In February, top leaders of Tata Consultancy Services (TCS), India’s largest software exporter, convened in Doha to attend their annual strategy conference, Blitz.

During that event, it became clear that the top bosses in the Tata group were displeased with the pace at which the software company was growing its topline. Revenue growth was flagging and that point became obvious during the discussions involving senior executives, three people aware of the development said.

Weeks later, on the evening of March 16, 2023, TCS informed stock exchanges that Gopinathan decided to step down. K Krithivasan, Global Head-BFSI (Banking, Financial Services and Insurance), the largest and most important vertical in terms of revenue at TCS, would succeed him as CEO. Gopinathan will continue until September 15, 2023 to help with the transition.

Tata Sons and TCS did not offer comments for this article.

To say Gopinathan’s exit was shocking would be to put it mildly. TCS has long taken great pride in the stability of its leadership.

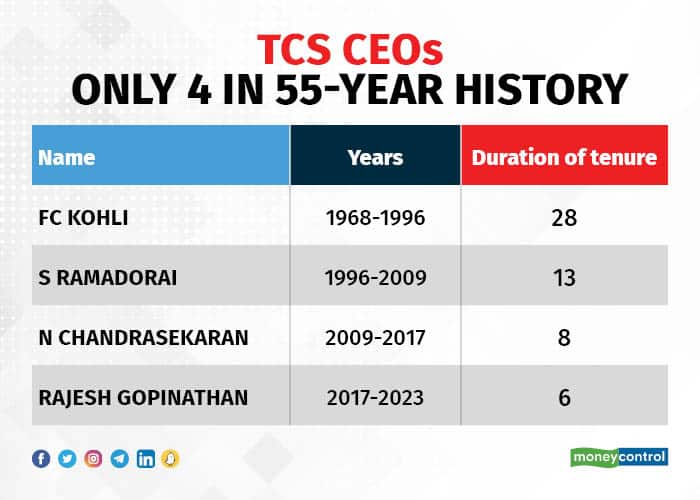

Unlike its rivals Infosys and Wipro, which were roiled by turbulent CEO appointments and exits, the Tata group company has had just four CEOs in its 55-year history. And all of them were TCS lifers who spent decades at the firm.

In February 2017, Gopinathan succeeded N Chandrasekaran as TCS CEO, as the latter assumed the role of Chairman of Tata Sons. Chandra, who was named TCS CEO in 2009, hand-picked Gopinathan for the CFO role in 2013. An engineer and MBA by training, Gopinathan had also worked closely with Chandra on organisational design and strategy.

Gopinathan’s departure was also a shocker because he was reappointed as TCS CEO for a five-year term until February 2027 only a year ago. It is rare for CEOs to quit when they have four years left in the tenure.

The timing could not have been worse. His exit also comes amid worsening macros in the US, the biggest technology market and the crisis of confidence that has gripped the US banking system in the aftermath of the collapse of Silicon Valley Bank (SVB) and Signature Bank.

According to JP Morgan analysts, TCS and Infosys have the highest exposure to regional banks in the United States and may need to set aside provisions due to their exposure to SVB.

Industry analysts also expect the SVB collapse to result in enterprise clients pushing their IT spending decisions, leading to longer sale cycles and delay the actual budget cycle for 2023.

Fatigue from 40 quartersWhile stakeholders were still scrambling for answers, the company implied that monotony and the earnings rigmarole got the better of its CEO.

TCS Investor Relations head Kedar Shirali sent a Whatsapp message to equity analysts minutes after the announcement, seeking to assuage their concerns.

The message read, "Rajesh told me that last quarter he realized that he had been doing the same thing for 40 quarters, getting on to the conference call bridge every 13 weeks and getting grilled by you. And that he'd been asking himself when's a good time to find something new to do. After discussing with Chandra, he decided that this was the best time to pull the trigger.”

The next day, Gopinathan and Krithivasan addressed journalists.

Gopinathan is usually reticent and unflappable at press meets and analyst calls. On that day, he was unrestrained. “It's an odd day today but I am happy to announce that I am stepping down after 22 years with TCS. I can’t tell you how happy and light I feel,” he said.

The writing on the wallWhile external stakeholders and TCS watchers were taken by surprise, insiders Moneycontrol spoke to said the move has been brewing for some time now.

A confluence of factors, importantly an organisational restructuring exercise, finally precipitated Gopinathan’s resignation.

Horror recastAt a time when Accenture and Infosys were snapping at its heels, TCS unveiled an organisational overhaul in April 2022. The company divided clients into four distinctive business groups depending on a client’s journey with it instead of verticals and geographies.

These were the acquisition group, relationship incubation group, enterprise group and finally business transformation group. While the previous restructuring saw TCS creating 23 unit heads tasked with running a $250 million business each, the new structure split the company into units based on the revenue grouping.

“I found the reorg funny. You are essentially grouping this based on revenue size, with the guy at the end of the food chain likely to benefit the most as the client keeps moving from one group to the next,” another executive familiar with the development said.

In other words, the upshot of the revamp was that a TCS executive would be loath to take ownership of an account because of the likelihood of it going out of their hands once it becomes big. This caused unrest among senior executives.

