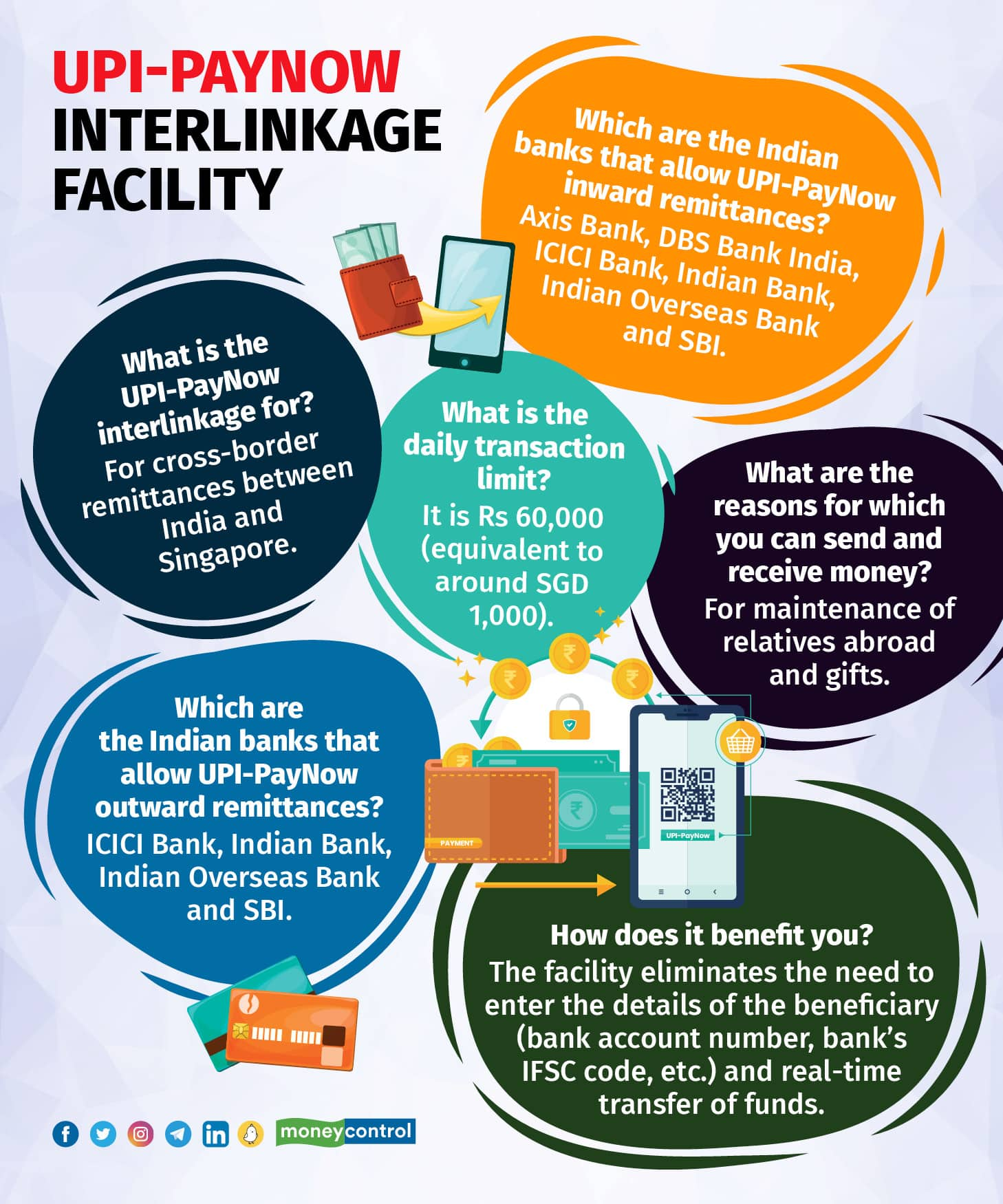

To facilitate swift cross-border remittances for residents of India and Singapore, the Reserve Bank of India (RBI) and the Monetary Authority Singapore (MAS) on Tuesday announced the UPI- PayNow linkage – the real-time payment system linkage between India’s Unified Payments Interface (UPI) and its equivalent network of Singapore, PayNow.

“The collaboration of two fast payments systems (UPI and PayNow) will enable real-time, cost-efficient, and, most importantly, safe cross-border fund transfer for users from the comfort of their mobile phones,” says Swapnil Jambhale, Co-founder and COO of Safexpay, a global payments platform.

Let’s decode how cross-border remittances work, which are the participating banks, the daily limit, and the benefits for users.

Who can undertake remittance transactions between India and Singapore through the UPI-PayNow interlinkage?

Account holders of participating banks and financial institutions in India and Singapore.

“The UPI-PayNow interlinkage is a milestone moment for cross-border transfers. We all know how UPI revolutionised domestic payments and we are now going to see a similar revolution in the cross-border payments space as well,” says Sanjeev Moghe, President & Head of Cards and Payments, Axis Bank.

