BUSINESS

FD rates go up: These banks offer up to 8% interest on three-year fixed deposits

The small finance banks, foreign bank and smaller private banks offer the highest interest rates for FDs with a three-year tenure. Comparatively, the public sector banks have lagged behind.

BUSINESS

Moneycontrol review | SwipeUp, a platform that allows you to upgrade your existing cards

The person holding a credit card of other bank is eligible to apply for a lifetime free credit card on SwipeUp platform. The users get one of the AU Small Finance credit cards as upgraded option from AU Xcite series launched with three variants.

MCMINIS

Gudi Padwa offers from developers. Should you buy?

Check these points before you decide

BUSINESS

Top 5 credit cards for international travel

Planning for an international tour during summer vacations? Here's a list of top five credit cards that offer travel related benefits on flight bookings, hotel stays and memberships.

MCMINIS

What is risk-based pricing of a home loan?

BUSINESS

Fallen into a credit card debt trap? Here are strategies to pay off your debt

Several millennials are falling into credit card debt because of an expensive lifestyle. But there are some strategies to pay off credit card debt

BUSINESS

Tax-saving FDs: These banks offer up to 7.6% interest rate

If you haven’t started your tax planning, do it now as we are just a few weeks away from March 31. Risk-averse investors and those in lower tax brackets can look at tax-saving fixed deposits.

MCMINIS

Why are home buyers choosing banks over NBFCs?

BUSINESS

Women’s Day Special: How Chetna Gala Sinha helped women in rural Maharashtra become financially independent

Chetna Gala Sinha, Founder and Chairperson of Mann Deshi Mahila Sahakari Bank, talks about her 25-year banking journey, serving rural women and providing financial support beyond banking through the Mann Deshi Foundation.

BUSINESS

Women must automate their investments, says Shalini Warrier, Executive Director at Federal Bank

Women should use credit cards judiciously. While spending using the credit card, make sure you have a budget and spend accordingly.

BUSINESS

Women’s day 2023: Best credit cards for women

On the occasion of Women’s day, Paisabazaar has compiled some of the best credit cards that will help women credit card users maximise the savings on their day-to-day spends.

BUSINESS

Axis Bank acquires Citibank’s consumer businesses in India| What's in it for Citibank customers?

Axis Bank's position in the cards business improved from 11.4 percent to 16.2 percent after this acquisition. It gets ready access to highly affluent wealth customers of Citi for Burgundy Private Banking.

BUSINESS

6 changes in the financial landscape this March you need to consider

There are changes in financial landscape this March as follows from Axis Bank’s acquisition of Citi’s consumer business to a nomination in mutual fund investments to tax planning and linking of PAN and Aadhaar, a lot is happening. Here’s what to watch out for

BUSINESS

Citi consumer business is now Axis Bank property: What changes for customers

Axis Bank is likely to make efforts to ensure that the transition is smooth for erstwhile Citibank customers. But home loan borrowers and credit card holders, in particular, will have to brace up for key changes.

BUSINESS

Low annual fees and good value: 5 cards that top the list

Most of the low annual fee credit cards offer benefits in the form of cashback, reward points, discount and co-branded benefits with popular merchants.

