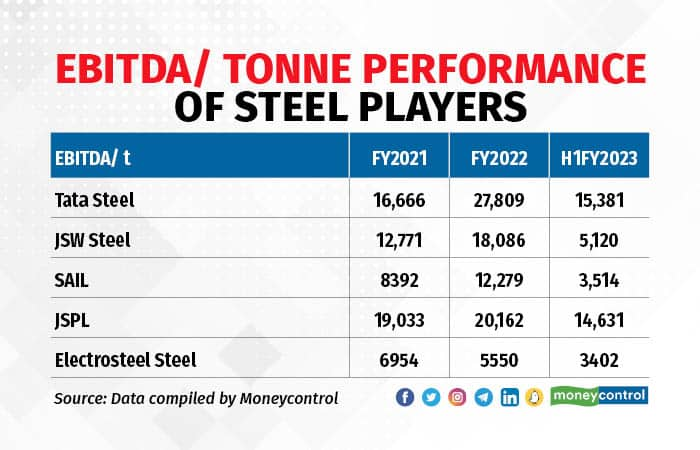

ESL’s earnings per tonne are relatively lower due to its smaller capacity and different product portfolio. The company’s product profile is secondary long products, unlike peers Tata Steel and JSW Steel. Its product range includes pig iron, billets, TMT bars, wire rods, and ductile iron pipes.

Potential Sale Comes Right After…

The report on the planned sale of ESL came right after Vedanta terminated Moody’s Investors Service for giving an unfavourable rating for London-based parent company Vedanta Resources’ unsecured bond.

In its October 31 report, Moody’s pointed out the possibility of the parent company squeezing the finances of operating companies Vedanta and Hindustan Zinc to pay for its borrowings since the holding company does not have operations of its own and relies on dividend income from subsidiaries to service debt.

The possible reasons for the potential sale of ESL include:

Vedanta’s debt

Vedanta’s net debt has been rising, especially since FY18. While the company managed to reduce its debt in FY22, it has picked up pace in the first half of FY23.

Selling ESL may be a viable decision given the small contribution of the steel business to Vedanta’s overall financials and significant capax needed to further expand and become competitive.

Change in capital allocation?

Another reason for the sale of ESL could be a change in Vedanta’s capital allocation strategy. The focus appears to be shifting towards the semiconductor business, which is perceived as a sunrise sector in India and has government support, unlike the steel sector, where scale is critical.

ESL’s current steel capacity is smaller than that of its counterparts. Tata Steel, Steel Authority of India, and JSW Steel all have capacities exceeding 20 million tonnes a year, while ArcelorMittal Nippon Steel and Jindal Steel and Power have huge capex plans in the pipeline.

ESL’s plan to reach 10 million tonnes per annum would require substantial investment, which may not be as lucrative at the moment compared to the situation one year ago, said Jayanta Roy, senior vice president at ICRA.

The Vedanta Group said in September it plans to invest $20 billion (Rs 1.54 lakh crore) to build a chip and display facility in Gujarat.

According to reports, the Gujarat government will provide a 75 percent subsidy for the first 200 acres of land required for a fabrication project. A 50 percent subsidy will be available for additional land required for the fabrication project or upstream/downstream activity, or other projects approved under the India Semiconductor Mission.

Commodity cycle volatility:

The softness in the commodity cycle may have promoted Vedanta to exit the lossmaking steel business. Worries about global demand, especially after the Ukraine-Russia war, have disrupted the commodity cycle, and the steel sector is no exception to that.

Shares of JSW Steel and Jindal Steel and Power are about 10 percent short of their 52-week highs.

“Indian steel spreads are around the last seven-year average and with global demand likely to be weak, it’s unlikely they will bounce back materially. In Q2, most companies reported abysmal margins but this is more of a normalisation and not the start of any strong rally as the peaks of May 2021 will take a few years to be revisited,” Rakesh Arora, cofounder of GoIndia Stocks, said in a written response to Moneycontrol’s queries.

The weak commodity cycle may have nudged Vedanta to consider the sale of ESL to have a disciplined capital expenditure plan and lower debt so as to provide more muscle to aid the finances of parent company Vedanta Resources in the form of dividends, which can only be generated via free cashflows.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.