Finance Minister Nirmala Sitharaman will present the Interim Budget (vote-on-account) on February 1, as this is an election year. The full budget for the financial year 2024-25 is expected to be presented by the new government in July, after the Lok Sabha elections.

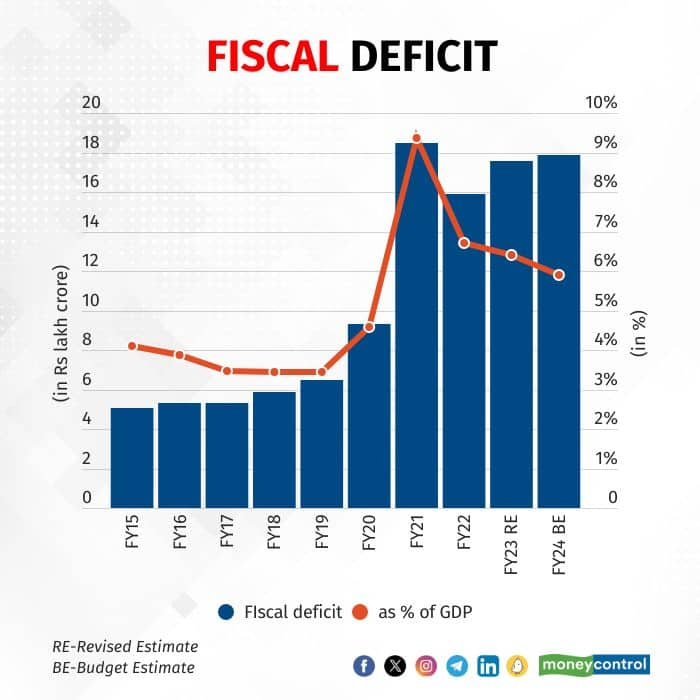

Following the implementation of the Fiscal Responsibility and Budget Management (FRBM) Act of 2003, India has been trying to cap its fiscal deficit at 3 percent of gross domestic product (GDP). The fiscal deficit was sustainably brought down from 5.8 percent in FY12 to 3.4 percent in FY19.

However, the COVID-19 pandemic-driven economic crisis demanded fiscal support.

Understanding the Union Budget 2024: A beginner’s guide

Therefore, the deficit targets were raised by temporarily aborting the FRBM. The fiscal deficit for FY21 stood at a whopping 9.5 percent and that for FY22 at 6.7 percent, which was further lowered to 6.4 percent in FY23. India has committed to a slow taming of the fiscal deficit.

The government has set a fiscal deficit target of 5.9 percent of the GDP for the financial year 2023-24.

Fiscal deficit - good or bad

Now, if the fiscal deficit is what has helped us get past the pandemic, is an elevated fiscal deficit really a bad thing?

There are two sides to this argument. One, a higher fiscal deficit is positive for demand and output. But there’s a flipside too.

Output (AD) = Private Consumption (C) + Government Consumption (G) + Investments (I) + Net Exports (NX)

If the government deficit is higher, it will have to do either of two things: a) increase taxes or b) increase borrowing. Higher taxes reduce disposable income and bring down resources available for private consumption.

Similarly, if the government borrows more, it leaves behind little for the private sector. Also, higher borrowing drives up interest rates and makes it more expensive for the private sector to borrow. In both ways of managing the deficit, the rise in G is compensated by a fall in C.

There are more factors or caveats to be considered. A high fiscal deficit devalues currency, makes imports more expensive, and harms the current account, creating a double whammy of a high internal (fiscal) and external (current account) deficit.

Union Budget 2024: Streamline direct tax rules for firms, start-ups to make India a $5 trillion economy

The impact of a fiscal deficit on the economy cannot be known ceteris paribus – that is, the effect of one factor on another when all other factors remain the same. All other factors rarely, if ever, remain the same. Fiscal deficits impact macro variables such as inflation, interest rates, currency movements, and consequent action from monetary policy.

Fiscal deficit’s effect on asset classes

Considering that a fiscal deficit invites monetary action to address the side effects of several macro variables, let’s turn to what this means for our asset classes.

Let’s split this into three categories: a) impact on equity, b) impact on debt, and c) impact on currency.

On the impact on equity, there are two opposing factors at play. As per the discounted cash flow (DCF) model, the current price is a function of expected cash flow.

A high fiscal deficit raises interest rates and therefore increases the denominator of this model, reducing the real cash flow expectation from equity after adjusting the cost of capital (as reflected via interest rates).Again, higher future taxes will impact aggregate demand negatively.

However, there’s another side to this textbook argument.

The impact of the fiscal deficit on equity will depend on the reasons for the high fiscal deficit.

If the fiscal deficit is rising due to higher productive expenditures such as the building of infrastructure, it creates jobs and employment opportunities and therefore adds to aggregate demand and corporate earnings. Even more immediately, this kind of deficit spending will add to the revenue of sectors directly affected by the infra push, such as cement and building materials.

However, if the fiscal deficit is from high and unproductive expenditure — let's say on subsidies — it can be overall bad for the markets. They do not increase corporate earnings, but the higher taxes reduce the expected cash flow of companies, and hence they can have a negative impact on the market.

Above all, a high fiscal deficit can be positive in the short term, but when rates/taxes go up after a lag, it could bite back with lower equity performance.