For what purposes can remittances be sent or received from either side?

At present, only Person-to-Person (P2P) remittances for the ‘Maintenance of Relatives Abroad’ and ‘Gifts’ are allowed.

“With India being one of DBS’ biggest markets for overseas remittances, retail customers, especially migrant workers, will now have another convenient option to send money to their loved ones back home,” says Shee Tse Koon, Singapore Country Head of DBS Bank.

“It will enable NRIs in Singapore to experience easy, seamless, and instant transactions (within a minute),” adds Yashwant Lodha, Co-founder of PayNearby, a fintech company.

Which are the participating banks in India and Singapore?

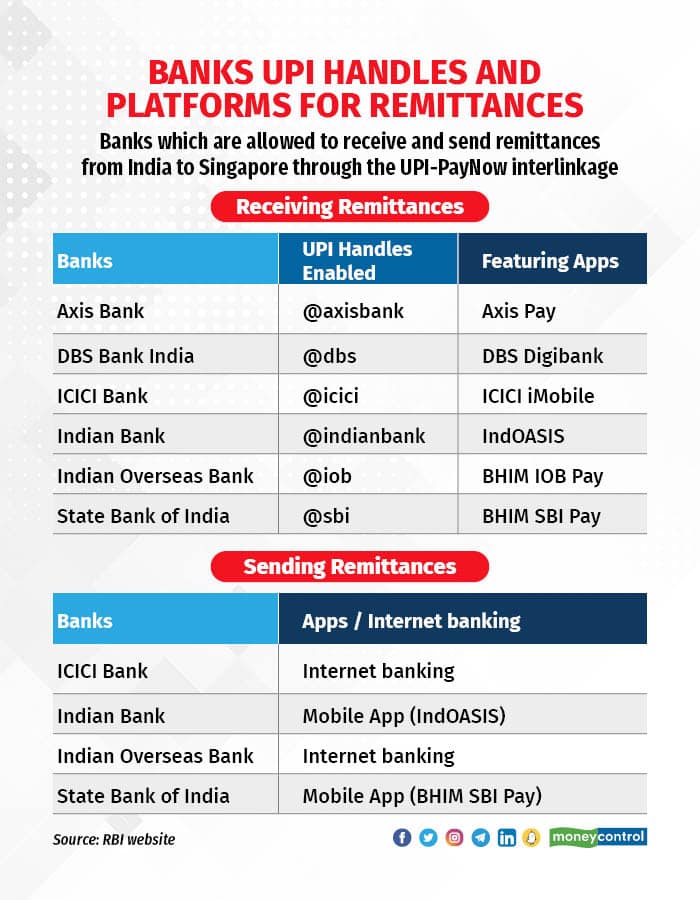

Banks from India are Axis Bank, DBS Bank India, ICICI Bank, Indian Bank, Indian Overseas Bank and State Bank of India (SBI). Going forward, the UPI-PayNow interlinkage will cover more banks and financial institutions.

From Singapore, DBS Bank Singapore and Liquid Group (Non-Bank Financial Institution) are selected.

How is the UPI-PayNow interlinkage facility going to benefit users?

With this facility, funds held in bank accounts or e-wallets can be transferred to /from India using just the UPI ID, mobile number, or Virtual Payment Address (VPA), which is essentially the address to or through which you can make UPI money transfers.

“This facility will eliminate the need for entering the details of beneficiaries, such as bank account numbers, bank codes etc.,” says Mandar Agashe, MD of Sarvatra Technologies, a banking technology service provider.

To add a beneficiary to initiate a first-time transfer of funds usually takes several hours for activation. With this payment facility, both inward and outward remittances will happen instantly.

Also read | MC Explains: Who stands to benefit from India's UPI and Singapore's PayNow linkage

Which apps or platforms can be used for receiving and sending remittances from India to Singapore through the UPI-PayNow interlinkage?

The list of banks in India, their UPI handles and platforms for receiving and sending remittances are given in the table below.

What’s the daily transaction limit?

It is Rs 60,000 (around SGD 1,000). Initially, DBS customers can use PayNow-UPI only to transfer funds up to SGD 200 per transaction, capped at SGD 500 per day. By March 31, 2023, all customers will be able to transfer up to SGD 1,000 daily. This restriction of SGD 500 applies only to DBS customers sending money to India. There is no such communication about capping for transferring funds through Liquid Group (Non-Bank Financial Institution) to India. Banks in India have not communicated about any restrictions on transfers yet.

Can I receive remittances into my account with any of the participating banks in India, even if my UPI ID is not registered with the same bank?

No. At present, you can receive remittance only in a bank in which you have an account and an UPI ID.

For example, you have accounts with Axis Bank and ICICI Bank. But if the UPI ID is registered only with Axis Bank, you can receive the remittance only in Axis Bank.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.