Expert advice: To determine whether you are liable to pay tax in India and file an ITR, two factors are relevant: your residential status in India for that financial year and whether the income was earned, received or accrued in India or outside.

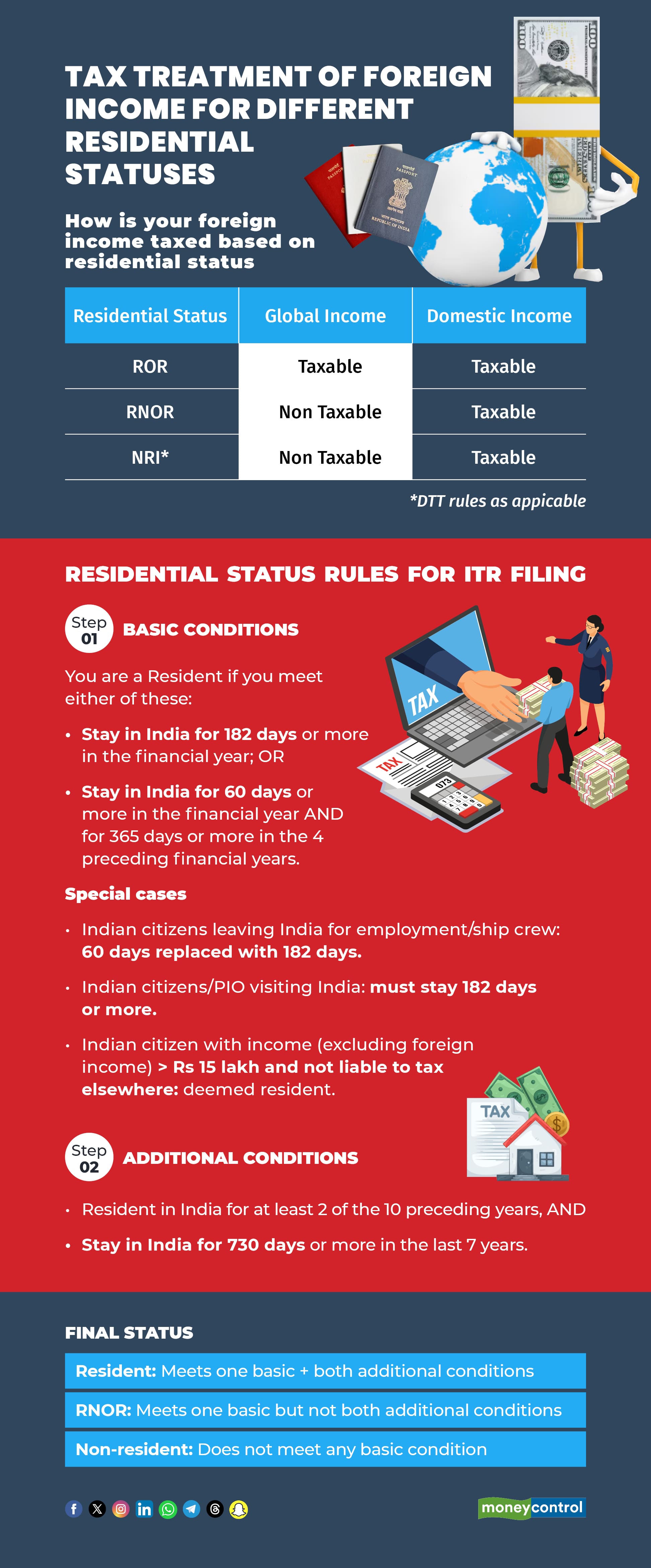

Your residential status is determined based on your physical stay in India during the financial year. You are considered a resident if you satisfy one of the following basic conditions:

a) You were in India for 182 days or more during the financial year; or

b) You were in India for 60 days or more during the financial year and for 365 days or more in the four financial years immediately preceding it.

For Indian citizens leaving India for employment abroad (or as crew on an Indian ship), the 60-day condition in (b) is increased to 182 days. Similarly, Indian citizens or persons of Indian origin visiting India must also stay at least 182 days in the year to be considered residents.

An Indian citizen who is not liable to pay tax in any other country will be treated as a resident if their total income (excluding foreign income) exceeds Rs 15 lakh during the previous year.

There are also additional conditions:

a) You were a resident of India in at least two of the 10 financial years preceding the relevant year and

b) You stayed in India for 730 days or more in the seven years immediately preceding the relevant year

If you satisfy one of the basic conditions and both additional conditions, you are treated as a resident for tax purposes and your global income becomes taxable in India, provided double taxation treaties (DTT) are considered. If you satisfy one of the basic conditions but not both additional conditions, you are treated as Resident but Not Ordinarily Resident (RNOR). In this case, only your Indian income and foreign income derived from Indian sources are taxable in India. Most global income remains non-taxable in India.

If you do not satisfy any of the basic conditions, you are treated as a non-resident and only your Indian income is taxable in India. Note that residential status must be determined separately for each financial year. Therefore, if based on your residential status your taxable income in India exceeds the basic exemption limit, you are required to pay tax in India and file your ITR.

Disclaimer: The views expressed by experts on Moneycontrol are their own and not those ofthe website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.