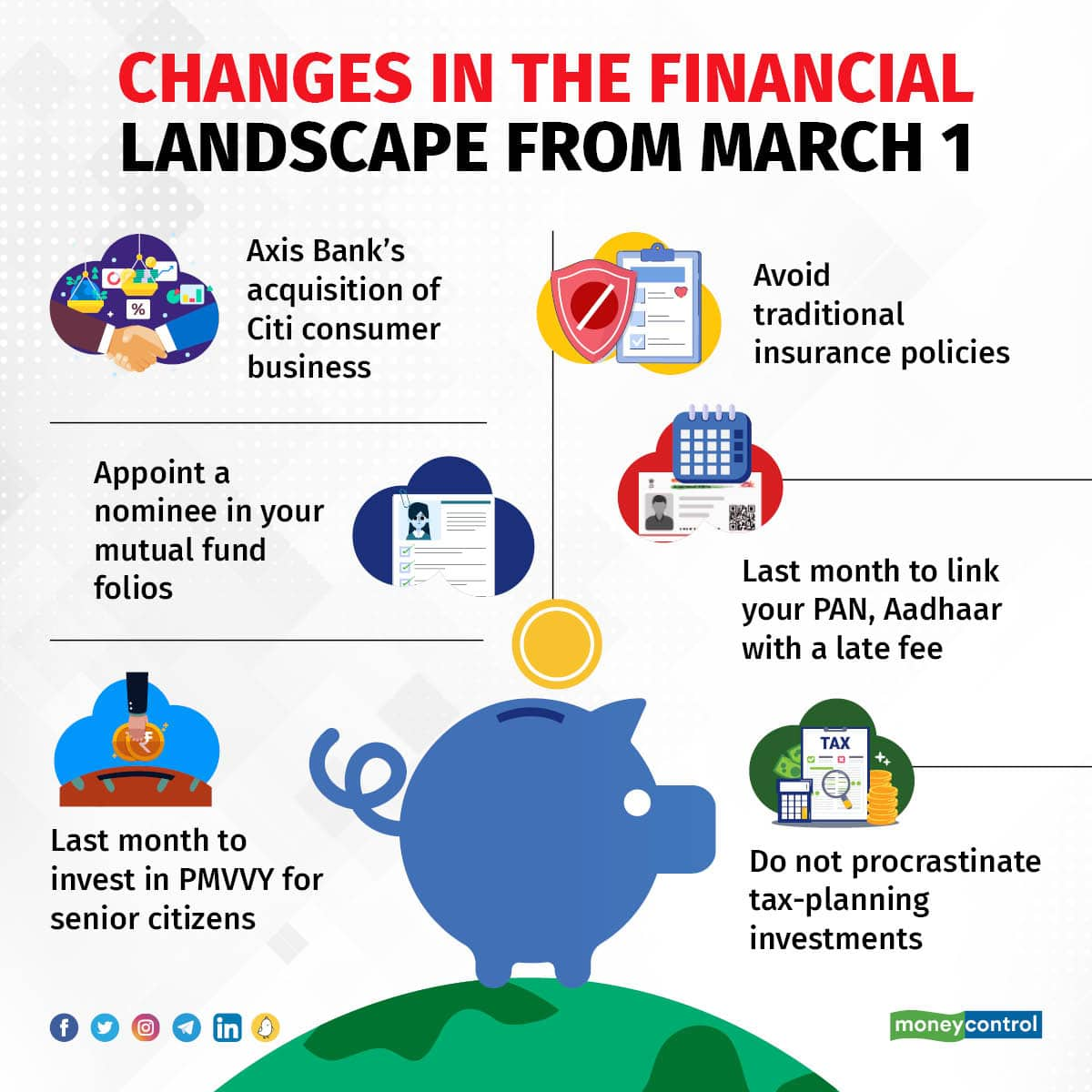

Last month in the financial year is crucial. It’s time to complete pending tasks, such as linking your PAN and Aadhaar with a late fee and invest wisely to save taxes if haven’t done so far. Avoid investing in traditional insurance policies with high premiums. Mutual fund investors know the rules of appointing nominees and take the action. Senior citizens invest in Pradhan Mantri Vaya Vandana Yojana (PMVVY) because the government may not extend the scheme after March 31 and other changes in the policy that will pinch your purse.

