Axis Bank has completed the acquisition of Citibank’s consumer business. The deal, announced in March 2022, will see India’s third largest private sector bank absorbing Citibank’s consumer businesses covering loans, credit cards, wealth management and retail banking operations in India.

Axis Bank, on March 1, put out a video advertisement to welcome the 30 lakh plus customers of Citibank. “Finding the familiar in the new, is a wonderful thing. Welcome to a dil se open world that feels less new, more you,” Axis Bank tweeted on March 1.

Citibank has now put out a list of answers to customers’ common queries about the transition process. Let’s decode its responses to queries around Citi’s existing products, services, charges, and more.

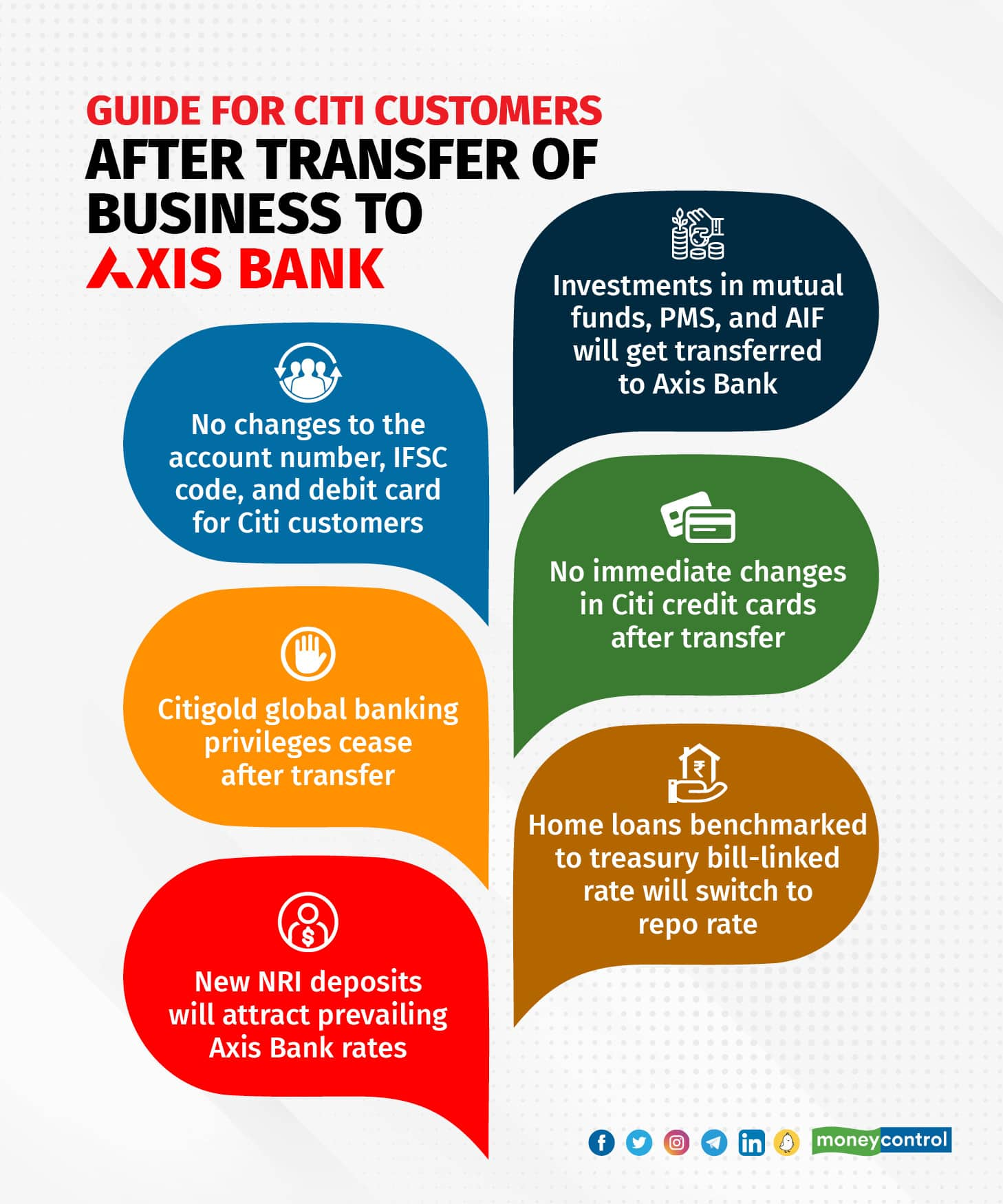

I have an account with Citibank. Will my bank account details remain the same after this transfer to Axis Bank?Yes, you can continue using your Citi account for now without any changes in the account number, IFSC / MICR codes, debit card, cheque book, fees and charges. In case of any changes in future, Axis Bank will notify the customers.

