Dear Readers,

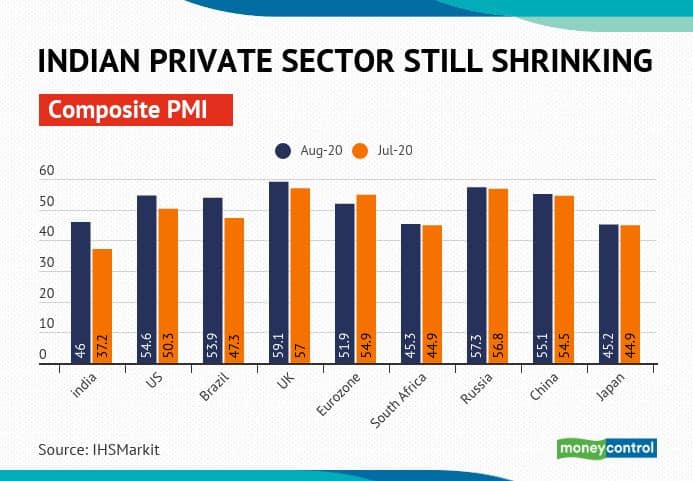

The US markets chose to sell off on Thursday, ironically at a time when the US Composite Purchasing Managers Index (PMI) for August came in at a solid 54.6, after a steady 50.3 in July. The seasonally adjusted composite PMI is a snapshot of economic conditions in the private sector in both manufacturing and services. A reading above 50 signifies expansion from the previous month, while one below 50 denotes contraction.

The US composite PMI therefore indicates that a strong rebound is on the cards in the current quarter. Since it measures changes in month-on-month activity, the PMI is signalling that the return to growth in July has not only been sustained but has become stronger. With the benefit of hindsight, therefore, there does seem to have been some fundamental reasons for the bullishness in US equities, although the improvement will certainly not explain all of it.

The US is not the only economy to see expansion in its composite PMI. China, Russia, the UK, the Eurozone all saw expansion in economic activity in both August and July 2020. The growth momentum, however, slipped in the Eurozone in August, probably because of the strong euro. Expect the European central bank to try and weaken the Euro and a stronger USD could have implications for emerging markets. China’s private sector, of course, has been expanding since May 2020.

On the other hand, India’s composite PMI came in at 46 in August, up from a very weak 37.2 in July. While the pace of the decline has slowed and the manufacturing sector has started to expand in August, there’s no escaping the fact that August was the fifth consecutive month the Indian private sector has shrunk.

There are plenty of other negatives. Let’s not forget that India’s GDP shrank by 23.9 percent from a year ago in the June quarter, the worst among the major economies. Consumer price inflation is one of the highest in the world and the RBI has been hard at work trying to contain a rise in bond yields. Global food prices have snapped back above March levels. The head of Axis AMC told us that a recovery in India is likely to take the shape of a W. Our recovery tracker’s latest update finds high frequency indicators to be a mixed bag. To top it all, new covid-19 cases in India are now the highest in the world and deaths have increased to around a thousand a day. If we were to construct a misery index, taking the GDP contraction, high unemployment, new infections and the inflation rate into account, India is very likely to top the tables.

Recall also that the Indian government has been niggardly in offering fiscal support, compared to most other governments. That’s because it was already propping up the economy even before the pandemic hit us. In July, the latest month for which data are available, central government spending lost momentum.

What then is our excuse for the rally?

But then, as we have been writing ad nauseam, there are many other reasons why stock indices go up, including liquidity, hope, a vaccine and the fact that stock market investors belong to a class insulated from the general misery. And let’s not underestimate the steely determination of central banks to create asset price inflation. This week, we revisited this favourite topic from a fresh perspective.

How then should investors position themselves? Some say the pandemic could leave lasting scars, but we took a contrarian position, pointing out that the Roaring Twenties succeeded the Spanish Flu pandemic of 1918-19. For those willing to wait, good things will come unto you. What manner of good things? Well, we brought you some high-quality multibaggers in beaten down sectors and stocks that could rise from the ashes.

Some stocks, as in the FMCG sector, have run up hugely during the lockdown and have very high valuations. But with capex unlikely in the near future and cyclicals uncertain, there’s a case for remaining invested in FMCG---Jubilant Foodworks being a case in point. Trent is another stock we believe will benefit from pent-up consumer demand, while of course, Reliance Retail made the headlines this week by acquiring the retail and other assets of the Future Group.

We showcased two phosgene producers, both promising, but in one of them we advised taking some profits off the table. For this agrochemical company, we said investors should buy only on declines. And sticking to pharma and chemicals, we also recommended a Vitamin D API maker registering strong export growth.

Coming back to the US market sell-off, pundits point out that the Vix, or fear gauge, was rising in tandem with stocks, a very unusual occurrence and a sign that all was not well. But given the strong rally in tech stocks, booking some profits is entirely rational.

With the US elections round the corner, volatility is expected to remain high.

Cheers,

Manas Chakravarty

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.