Citibank customers also take a note that from March 1, 2023, the bank will transfer its consumer business in India to Axis Bank. So, there could be some announcements in the month for customers.

1 Axis Bank’s acquisition of Citi consumer businessCitibank customers, take note! From March 1, 2023, the bank will transfer its consumer business in India to Axis Bank, completing the final step in the process of acquisition that started in March last year.

The multinational bank’s consumer business in India comprises credit cards, home loans and personal loans, retail banking and insurance distribution, among others.

The deal came after Citigroup, in 2021, announced its decision to shut its retail banking operations in 13 countries, including India, as part of a global business strategy.

Axis Bank is likely to make efforts to ensure that the transition is smooth for erstwhile Citi customers, but home-loan borrowers and credit cardholders, in particular, will have to brace up for key changes.

Also read | Citi consumer business becomes Axis Bank property today: All that you must know2 Mutual fund folios without nomination or an opting-out declaration will be frozenAll existing mutual fund (MF) folios, held in a single name or jointly, need to have a nominee or an explicit opting-out declaration. The fund houses are told to get this done by March 31, 2023. MF folios without nomination or an opting-out declaration will be frozen and investors cannot sell their units in such folios.

If your folio does not have a nominee nor have you opted out of nomination, it is better to approach the fund house and exercise your choice, to ensure that your folios do not get frozen after the deadline.

The Pradhan Mantri Vaya Vandana Yojana (PMVVY), a pension scheme exclusively for senior citizens aged 60 years and above, will cease to exist after March 31, 2023, assuming the government doesn’t extend it beyond March 2023.

It was started as a one-time pension scheme in 2017 and was twice extended – first for two years (from 2018 to 2020), and, then, for three years -- from 2020 to 2023.

In this scheme, senior citizens can invest up to Rs 15 lakh until the end of March 2023. The current PMVVY rate is 7.4 percent per annum, which translates into an annual income of Rs 1.11 lakh. Since PMVVY’s tenure is 10 years, the investor is assured of getting Rs 1.11 lakh a year for 10 years.

With Budget 2023-24 removing tax exemptions on insurance policies with an aggregate premium above Rs 5 lakh, bought after March 31, some agents and banks have started to push such policies before the financial year ends. Buying such policies would be a mistake.

Investment-based insurance policies pushed by financial advisors typically tend to yield lower returns than a pure-term cover for a similar amount. Such policies invest the remaining amount in a mutual fund.

5 Link your PAN and Aadhaar with a late feeTaxpayers, note! Linking your PAN and Aadhaar by March 31, 2023, latest, is mandatory. It will invite a late fee of Rs 1,000, if you delay it.

There are consequences of not linking your PAN and Aadhaar. Following are the consequences. Your PAN will become inoperative, filing ITRs will not be possible, pending income-tax returns will not be processed, pending refunds will not be issued and taxes will be deducted at a higher rate.

6 Do not procrastinate tax planningTax optimization should always be a part of your financial planning exercise and not a task to be completed towards the end of the financial year.

If you haven’t started your tax planning, do it now as we are just a few weeks away from March 31, the end of the financial year.

Invest wisely, considering your financial goals. You can achieve your tax planning goals by investing in existing commitments, which might include your Public Provident Fund (PPF), National Pension Scheme (NPS), Sukanya Samriddhi Yojana (SSY), monthly SIP in equity-linked savings schemes (ELSS), Employees’ Provident Fund (EPF) or life insurance premium.

Buy health insurance to get additional tax benefits under Section 80D of the Income-Tax Act, up to Rs 25,000 each for self, spouse and children. The same limit of Rs 25,000 is applicable for your parents as well, if they aren’t senior citizens, yet.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.