The government’s thrust on capital expenditure will likely extend in Budget 2024, topping last year’s record Rs 10 lakh crore, even as the pace of expansion may moderate. However, despite the Centre’s attempts over the last four years, private sector capex has lagged in spite of healthy balance sheets, comfortable liquidity and robust profits.

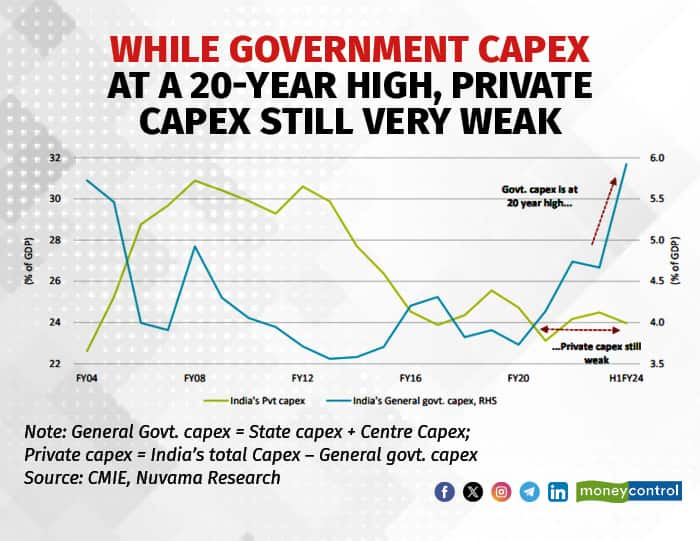

In a report, Nuvama Institutional Equities noted that during the first half of the current fiscal year, general government capex grew 35 percent-plus, but private capex languished below 10 percent on-year. “Besides, real rates are at decadal highs and the global capex cycle too is languishing. Thus, we are not constructive on private capex revival,” said the brokerage.

Follow all the latest updates on the Interim Budget 2024 here

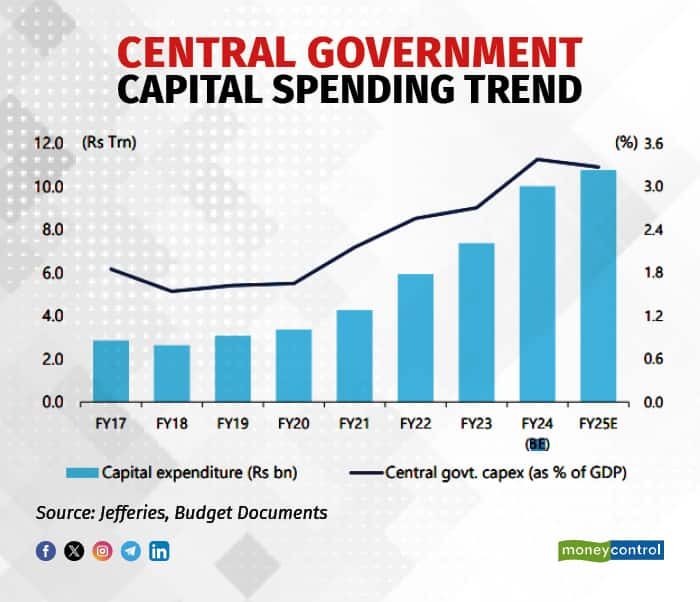

Government capex expectationsThe Union government’s capex has tripled over the past five years. Among the various sectors, it has been focusing on public infrastructure to drive capex growth.

However, for Budget 2024, the growth in capex could moderate to 7-8 percent, as fiscal consolidation takes a toll, said Jefferies. Other estimates range from 7 to 15 percent.

