BUSINESS

Avanti Feeds, Apex Frozen Foods & Waterbase: The good days seem to be over

FY18 turned out to be an exceptional year for shrimp exporters as the companies benefited from slight pick-up in realisations as well as benign raw material prices.

COMPANIES

Large cap cement pack – where should you put your money?

The industry is looking forward to better capacity utilisation this year, as the demand environment, led by a pick-up in infrastructure and housing, is expected to remain buoyant.

BUSINESS

Cera among top picks in sanitaryware segment for long-term investors

The sectoral outlook for FY19 looks positive as revival in new construction activity (post the implementation of RERA) is expected to spur the demand for building products

BUSINESS

Prefer VRL Logistics to Allcargo, accumulate on dips

We expect VRL Logistics to be a steady compounder over the next few years and therefore advise long term investors to accumulate the stock on dips

MONEYCONTROL-RESEARCH

4 consumer durable stocks to bet on for the long term

The consumer durable market offers immense growth potential as penetration levels of even the most basic electronic goods are in low double-digits

BUSINESS

Prefer Heidelberg, Sanghi Industries from midcap cement pack

We feel the competitive pressure will continue to remain high in the northern and western regions. However, the companies with strong presence in east, central and south (specifically Andhra and Telangana) region will benefit from an improved demand environment in these geographies.

BUSINESS

Outlook positive on Indian tile industry, watch out for Asian Granito

While Asian Granito is focusing on increasing its retail presence, Kajaria and Somany are gradually diversifying their business by foraying into sanitaryware and bathware segments

BUSINESS

Berger Paints: Near term positives priced in, upside limited

The management is optimistic on demand in FY19 and remains confident that the recent price hikes will ease off margin pressures.

BUSINESS

TCI Express: Moving in the fast lane

Aided by industry tailwinds and increased economic activity, the managements expects FY19 topline to increase around 20%

BUSINESS

Shreyas Shipping & Logistics: Making waves

The company enjoys a market share of over 50 percent in the domestic containerised cargo trade business and 90 percent share in EXIM transhipment.

BUSINESS

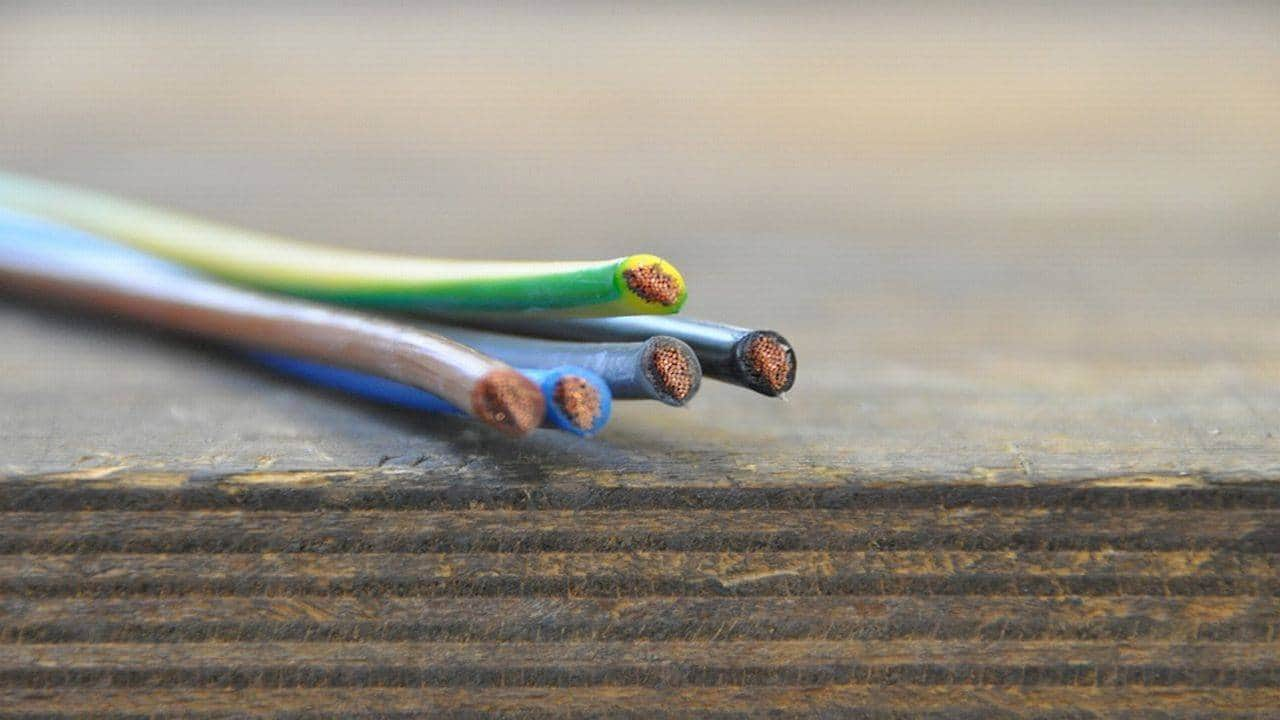

Finolex Cables: Accumulate for the long term on any weakness

Considering its industry prospects and the management’s execution capabilities, we expect the company to grow at a steady rate of 14-15 percent for the next couple of years.

BUSINESS

Transport Corporation of India: More tailwinds at a reasonable valuation

Aided by industry tailwinds and increased economic activity, the managements expects the momentum to continue in FY19 and expects a topline growth of 15 percent.

BUSINESS

Dixon Technologies: A secular play on Indian consumer electronics; Accumulate on dips

The management is aiming for a 20 percent growth in topline by adding clients as well as mining relationships with existing clients.

BUSINESS

Dalmia Bharat Q4 review – Strong Volume growth; Margins surprise positively

Strong demand in eastern markets should help the company clock double digit volume growth over the course of the current financial year.

BUSINESS

Star Cement Q4 review – Weak quarter, but long term outlook intact

With a pick-up in infrastructure development activities, demand is expected to remain firm in Star Cement’s core operating markets.

BUSINESS

Crompton Greaves Consumer Q4 review: Product innovations drive growth

Crompton aims to introduce 1-2 innovate products in each season across categories.

BUSINESS

Kajaria Ceramics – Expect growth revival in couple of quarters

We remain sanguine on the long-term prospects of the company as it enjoys a market leadership position and strong brand recall. We reiterate our view of a growth revival from the second half of the current fiscal