Investors in Burberry Group Plc are keeping their enthusiasm in check.

Shares in the British luxury brand fell as much as 7% on Thursday morning after it delivered growth behind its bigger rivals, a disappointing outlook and confirmation that the US luxury market is slowing.

The doomsday reaction is overdone. Burberry’s transformation is well underway. With the major luxury players largely listed in Europe — led by the region’s most valuable company LVMH Moet Hennessy Louis Vuitton SE — for UK investors, Burberry remains a home-grown way to play the bling boom in China.

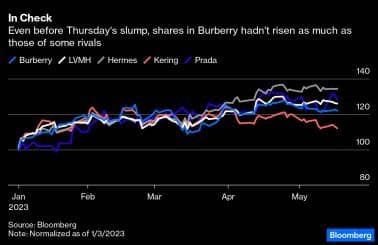

Even before Thursday's slump, shares in Burberry hadn't risen as much as those of some rivals

In Check

In Check

Here, the company’s performance is encouraging. Comparable store sales in mainland China rose 13% in the three months to April 1. But Chief Executive Officer Jonathan Akeroyd said sales to Chinese consumers rose 23% in the period, not too far from its more muscular rivals.

Burberry is well-placed to capitalize on demand within the country and from Chinese travelers looking abroad to buy luxury. Prior to the pandemic, the fashion house generated about 40% of sales from Chinese customers at home and abroad. The proportion is now around 30%.

There is, of course, a question mark over whether Chinese consumers will buy Burberry over names such as LVMH’s Louis Vuitton and Dior. But the British heritage brand has an advantage. New designer Daniel Lee is poised to enhance its handbag offerings with fresh styles and introduce new shoe lines.

The trend for “quiet luxury” could also play into the company’s hands. Lee created just this sort of sleek look when he reinvigorated Kering SA’s Bottega Veneta, which has emerged as of one of the beacons of the new minimalism. The trenchcoat, Burberrys’s core product, is also having a fashion moment. Indeed, outerwear comparable sales rose 30% in the fourth quarter.

But there is one significant hurdle that Burberry will have to navigate to unleash its full potential. The past three years have seen the strongest luxury brands, led by Louis Vuitton and Dior as well as Richemont’s Cartier, become stronger. Others, particularly those trying to reposition themselves, such as Kering SA’s Gucci, have found life more challenging. Prada SpA is proving the exception to the rule, enjoying a Gen-Z revival.

As the industry giants are able to snap up the best flagship store locations, the most powerful advertising and the highest profile brand ambassadors, everyone else will have to invest to stand out.

At least Burberry has plenty of financial firepower to spend on making its voice — now much clearer thanks to its long overdue focus on its British heritage — heard above the noise. Excluding lease liabilities, the company had net cash of £663 million ($824 million), and it announced a £400 million share buyback.

There are other potential pitfalls. Lee showed his first collection in February, but products won’t hit stores until September. There’s a huge amount of excitement about his designs, but there’s still a risk that they don’t chime with consumer tastes, particularly in China. And there is the ever-present possibility that Chinese demand weakens after an initial post-zero Covid splurge.

Meanwhile, luxury sales in the US are slowing. While Burberry is in the process of taking its products more upmarket under Lee’s direction, right now it is still exposed to younger, aspirational shoppers, who are cutting their purchases of sneakers, hats and belts. Comparable sales in the Americas fell 7% in the final quarter.

Burberry has also been a beneficiary from sterling’s weakness. So with the recovery in the pound, it now faces a £40 million hit to operating profit from currency movements.

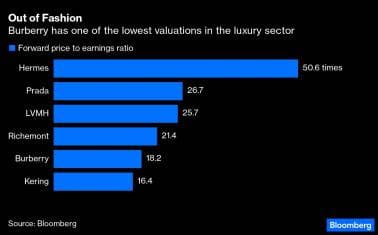

That might explain why even before Thursday’s slump, Burberry shares hadn’t gained quite as much as their European peers. They trade on a forward price-to-earnings ratio of about 18 times, ahead of Kering but lagging other leading luxury names.

Out of Fashion | Burberry has one of the lowest valuations in the luxury sector

Out of Fashion | Burberry has one of the lowest valuations in the luxury sector

To close the gap, Akeroyd and Lee must continue Burberry’s transformation from simply premium to super-luxe. At the same time, they must create the sort of buzz about the brand that Gucci achieved in the early days of its turnaround seven to eight years ago.

It they can achieve this, then Burberry has every chance of becoming the British LVMH. If not, unencumbered by a controlling family stake, it could fall prey to the French giant.

(Andrea Felsted is a Bloomberg Opinion columnist)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.