When N Chandrasekaran (59) and K Krithivasan (58) studied at Tamil Nadu’s Coimbatore Institute of Technology (CIT) in the early 1980s, little did they know that their futures would unfold in remarkably similar ways.

On March 16, CIT added another feather to its cap when K Krithivasan was named CEO and MD-designate of Tata Consultancy Services (TCS), India’s largest IT services firm.

This marks the second instance of a CIT graduate leading TCS, with the first being none other than Chandrasekaran. The former CEO is now the chairman of the company’s parent, Tata Sons.

However, Chandra and Krithi, as they are called, have more in common than an alma mater. They both have a lifelong association with TCS and the Tata group, share a passion for running, and are willing to live out of a suitcase if it leads to better chances of client closures and deal wins.

“Krithi has already started to travel like crazy. He was in the US, EU, and London twice. He is very similar to Chandra (N Chandrasekaran, the chairman of Tata Sons). He will go as many times as a client asks him to for a deal,” an industry analyst said.

A senior official at TCS concurred with this assessment. “That is an accurate description. He is very customer oriented. Internally, he is popular and gets along very well with other leaders.”

An alumnus of CIT and IIT Kanpur, Krithivasan takes over the TCS reins on June 1 as the fifth CEO in its over-five-decade-long history. While Krithi was based in Chennai, he has been operating out of the TCS guest house in Mumbai for the last few months and will start house hunting soon as his family will be relocating. An avid reader, he has also been taking an intensive Sanskrit course over the last few years.

At 58, he will be one of the seniormost executives in the company to be appointed CEO. Prior to this, he was the global head of TCS’s Banking, Financial Services and Insurance (BFSI) Business Group, which contributes around 35 percent of the company’s revenue.