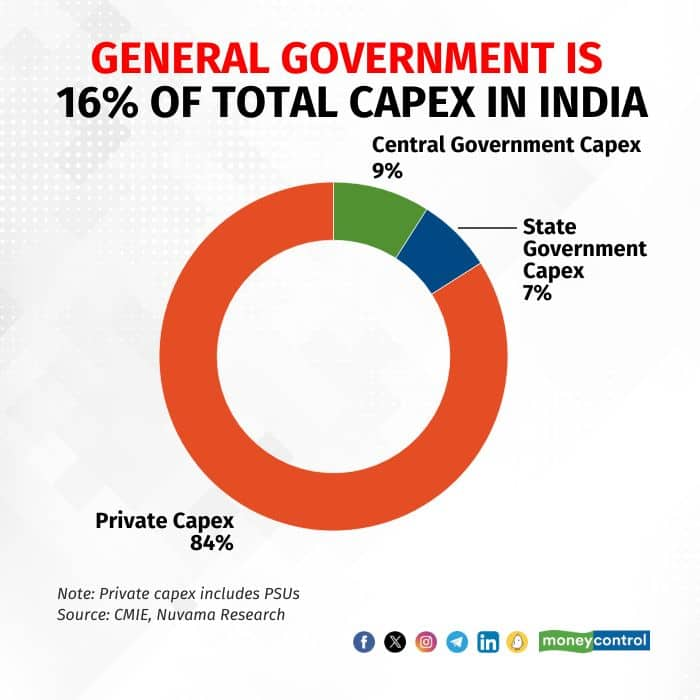

State governments have also participated in the current capex cycle. Kashyap Javeri, fund manager, Emkay Investment Managers, said, “The state government capex rose to 3.2 percent of GDP for FY24 and is likely to rise to 3.4 percent of GDP next year. To put things in perspective, the overall government capex (state plus central) which used to languish at about 2.8 percent of GDP until FY20, would more than double to around 6 percent of GDP in FY25.”

Palka Arora Chopra, director, Master Capital Services, said, “Over the last decade, private capital spending has shown sluggish growth, with the macroeconomic environment becoming increasingly uncertain due to factors such as supply chain issues, the COVID-19 pandemic and escalating inflation rates.”

Some analysts disagree with the general notion of private capex lagging. Javeri said that capacity utilisation of the top five to ten players across industries like cement, steel and power is hovering around 80 percent or more.

On a TTM or trailing twelve months basis, the total capex of manufacturing-related companies within the BSE500 Index stood at Rs 5.3-5.5 lakh crore, a growth of 14.5 percent over the same period last year, he added.

Nevertheless, the pervasive sentiment of lacklustre private spending remains. According to experts, while publicly listed companies have ramped up their capital expenditure in the last two years, the unlisted sector—a grouping that is nearly three times larger than the listed sector—has witnessed a notable slowdown in capital spending, mirroring its weaker financial position. This dissonance is a key factor contributing to the overall downturn in corporate investments across the country.

Private capex has also been selective so far, and not full-fledged, especially since private consumption has exhibited a K-shaped pattern. “Urban India and higher economic strata have heavy-lifted consumption, while the same momentum is not apparent in rural areas and lower economic strata,” said Hitesh Jain, strategist, Yes Securities.

What can the government do to reinvigorate private capex?Successfully reviving private capital expenditure in India post-Budget 2024 hinges on several factors, said Sheersham Gupta, director of brokerage Rupeezy. Once election uncertainties have passed, he anticipates a positive trend in private investment. The budget's effectiveness in stimulating private investment depends on creating a favourable business environment, implementing pro-investment policies, and addressing inflation and supply-side issues.

Also Read | Budget 2024: Will the government rationalise capital gains taxes?

A significant emphasis on infrastructure spending is expected, which will foster a conducive environment for private sector participation through public-private partnerships. “The budget should prioritise ensuring easy credit availability, with the establishment of credit guarantee schemes to mitigate risks for banks. Regulatory reforms aimed at simplifying processes and fostering a business-friendly atmosphere should be on the agenda,” Gupta added.

“The budget could include reforms in urban planning and transportation to make it easier for private sector companies to invest in these areas. Additionally, tax incentives and subsidies will encourage private sector investment in key sectors such as manufacturing, renewable energy, and technology,” said Nikunj Saraf, vice president, Choice Wealth.

However, since the budget will focus on fiscal consolidation, it will not allocate the same level of resources for capital expenditure. Therefore, the government will try to prod private capex through production-linked incentives and other schemes, while pushing for state capex through interest-free loans.

“Emphasis on state capex will be there, given that state capex has higher efficiency and growth multiplier impact than the centre’s capex,” said Jain.

Stocks to bet onJaveri said that the capital goods and infrastructure sector will continue to reap the benefits of strong government and private capex. “This could include segments in EPC (engineering, procurement and construction) as well as products like gears, compressors, transformers and other segments as well,” he added.

Some stocks on Gupta’s radar are Coal India, SRF, Aether Industries and Larsen & Toubro (L&T).

Also Read | Budget 2024: Auto sector eyes EV incentives to push entry-level cars

On the other hand, Jefferies said this lower capex might disappoint the market, and stocks exposed to the government capex programme may see some correction. The international brokerage changed its stance on L&T to neutral.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.