Impact of a high fiscal deficit on debt

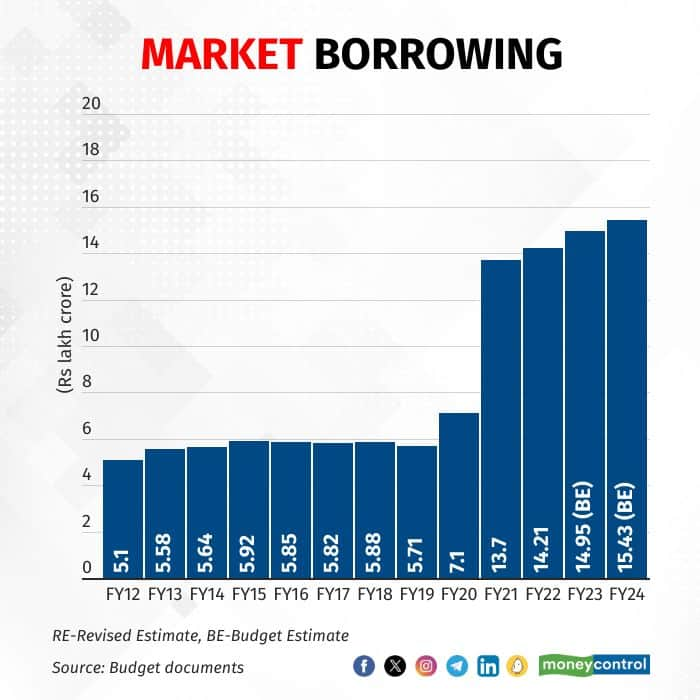

Theoretically, a high deficit translates into higher bond issuances and, therefore, higher interest rates and consequently lower bond prices. Clearly, bond supply exceeds bond demand here, and therefore the prices go down.

Typically, bonds carry a fixed coupon when issued by the government. So when the government has to start issuing higher coupon-bearing bonds to push additional supply because of a bigger borrowing programme, the prices of lower-coupon-bearing bonds trading in the secondary market fall to ensure that the yields on these securities are aligned to the new rates.

However, here’s the catch: if the central banks step up and increase bond demand by absorbing the excess supply, bond prices necessarily do not fall.

Union Budget 2024: The insights into indirect taxation & more that the interim budget could offer

Additionally, if inflation and growth are low, central banks can cut interest rates, which can increase bond prices even when the fiscal deficit is high (usually in a crisis-like scenario).

Also, a lot of it depends on the movement of global asset classes. If a country is increasing its fiscal deficit in isolation, it is likely to be bad for asset classes since the country stands the risk of a rating downgrade, which could bring down foreign inflows. However, if it is a global wave, the impact will be judged on a relative basis.

Emerging markets (EM) versus developed markets (DM) yields matter for fund allocation and relative yields matter for the bond prices of a country. Therefore, a high fiscal deficit, while theoretically negative for bond prices, has many ifs and buts playing in the opposite direction.

Impact of high fiscal deficit on currency

Usually, a high deficit translates into a weaker currency.

As said earlier, a higher fiscal deficit increases the chance of a rating downgrade and therefore brings down foreign flows. A fall in foreign flows makes the currency weaker. More so, a higher fiscal deficit adds extra domestic currency liquidity to the economy and therefore devalues the currency.

This is positive for exports and negative for imports, but since India is a net importer, it has usually been overall negative for the current account balance.

All of the asset classes react to the fiscal deficit with a lead/lag. Markets anticipate the future and act as lead indicators, reflecting expectations. But as things play out, prices move to reflect deviations from what was anticipated. Lag movements thus capture the surprise elements.

What to expect from Budget 2024?

Minister of State for Finance Bhagwat Karad has said that the government is poised to meet its fiscal deficit target of 5.9 percent of the GDP for the financial year 2023-24.

For the first seven months of the financial year 2023-24, India's fiscal deficit stood at Rs 8.04 lakh crore ($96.86 billion), accounting for 45 percent of the projected estimate for the entire year, according to data released by the government in November.

As per a Reuters report, the government is planning to lower its budget deficit by at least 50 basis points (bps) in 2024-25 from this year's target of 5.9 percent of GDP, while also looking to raise capital spending by as much as 20 percent.

Shrinking the fiscal deficit while at the same time increasing capital spending will depend on an increase in revenues and efforts to curb subsidies, said Devendra Pant, an economist at India Ratings.

Moves to cut welfare spending and subsidies would be unusual for a government facing a national election in just a few months.

Over the past few years, the government's push to increase spending on infrastructure has been the main driver in making India one of the fastest-growing economies in the world.

What would be important to watch in the budget is what is moving the fiscal deficit.

Under the revenue head, additional taxes will not be welcomed, but higher and credible revenue via disinvestments, dividends, and so on can be positive. Under the expenditure head, a higher capital expenditure will be preferred over non-productive heads.

If the expenditure is such that it fuels the economy, then even a higher fiscal deficit will be easily accepted.

Sources of borrowing

This matters for the bond markets. A high fiscal deficit, with some part of it borrowed internationally, could be more acceptable compared to the entire borrowing being financed through domestic markets. This is because yields in developed markets are still low.

Also, how the Reserve Bank of India (RBI) steps up to finance the borrowing will be critical. If the central bank buys a portion of the government bonds through open-market operations (OMO), the price of bonds will not fall and yields will not go up.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.