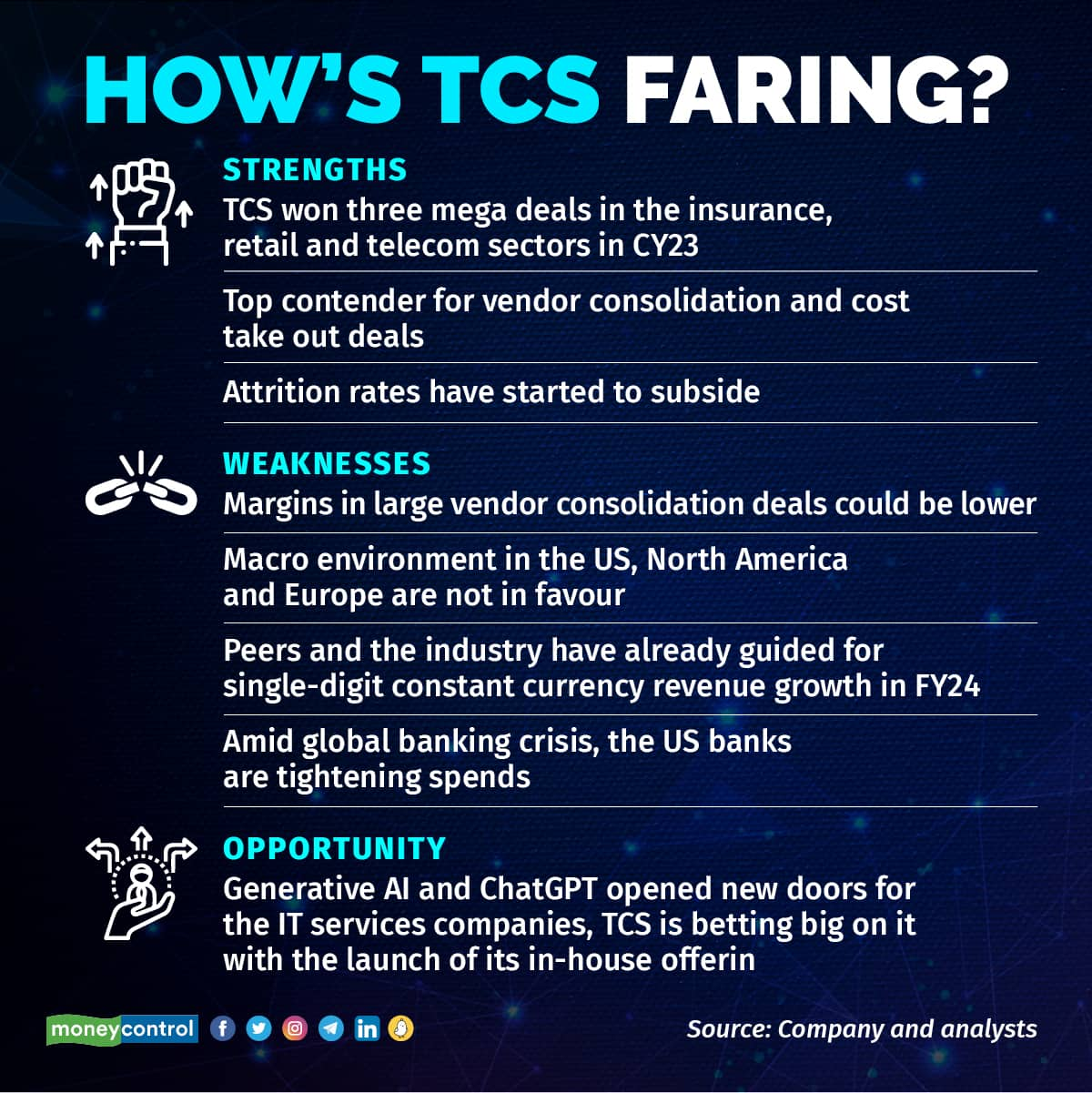

Krithi takes charge at a time when growth is slowing down for the IT sector due to uncertainties, and caution in key markets such as the US and Europe.

In his tenure at TCS spanning over 33 years, Krithivasan has maintained a low profile, but those who have known him describe him as a hard-working, execution-driven leader, who is also approachable and cordial. According to a recent note by Kotak Institutional Equities, he managed a large BFSI portfolio of $11 billion.

Ronak Doshi, partner at Everest Group, who has interacted with Krithi over the last five years, said he is respected by clients and focused on outcomes.

“He has a lot of credibility among the analyst and investor community as a client-facing P&L owner. He is highly accessible to clients and has empowered his leadership team to act in the best interest of the client,” Doshi told Moneycontrol.

Driven, focused and smart — that’s how Phil Fersht, CEO of HFS Research, an outsourcing research firm, describes Krithivasan, with whom he has been acquainted over the years. “He seems smart, articulate, and really knows the business. He also has a warm, empathetic manner to motivate key people to deliver for the firm,” Fersht said.

When Chandrasekaran moved to Tata Sons, Krithivasan was one of the frontrunners to replace him, before outgoing CEO Rajesh Gopinathan was picked for the top job in 2017. While most disappointed frontrunners tend to quit, Krithi stayed back and continued to perform.

His growth trajectory at TCS has many parallels with that of Chandra. He learnt the company’s business and operations ground-up, having worked in delivery, pre-sales, sales and large client groups.

As he settles into his new role at the corner office, the focus will be on ensuring growth in key markets such as the US and Europe, and striking the right balance between growth-focused large deal wins and small/ mid-sized deals, analysts said.

TCS began calendar year 2023 on a good note. It has already bagged three mega deals of over $700 million. These include a $723-million deal from UK-based insurer Phoenix Group and another one with British retailer Marks and Spencer (M&S). Though the exact deal size was not disclosed, the M&S deal was worth $1 billion, according to reports.

Most recently, a consortium led by TCS received an advance purchase order for a $1.8-billion-plus deal from government-owned telco Bharat Sanchar Nigam Limited (BSNL) to deploy its 4G network across India.

Beyond deal win prospects, travelling and meeting clients in person to understand market and demand cycles will top Krithi’s agenda as he takes charge. He will also be looking at building a better connect with TCS’ employees. Krithivasan is already regarded as an empathetic leader and consensus builder within the company.

TCS’ cautious approachPerhaps the biggest news about TCS in 2022 was its business restructuring plan and what it really meant. The company had unveiled four distinctive business groups based on the client’s journey with the company, instead of verticals based on business sectors and geographies.

These groups were the acquisition group, relationship incubation group, enterprise group and finally business transformation group. Apparently, not many within the company liked this model. In a previous report, Moneycontrol had reported that Krithivasan himself was not happy with the reorganisation plan and decided to keep his vertical out of it. Also, TCS is yet to start reporting group-wise revenue and growth numbers.

Analysts Moneycontrol spoke to are now waiting to hear an update on the same. “This rejig has caused considerable unrest among senior executives and vertical heads. The new CEO needs to take a call on whether to continue with the restructuring or roll back the proposed changes,” Everest’s Doshi said.

For FY24, in terms of business, TCS has already alluded to the mix of deals in its bookings being more near-term, quick ROI-based small-to-medium term deals (aligned with the cost agenda of clients), implying a faster degree of revenue conversion in the future.

On May 30, Gopinathan, whose exit stunned the industry, sent out a heartfelt internal note to employees as his last day as the CEO neared. Gopinathan expressed gratitude, and also highlighted some interesting milestones from his six-year-long tenure.

TCS’ revenues grew from $17.5 billion in March 2017 to $27.9 billion in March 2023, he wrote. During this period, the company’s market capitalisation grew from $74 billion to $143 billion, and it returned over Rs 2 trillion ($27.3 billion) to shareholders through dividend and share buybacks.

Gopinathan, also a TCS lifer, expressed gratitude to his predecessors FC Kohli, S Ramadorai and N Chandrasekharan.

He welcomed Krithivasan saying TCS’s best years are ahead. “I wish Krithi the very best as he takes over the TCS baton and charts the way forward to our $50 billion aspiration,” he wrote.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.