Just two weeks before the renewal of a group life insurance cover, a mid-size infrastructure firm decided against buying a cover for the employees. The annual premium of Rs 7,500 per employee for the Rs 50 lakh crore was turning out to be an additional cost for the 500 member organisation.

The rising cost pressures amidst a slowdown-like situation in the economy has led to a drop in sales of group life insurance covers. Used as a retention tool among companies in India since the country does not have social security programmes, group life is now being seen as an excess expense.

"Business has been weak and we have not been able to meet sales target. At this juncture, having a group life insurance is not feasible," said the head of employee benefits at the firm quoted above.

While some firms have decided to not buy this cover, others are reserving it for senior management.

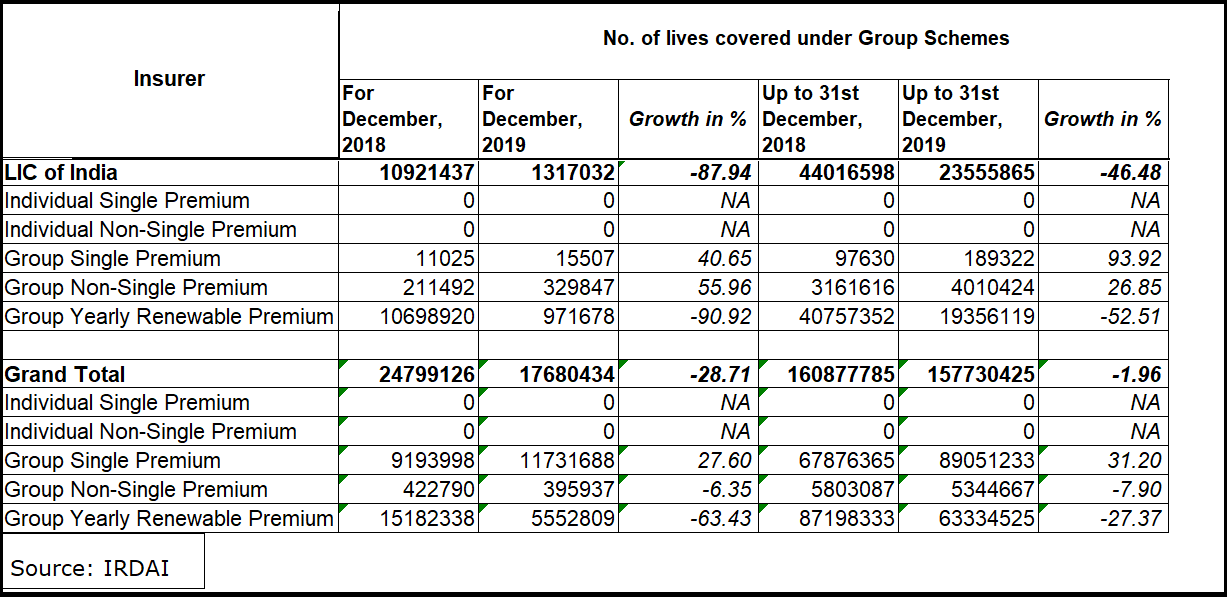

A direct impact of this has been seen in the sale of group insurance schemes by the life insurance companies. IRDAI data showed that there was a 29 percent drop in the number of lives covered under group schemes in December 2019 compared to a year ago.

Insurance sector officials said that this was due to the dual impact of a drop in loan disbursements as well as corporates going slower on cover purchase.

Home loan customers are one of the biggest sources of group insurance schemes. Whenever a individual buys a home loan, life insurance comes attached in the form of group credit life cover. This is equal to the loan amount and pays the loan amount in case the insured person dies before the tenure.

However, with tightening liquidity conditions and slowdown, purchase of home loans is also seeing a slump. When home loans sales drop, the allied purchase of insurance is also impacted.

Among the insurers, Life Insurance Corporation of India saw a 46 percent year-on-year drop in the number of lives covered under the group schemes in the April to December 2019 period.

For the corporate customers as well, there has been a rise in premium cost for insurance products by 10-20 percent over the past two years. This has made mid-sized and smaller companies reconsider their decision to buy group life products for the entire organisation.

Insurers said that manufacturing firms and FMCG companies are now buying covers on a group platform only for employees above a certain pay-scale. Earlier, the group life cover was offered to all employees.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!