BUSINESS

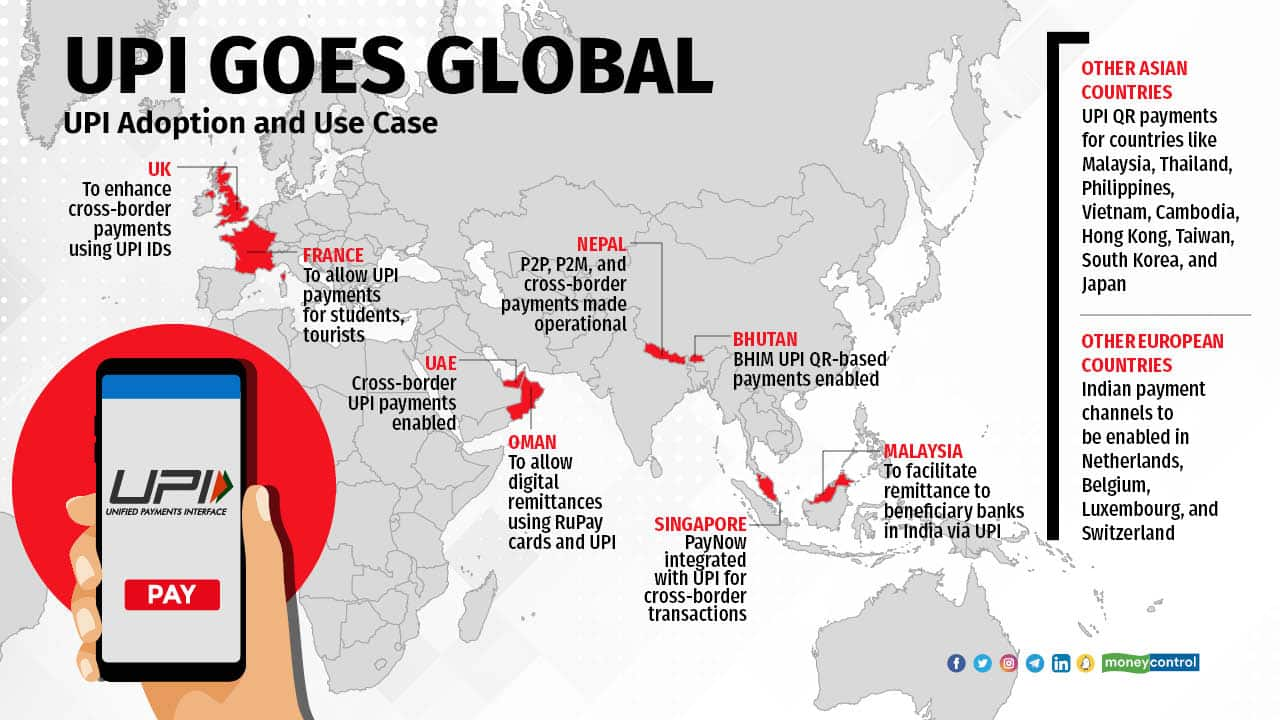

Everything you need to know about the UPI-PayNow interlinkage facility

To begin with, a few banks have been selected from India and Singapore. Customers of these banks will be able to undertake cross-border remittances. At present, there is a daily limit of Rs 60,000 (around SGD 1,000).

BUSINESS

FD rates go up: These banks offer up to 7.85% interest on three-year fixed deposits

The interest rates on FDs offered by public sector banks are not as competitive as rates offered by private and small finance banks.

BUSINESS

Despite rate hikes, home loan demand up in Rs 30-50-lakh, Rs 50-75-lakh segments

Repo rate hikes have been passed on to home loan borrowers, which have led to a significant increase in EMIs ranging from 10-25 percent, says Amit Diwan, Chief Distribution Officer, IMGC

MCMINIS

Gifts to ensure your Valentine's financial security

BUSINESS

Valentine’s Day: How newly-married couples can start talking money, together

Marriage is a new beginning, and for most couples discussing money may not be a priority. However, timely handling of money matters will help avoid future conflicts.

BUSINESS

Senior Citizens FD rates | Private banks that offer up to 8.35% interest on three-year FDs

Despite some boosts to the existing senior citizen's schemes, senior citizens should invest a part of their savings in FDs which offer liquidity and ensure interest income periodically.

MCMINIS

RBI rate hike: Should you switch to a new home-loan provider?

BUSINESS

Increase home loan EMIs or tenure: What should borrowers do?

Existing home loan borrowers have two options to cope with rising interest rates. Increasing the tenure doesn’t burden your monthly outgo, but banks might not allow it if the repayment period goes past your retirement age

BUSINESS

Budget 2023: All you need to know about Mahila Samman Saving Certificate

FM announced a new one-time small savings scheme for women in the Union Budget.