It was also complex to execute. For instance, the accounts below $10 million followed a horizontal structure, the ones between $10-100 million a vertical structure and the ones above had a mix of vertical and horizontal. "It was confusing on who would take ownership of a client," the executive cited above said.

Another executive said the structure would never work for a domain-specific industry like IT. “If I am running a unit with two large insurance clients, I can win smaller clients on the back of that expertise. Here, people in the acquisition group will be stuck and can never scale to a bigger client. And winning the account the first time is usually the toughest part of the journey,” he said.

Many people in TCS harboured the same feelings. One of the sources cited above said CEO designate Krithivasan, who ran the biggest vertical within the company, too was not in favour of the horizontal structure.

So much so that his vertical was completely kept out of it. "Krithi kept the BFSI vertical out of the redesign," at least two sources confirmed to Moneycontrol.

Empathy factor“Whenever people had an issue they would go to NGS (COO N Ganapathy Subramaniam) or N Chandra. Rajesh has amazing intellectual horsepower but he doesn’t suffer fools,” one of the sources cited above said.

This trait might have served him well as a CFO. But as a CEO he had to persuade the leadership team, and take the entire organisation along. And those qualities became a weakness as a CEO.

The same person added that Krithivasan is “high on empathy” and a “consensus builder.” Attributes that will help him as he gears up to manage a company with over 600,000 employees.

In fact, Krithivasan was a front-runner for the CEO role even in 2017, given he ran the largest portfolio and grew it in a consistent manner.

Growth pangsTCS’ growth too was underwhelming compared with rivals such as Accenture and Infosys.

Under N Chandra, TCS was on a strong wicket, heaving the company to leadership in various domains and geographies. TCS was nimble, gaining from early investments in digital, products and platforms. Under his leadership, TCS had generated consolidated revenues of US$16.5 billion in 2015-16.

To be sure, Gopinathan built on these strengths, with TCS delivering consistent performance under his watch.

In the last six years, TCS added more than $10 billion in incremental revenues and saw an over $70 billion increase in market capitalisation.

It has a revenue run rate of $28 billion, with industry-leading margins.

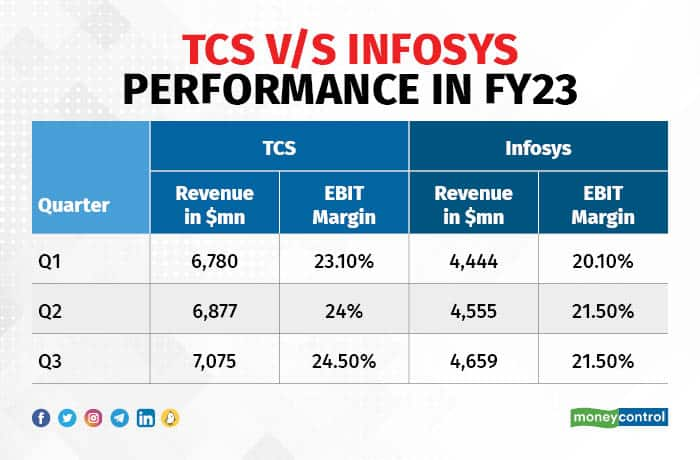

Nonetheless, TCS seems to have lost sheen compared with its larger rival Accenture and smaller rival Infosys.

For instance, Accenture, which is more than double the revenue base of TCS, has been growing faster than the latter in the past three years. Infosys’ revenues grew faster than TCS for the past three financial years in a row. To be sure, TCS also has a higher base compared with Infosys.

An industry executive said Gopinathan is very sharp intellectually and is a brilliant strategist who can think through complex problems. But will he go out of his way to meet customers and swing deals?

“Rajesh was a reluctant traveller and also hierarchical in terms of choosing whom to meet. He didn’t want to live out of a suitcase,” this executive said, asking not to be named.

Another person familiar with TCS’ operations said Gopinathan was too focussed on financials, at a time when competitors were winning large deals, even if that meant sacrificing margins.

Unlike N Chandra and Krithivasan, who spent decades in client-facing roles, Gopinathan was steeped in finance for a significant part of his tenure—in functions such as Business Finance and CFO, before he became CEO.

First among equals“Normally, a new CEO appointment leads to the exit of disappointed front-runners. While exits are possible, it must be pointed out that Krithivasan was a clear front-runner in case Rajesh ever wished to step down,” a Kotak note by Kawaljeet Saluja, head of research, said.

His career trajectory at TCS has many parallels with that of N Chandra, who also graduated from the Coimbatore Institute of Technology.

Just like Chandra, he learned the business and operations of the company ground-up, having worked in delivery, pre-sales, sales and large client groups.

According to the people Moneycontrol spoke to, over the years, Krithivasan has built a reputation for his chops in execution.

“Krithi has a very strong track record leading the BFSI business and has 34 years in TCS. He will be a very solid presence to take things forward for the firm. He bleeds TCS, and knows the firm from top to bottom, with deep respect from his peers and staff," said Phil Fersht, Founder and Chief Analyst of HFS Research.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.