Sachin Pal

Moneycontrol Research

For tile manufacturers, Q4 FY18 wasn’t an exciting quarter. Most obstacles that had marred performance in the past appear to be receding, hence the sector merits attention. So, which stock should investors bet on now?

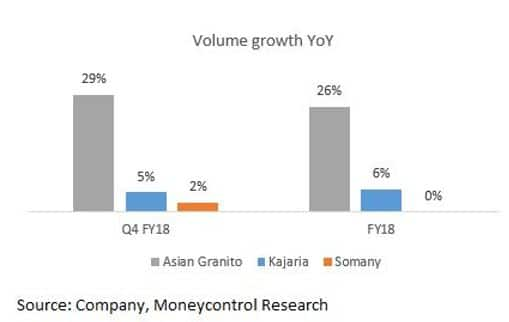

Tile manufacturers reported muted set of earnings in Q4. Asian Granito outperformed larger peers - Kajaria Ceramics and Somany Ceramics - by reporting strong double-digit volume growth. Realisation took a hit as prices of glazed vitrified tiles softened and increase in fuel prices dented margins. Despite a lacklustre performance, players remain optimistic on volume growth and demand recovery in FY19 as industry reforms and government policies should have a positive impact on organised players.

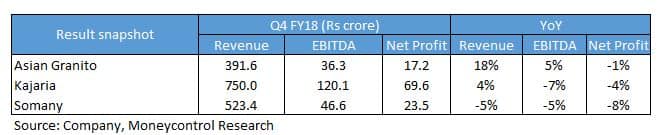

Q4 FY18 result snapshot

Of the three listed players, tile volumes of Asian Granito rose 29 percent year-on-year. On account of a large base, Kajaria and Somany posted low single-digit volume growth.

Asian Granito’s revenue growth lagged behind volume growth due to decrease in price realisations from both tile manufacturing and natural marble trading segments, while Kajaria and Somany reported a muted topline and bottomline.

Increase in key input prices resulted in a contraction in operating margin and subsequently lower profits for all players.

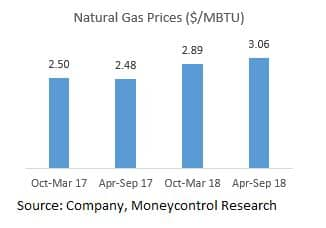

Gas prices impact profitability

Realisations for all players suffered as increased competitive intensity from unorganised players (post the Vibrant Gujarat meet in December last year) resulted in prices of glazed vitrified tiles declining 2-3 percent in the quarter gone by. However, prices seem to have stabilised after the correction and the same is expected to continue for the next 3-6 months.

While the cost of raw materials remained largely stable, operating margin came in lower as gas prices rose sharply. Tile manufacturing is a power-intensive industry with natural gas and electricity accounting for 40-45 percent of total costs. The price of natural gas has seen a steep increase of around 23 percent in the past one year. Prices from April-September have been fixed at $3.06 per million British thermal units after the last price revision. The latest 6 percent hike might further dent margins of players by 80-100 basis points as realisations are unlikely to rise given the heightened competitive intensity.

Somany is somewhat immune to gas price movements compared to Kajaria and Asian Granito as its manufacturing plants in Morbi, Gujarat receive state government subsidies. However, higher gas prices will impact its northern plants, which contribute 20% percent to revenue.

Solidifying market presence through dealer network and store presence

All three companies are focusing on increasing dealer presence to increase customer touch-points and shore up sales volumes.

Asian Granito added 200 dealers in FY18 taking its total dealer network to 1,200 at the end of the year. It plans to add another 300 dealers in FY19.

Somany had gross dealer additions of around 600 last fiscal. However, net addition stood at 325 as around 275 dealers exited the system due to Goods & Service Tax-related issues. Overall it has around 2,000 billing points (including dealers as well as sub-dealers) and around 320 exclusive showrooms.

Kajaria added around 150 dealers to its distribution network taking its total tally to 1,400 at the end of FY18. It plans to expand this network at a similar pace in FY19.

While Asian Granito is focusing on increasing its retail presence, Kajaria and Somany are gradually diversifying their business by foraying into sanitaryware and bathware segments.

Outlook and recommendation

The tile industry faced a challenging year as performance was impacted by demonetisation, rollout of GST and implementation of the Real Estate Regulatory Authority (RERA).

The e-way bill is anticipated to be a game-changer as it will reduce tax evasion from unorganised players and aid market share of organised players. Surveillance measures in the current e-way bill need to be stricter to ensure a higher level of tax compliance and create a level playing field for organised players.

Recovery in real estate (after implementation of RERA) is expected to further spur demand for building products. These players will also benefit from the government’s Housing for All (6 crore new houses by 2022) and Smart City mission (development of 100 smart cities).

Anti-dumping duty on Chinese vitrified tiles (valid up to 2022) would further aid organised players like Kajaria, Somany and Asian Granito.

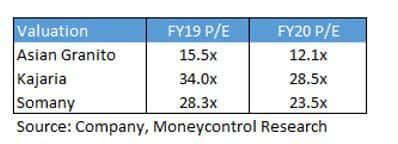

Kajaria enjoys best-in-class operating metrics but current valuations leave little scope for appreciation in the near term.

We remain optimistic on the long term prospects of all three players. But considering the risk-reward ratio, we prefer Asian Granito at current valuations. The company had a stellar volume growth in FY18 and expects to clock 15 percent volume growth in FY19. It continues to expand its retail footprint in an aggressive manner and has increased advertising spends to enhance its brand image. It is also focusing on value-added products to enhance its margin and appointed Vector Consultants to streamline its working capital cycle. Increasing scale, strong free cash generation and declining debt could trigger a re-rating in the stock in line with industry majors: Kajaria and Somany.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!