As the countdown to the Union Budget – this time an interim one, to be precise – has begun, we are back with our in-house Moneycontrol Budget Sensitive Index or MC BudEx.

The index, heaving 30 constituents, measures what kind of expectations are being factored in by the stock markets in the run up to the Union Budget, which is scheduled to be presented on February 1.

In India, the Union Budget is a closely watched event by the stock markets as tweaks in taxes and government spending can often direct the growth trajectory, especially in years when private investments and consumptions are weak.

Agreed that this year, the Budget is more likely to be vote on account – also confessed by Finance Minister Nirmala Sitharaman – there is no dearth of hopefuls who believe some crucial announcements can be made. Why? Because, perhaps this is the last chance for the ruling party in the government to entice those voters sitting on the fence or even sway those leaning towards other parties.

A reflection of all the hope can be seen in stock movement, and MC BudEx is the barometer that aims to capture that.

How MC BudEx is built

MC Budex captures how expectations from the Budget are getting priced into the stock market. The index constituents have been picked after conversations with several stock-market participants, and after back-testing data for the past seven years to see which segments of stocks were most sensitive to the Budget relative to the rest of the market.

To back-test, we first saw how each of the BSE thematic and sectoral indices performed 30-days and 45-days prior to the Budget and five days after the Budget. And then, we tried to find out which sectors and indices were the most sensitive towards the Budget.

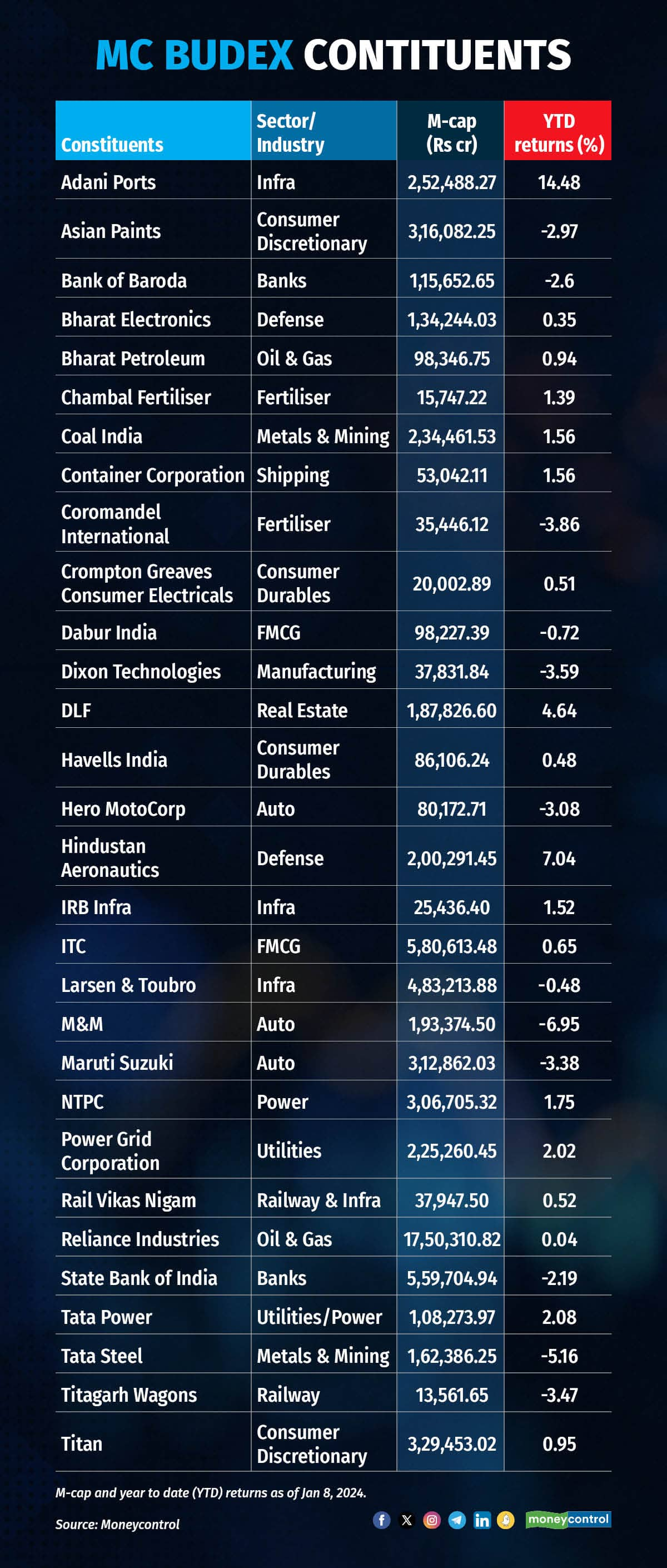

The index has thus a representation from the infrastructure universe, including defence and railways, public sector undertaking, including some divestment candidates, banks, consumer staples, and discretionary companies, and agriculture and fertiliser industries.

All stocks in the index have equal weight to ensure that the index is not skewed by mega-cap and large-cap companies. The index, thus, captures the broad market action, be it driven by small stocks or the big ones.

The stocks in the index are sensitive to the Budget either because policy changes and tax tweaks can directly impact their financial performance, or can indirectly impact their financial performance by way of a change in consumption or investment activity in the economy.

Performance till now

MC BudEx has a base of 100 as on December 1, 2023. It is up about 5 percent as of January 8, underperforming the Nifty and Sensex that are up about 7 percent in the same period. The market has been buoyant for the last few months thanks to receding inflation, increasingly dovish central banks and some good financial performance by companies, directed partly by policy support from the government.

Over half of the constituents in the BudEx have delivered double digit returns since December 1. Adani Ports leads with 41 percent gains followed by Bharat Electronics, Tata Power and Hindustan Aeronautics. The top is heavy with so-called infra plays, a reflection of the hope that the government will likely keep its spending momentum in the sector. DLF, Chambal Fertiliser and NTPC are among the top gainers.

There are just two stocks that are down in the period – M&M and Maruti Suzuki – both auto names. They seem to be taking a breather after a massive rally. The Street expects the government to take a decision on extending its FAME policy to encourage the adoption in EV. Until then the uncertainty is also hurting M&M that has emerged as a major EV player.

The underperformance in the index seems to be due to how Nifty and MC BudEx are built up. Since the latter is an equal weight index, it smoothens the impact that outperformance in a select few stocks can have, unlike Nifty – a free float index.

We will keep you updated on market expectations from the Budget through the next few days so that you are able to understand if the hopes that has built up are anything substantial or it just air.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.