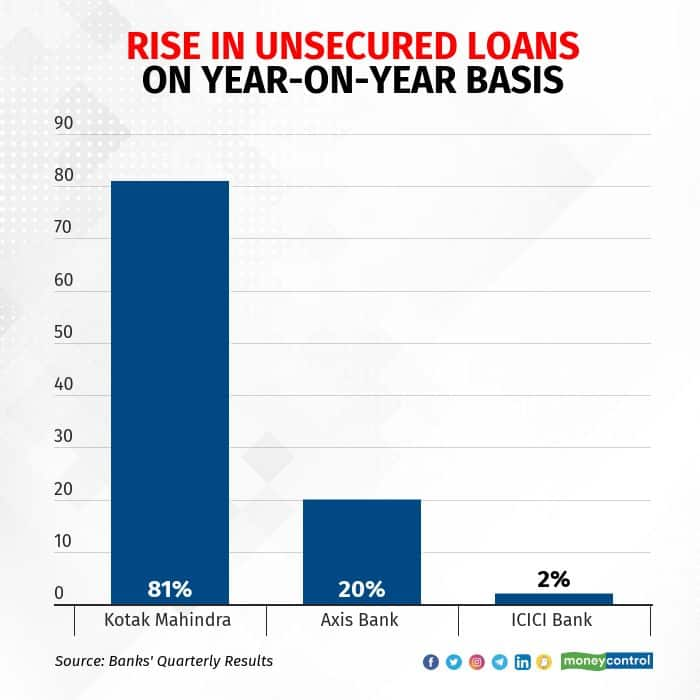

Many private banks like Kotak Mahindra Bank, Axis Bank, and ICICI Bank have shown a significant rise in disbursement of unsecured loans last quarter, as per their latest quarterly results. During the outbreak of COVID-19, banks had excessively tightened their disbursement policy. But now, with the economy looking up, banks are gradually easing up, and disbursing more unsecured loans. For banks, unsecured loans are a source of better profit margins in, say analysts.

Going forward, analysts expect a significant rise in the retail unsecured loan portfolios of more banks this fiscal.

Although the data for year-on-year (YoY) growth for IndusInd Bank was not disclosed, the bank said during the announcement of their results that retail loans grew by 3 per cent on quarter-on-quarter(QoQ) basis, with significant pick-up in retail unsecured loans. Credit card lending grew 17.4 per cent QoQ, while personal loans climbed 9.5 per cent QoQ.

Here are the major reasons for private banks to be lending more unsecured loans compared to the previous years:

Although, most of the banks have performed well in terms of dealing with NPAs, analysts have cautioned banks against being too confident in terms of disbursing unsecured loans, considering the economic turmoil India is going through. “Banks should not be too confident as there may come some challenges in the job sector that may affect repayment,” said Aggarwal.

Banks need to have proper credit appraisal and risk management systems in place to be able to deal with any possible defaults. That will help them keep NPAs under control, else in a fast growing book NPAs could rise. “Even if a bank is disbursing loans to salaried individuals or someone having regular earnings, it is important for the banks to evaluate their financial standing and repayment capabilities through adequate credit appraisal mechanisms,” added Sitaraman.

According to analysts, apart from the salaried or self-employed categorisation and credit bureau scores, banks have multiple attributes that go into their scorecards for arriving at lending decisions. Such scoring parameters include socio-economic factors which could now be populated based on the digital information about the borrower, such as physical location, educational qualifications, and details of friends and family members, which help in the socio-economic profiling of the borrowers and predictability of future defaults.

“Tighter underwriting, including granular and diversified credit portfolio, and smaller exposures to new-to-credit customers are some of the other precautionary measures that can be taken by banks to minimise the risk of NPAs,” added Aashay Choksey, Assistant Vice President, Financial Sector Ratings, ICRA.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.