Ruchi Agrawal

Moneycontrol Research

- Attractive agrochemical pick with long-term tie-ups with top MNCs

- Consistent revenue and earnings growth along with margin expansion

- Return on capital employed higher than peers

- Capacity expansion along with debt reduction bode well for the stock- Foray into the international market to bring volume uptick

-------------------------------------------------

Bharat Rasayan (BRL) is a steadily growing agrochemical manufacturer and has been generating above-average returns. The company has a strong balance sheet and has posted steady revenue growth along with consistent margin expansion which make the stock an attractive pick.

About the company

BRL is a manufacturer of technical grade pesticides used for the manufacturing of agrochemical formulation products. It has two plants, one at Rohtak with a capacity of 5,000 metric tonne per annum (MTPA) and another at Dahej with 15,000 MTPA capacity. The Dahej plant was installed in 2013, after which the company has seen a manifold increase in turnover.

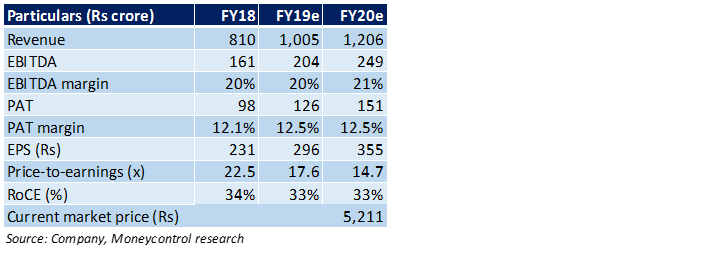

Strong double-digit growth and returns

The company has posted a strong and consistent growth in revenue and profits along with a healthy margin expansion over the past years. In the last 5 years, the company has posted a revenue CAGR (compounded annual growth rate) of 15.7 percent, EBITDA CAGR of 20 percent and profit after tax CAGR of 37 percent. Margins have also consistently grown with around 20 percent EBITDA margin in FY18.

The return on capital employed (RoCE) has remained strong and improved in the last few years. It was around 39 percent in FY18, much higher than its listed peers.

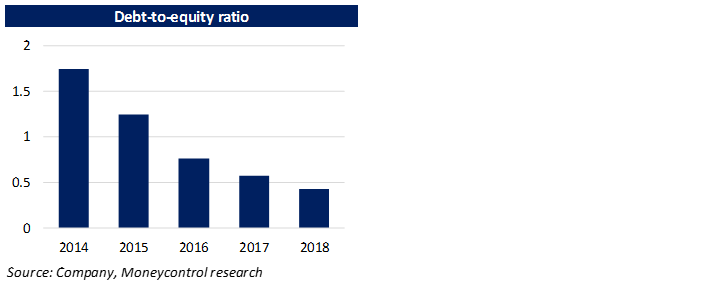

Healthy balance sheet

After a period of heavy capex and high debt during 2012-13 for the installation of the Dahej facility, the company has steadily paid off its debt. It now has a strong balance sheet with a debt-equity ratio of 0.43. This leaves scope for expansion, both organic and inorganic which could be another turning point for the company.

Capacity expansion to drive volume and backward integration to de-risk business

The company is planning Rs 100 crore capex for expanding the Dahej facility along with Rs 200 crore capex for setting up a new manufacturing unit in Sayakha, Gujarat.

While the Dahej expansion is to be funded from internal accruals, the company plans to raise debt or enter into a strategic JV for the Sayakha plant. Both these plans with enable an uptick in volumes. BRL also plans to start production of intermediary chemicals thereby facilitating backward integration. The company plans to sell these in the market in order to capture the void created by the shortage in Chinese supply. The expansion aims to bring down costs by 10-20 percent and reduce dependency on the Chinese supply by almost 50 percent.

International expansion

The company is looking to expand its presence in the international markets. BRL is working on seizing contracts from Japanese manufacturers. These contracts are usually long-term contracts and would bring in steady inflows. The company already has healthy relations with Syngenta and Nissan of Japan.

BRL has applied for registrations of around 5-7 molecules in Brazil of which at least one is expected to be received in the current year. Brazil is a large market for agrochemicals and this expansion is expected to drive up volumes in the long run. BRL expects to bring in around 10-15 percent of the revenue from Brazil in the medium term.

Recent financial performance

BRL delivered a strong performance during the first half of this fiscal. Revenue in H1 increased 30 percent year-on-year (YoY) to Rs 530 crore. Operating profit rose 39 percent over the same period on higher sales and expansion in operating margin. Performance has been aided by multiple factors including a favourable base, capacity expansion and higher realisations.

Key Risks

Working capital-intensive business – the company is involved in the manufacture of technical grade chemicals which is a capital-intensive business with higher working capital cycles.

Dependence on monsoons – the agrochemical business and demand for the company’s products are highly linked to the monsoon performance thereby exposing the company to vagaries of nature.

Our take and valuations

We remain optimistic about the long-term prospects of BRL given the proven track record in the past. We see the business as a strong and growing one generating a strong return on capital. With Chinese factories closing down, we believe it is a golden time for Indian chemical companies to capture the market and expand internationally.

The company has posted strong results with each passing quarter. The stock has corrected 37 percent from its 52-week high and is now trading at a 17.6x 2019e (estimated) earnings. We find current valuation reasonably fair and recommend to accumulate the stock with a long-term perspective.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!