“There is going to be a slow transition for a select set of customers from Citi to Axis Bank. That’s a good thing. Otherwise, there would have been a disruption for Citi customers,” says Parijat Garg, a digital lending consultant.

Will I be able to access Axis Bank ATMs after the transfer date, i.e., March 1, 2023?Yes, you will be able to access any Axis Bank ATM after the transfer date. The number of free transactions currently available to you at Citibank ATMs will be extended to Axis Bank ATMs as well. Any charges currently applicable over and above free transactions at Citibank ATMs will be charged on transactions at Axis Bank ATMs too.

At Axis Bank ATMs you can avail the following services ― balance inquiry, cash withdrawal, PIN change, and mobile number update.

Will Axis Bank continue with Citigold ‘Global Banking Privileges’ for credit card customers after the transfer?The Citigold Global Banking Privileges include bank account opening service if you are relocating to another country. If you are a frequent international traveller then you get attractive deals at hotel, retail shops, restaurants and access to lounges worldwide. You can even withdraw up to $10,000 instantly from your account as emergency cash while traveling.

Now, after the transfer to Axis Bank, these global banking privileges will cease.

“Ceasing this facility will affect only a small portion of Citi customers because not all customers require these global services while travelling abroad,” says Garg.

“The premium card of Axis Bank has similar benefits. So, Citi customers can apply for those credit cards,” says Raj Khosla, MD, MyMoneyMantra.com.

After this transfer, existing NRI deposits (NRE/NRO/FCNR) will continue to earn interest as per rates they were earning on their Citi deposits. But, any new NRI deposits will be as per prevailing Axis Bank rates. The revised SWIFT code for foreign currency inward and outward transactions will be AXISINBB.

You can download the interest certificate and tax deducted at source (TDS) certificate from Citibank Online to determine the amount of interest earned and the amount of tax deducted, respectively.

My investments include mutual fund units, portfolio management service (PMS) and alternate investment funds (AIF) with Citi. What changes should I expect?Effective March 1, your investments in mutual funds, PMS or AIF will be transferred to Axis Bank (ARN 0019). You can continue to access your investment portfolio and transact in your investment account through bank branches / relationship managers / Citibank online, and mobile banking. Your existing investor risk rating will continue to be valid until its expiry date.

However, you will have to brace up for one key change. You will get access to research reports, product information and investment communication that will be in line with Axis Bank’s house views and policies, instead of Citibank’s.

I had taken my insurance policies through Citibank. What will be the impact on these policies?Axis Bank will continue to service the insurance policies taken through Citi after the transfer.

The insurance coverage provided by the insurer will continue as it is after this transfer, provided you pay the insurance premiums as and when due.

There will be no change in the premium being paid as a result of this transition because insurance premiums are decided by the insurance company. The insurance policy is a contract between the insurer and you. The bank is merely a distributor between you and the insurance company.

I am using Citibank credit cards. Will there be any change in earning rewards, redemption process, billing cycle and fees for credit cards after the transfer to Axis Bank?According to Axis Bank, there will be no change in the earning rewards and redemption process after this transfer. Your reward points across Citi credit cards will continue to accrue and remain available for use.

There will be no change in fees, interest charges, billing cycle, payment due date, and bill payment methods for Citi credit cards.

All your standing instructions given to Citi with regard to loan payments, bill payments, or any other account transfer will continue after March 1 as well.

The private sector bank seems to be putting in efforts to make the process of transition as smooth as possible for Citibank customers.

“Axis Bank will go the extra mile to keep Citi customers happy with their customer services, rewards program on credit cards and other services,” says Khosla.

I have an ongoing dispute with Citi credit card related to an outstanding amount. What I should do now?If you have some disputes related to an outstanding amount or late payment charges with Citi, then clear them soon and make sure your credit history is clean. Once the transition between Citi and Axis Bank gets over, getting a resolution to your card complaints might be difficult and time-consuming. “An unresolved dispute may also reflect in your credit report. In the future, there could be challenges while applying for a loan,” says Garg.

What will happen to my home loan account with Citi after March 1?If your home loan is fully or partially disbursed and you have consented to transfer it to Axis Bank, the same shall be assigned to Axis Bank. There will be no changes in the terms and conditions of existing credit facilities.

Will there be any change in the benchmark rate for my home loan with Citi after transfer of loan to Axis Bank?If you have a home loan at Citi linked to the treasury bill-linked rate (TBLR), the same will now be moved to a repurchase agreement rate, i.e. known as a repo rate. An Axis Bank representative will contact you with the process.

If you have a home loan which is benchmarked to Citibank mortgage prime lending rate, base rate or marginal cost of lending rate (MCLR), the same will not undergo any change. In case of any change during the course of transition, Axis Bank will update the borrowers with due notice.

Disclaimer: Axis Bank did not respond to Moneycontrol’s email seeking responses to additional queries and clarifications. An official spokesperson indicated that queries are likely to be addressed at a press meet to be held on Wednesday.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.