Transport Corporation of India (TCI), India’s leading integrated multimodal logistics service provider, reported a strong set of numbers in the last quarter of FY18. The growth in revenue and profitability was driven by strong performance of the Seaways and Supply Chain Solutions business segments. Transport Corporation of India continues to perform well on the operational front and the current valuations makes the stock noteworthy at current levels.

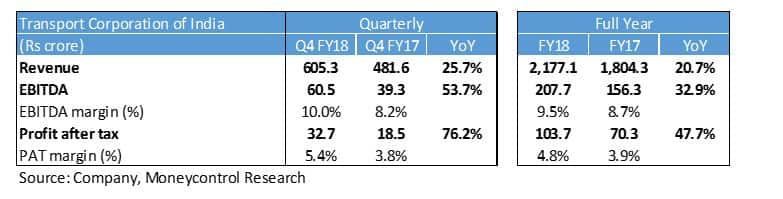

The sales for the quarter increased by 26 percent to Rs 605 crore. EBITDA grew 54 percent at Rs 61 crore while profit after tax nearly doubled to Rs 33 crore. The company ended the fiscal year on a solid note and reported a topline growth of 21 percent and bottomline growth of 54 percent.

TCI operates through three business segments and provides multimodal logistics solutions to its customers. TCI Freight division enables surface transportation, TCI Supply Chain Solutions designs and develops integrated supply chain solutions for corporates and TCI Seaways caters to coastal cargo requirements for container and cargo movements. The company is witnessing demand across all its business segments post-rollout of the Goods and Services Tax (GST) in July last year.

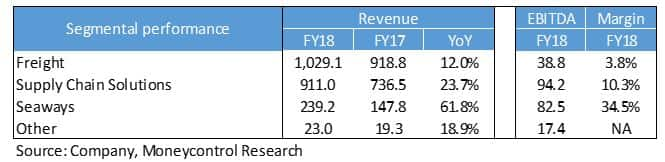

Freight division reported a topline of Rs 1,029 crore for FY19, implying a segmental revenue growth of 12 percent. Margins came in better compared to last year as the management focused on large clients and key account management with value-added services. This segment continues to grow at a steady pace as organised players like TCI are witnessing uptick in demand for Full Truck Load and Less Than Truck Load services post-rollout of GST and E-way bill.

Supply Chain Solutions (SCS) business segment continues to witness good industry demand across sectors, especially automobiles which contribute to the largest revenue share in this segment. The revenue growth in this segment was driven by large contract sizes from existing clients as well as addition of new clients. TCI plans to increase the share of SCS business from current levels by rendering post-GST supply chain restructuring services and increasing focus on third-party logistics services.

Seaways division reported the strongest revenue growth across its three business verticals and reported a jump of 62 percent in FY18. Strong performance of the Seaways boosted the profitability of the company at consolidated level as it has considerably higher margins compared to the other verticals. In March 2018, TCI has added another ship to its existing fleet of five ships which operate on the east and west coast. The new ship will be deployed on the west coast and will start contributing to the topline and bottomline once it starts commercial operations in June-July. The management expects the Seaways business to grow at a healthy rate and contribute 12-15 percent to the total group revenues. Going forward, the company plans to add one ship every 12-18 months.

The company has planned a capital expenditure of Rs 250 crore for FY19. This capital will be used for setting up new warehouses and acquiring a new fleet of trucks and ships. The investment will be funded through a combination of debt and internal accruals. The balance sheet remains healthy and the debt-equity ratio is expected to increase moderately from the current levels of 0.6x.

Oil forms around 40-50 percent of the total cost basket for TCI. Accordingly, it has signed price escalation contracts with its clients to mitigate the commodity price risk. However, the inability to transfer the price hikes to customers could impact profitability of the company.

Aided by industry tailwinds and increased economic activity, the managements expects the momentum to continue in FY19 and expects a topline growth of 15 percent. The growth will be supported by recent government initiatives such as Dedicated Freight Corridors (DFC), Sagarmala and BharatMala as well as growing industry demand.

Considering the growth prospects, TCI (CMP: 285; Market Cap: 2,187 crore) currently trades at an attractive forward price-earnings multiple of 18x and provides significant scope for re-rating as the majority of industry peers trade in the range of 22-25x.

In the medium term, there could be potential upside in the stock through demerger of SCS business. This could lead to significant value unlocking for shareholders as the listed third-party logistics peers — Future Supply Chain Solutions and Mahindra Logistics — trade at more than 30 times forward price-earnings multiple. TCI has previously demerged its express logistic business (TCI Express) in 2016 and expect it to follow suit once the SCS business reaches a scale of 1.5-2x of the current size.

Follow @Sach_PalFor more research articles, visit our Moneycontrol Research pageDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.