BUSINESS

RuPay takes pole position in debit cards; PhonePe, GPay lead in UPI transactions: Report

According to a report by Fibonacci X, a venture platform, India’s RuPay network holds 69 percent of the debit card market as of CY23, while UPI transaction volumes grew 6.5 times between 2020 and 2023

BUSINESS

Citibank credit cards to become Axis from July 15: Know your fees, features, benefits

The migration of Citi credit cards to Axis Bank will be completed by July 15. Here, we address common questions from Citi credit card users regarding the migration process, the benefits and features of the Axis Bank credit card replacing the Citi card, rewards programs, annual fees and charges, and more.

BUSINESS

Home Loans: Who's got the lowest rate on offer among these housing finance companies and NBFCs?

Lowest home loan rates: LIC Housing Finance, ICICI Home Finance and Aditya Birla Capital offer interest rates between 8.50 and 9 percent on a home loan of Rs 75 lakh for a tenure of 20 years.

BUSINESS

Father’s Day 2024: Why the birth of a child calls for an overhaul of financial plans and how to go about it

Even before the child is born, fathers should start reviewing the family’s household budget, enhance the emergency corpus, make an investment plan for children’s education goals and buy adequate insurance cover for the family, including the child.

BUSINESS

Personal loans: Check out banks that offer the lowest interest rates on a Rs 5-lakh loan

Bandhan Bank, ICICI Bank and Bank of Baroda offer interest rates between 9.47 and 11.40 percent on a personal loan of Rs 4 lakh for a tenure of 4 years.

BUSINESS

Credit on UPI: Convenient loans at your fingertips, but watch for pitfalls

Despite the long list of advantages, uptake of ‘credit on UPI’ remains low due to a lack of enthusiastic participation by banks, which prefer more profitable credit cards.

BUSINESS

RBI plans auto-replenishment of UPI Lite wallet: What does it mean for users?

UPI Lite was launched by the National Payments Corporation of India (NPCI) in September 2022.

BUSINESS

RBI holds repo rate at 6.5%: No impact on home loan EMIs

Existing home loan borrowers who are servicing loans at higher interest rates can look to make lump-sum part-prepayment, increase their EMIs, switch to other lenders or negotiate with their existing lenders to bring down the overall interest burden

BUSINESS

Where to get best rates on your FDs? Canara Bank, PNB offer 7.25% on 15 months duration

Public sector banks top the list of entities that offer the highest interest rates on short-term fixed deposits.

BUSINESS

Eight key financial changes you need to bear in mind this June

From evaluating the impact of the Lok Sabha election results, providing a nominee for mutual fund investments and paying the first advance tax installment to filing income-tax returns for financial year 2023-24, a lot is happening in June. Here’s what to watch for.

BUSINESS

Stay calm, don’t get swayed by election results, say financial planners

Ahead of the Lok Sabha election results on June 4, top financial advisors are advising investors to avoid speculative bets and knee-jerk reactions to market movements, and instead focus on their long-term goals and asset allocation

BUSINESS

Why account aggregators spell great news for rural financial customers

People residing in rural areas will be able to get loans faster despite having bank accounts with smaller or regional rural banks, thanks to the spread of account aggregators, explains Bertram D’Souza, Protean eGov Technologies, in an exclusive interview with Moneycontrol.

BUSINESS

Tomorrow's investors: How children are learning about personal finance

Moneycontrol interacted with three children aged 9-14 years to understand their budgeting and investment skills, and how they manage debt. We also asked them what they had learnt from their parents' investing mistakes.

BUSINESS

BoB's One credit card is revising charges. Here are the details

Bank of Baroda has increased the charges on overlimit fees, late payment charges and interest rate on unpaid dues of OneCard credit card effective June 23.

BUSINESS

Loan against property: HDFC Bank, State Bank of India and Indian Bank offer the lowest interest rates

HDFC Bank, State Bank of India and Bank of Baroda offer interest rates ranging between 9.50 and 10.85 percent on a Rs 15 lakh loan against property for a 7-year tenure.

BUSINESS

Swiggy HDFC Bank Credit Card revises cashback structure: Here are the details

Effective from June 21, any cashback you earn will reflect in your credit card statement, rather than appearing as Swiggy money cashback on the swiggy app.

BUSINESS

Foreign education loan: How to get the best deal

Study Abroad: You should have a strong academic record and a confirmed admission letter from a recognised university to strengthen an education loan application for studying abroad. Avoid giving false information in the application form to process the loan. These can cause rejection of the education loan.

BUSINESS

HDFC Bank’s Pixel Play credit card: So, you can customise this; but is it worth it?

The card offers the flexibility to choose spend categories to maximise rewards. However, the drawback is that only select merchants are available. And the interest is usuriously high.

BUSINESS

Education loans for overseas studies: Indian Bank, Union Bank and Bank of Baroda offer the cheapest interest rates

Indian Bank, Bank of Baroda, ICICI Bank and Canara Bank offer interest rates between 8.6 and 10.85 percent on an education loan of Rs 50 lakh for a tenure of seven years.

BUSINESS

Travelling abroad to study? Here are the best ways to carry forex

While travelling abroad for higher studies, you can opt for multi-currency cards. Look for a forex card with zero markup on transactions in the base currency. It’s also advisable to carry 10 percent of your funds in cash for small purchases, especially in the early days.

BUSINESS

Studying abroad? Beyond college fees, here are 5 additional costs you should budget for

While planning and budgeting for studies in a foreign country, it's crucial to factor in a range of expenses beyond your course fee. Read on to find out what they are.

BUSINESS

Planning your summer holidays? Here are five credit cards offering travel goodies

Credit cards with travel benefits offer airport lounge access, discounts on travel-related purchases, and rewards or air miles that can be redeemed against flight bookings.

BUSINESS

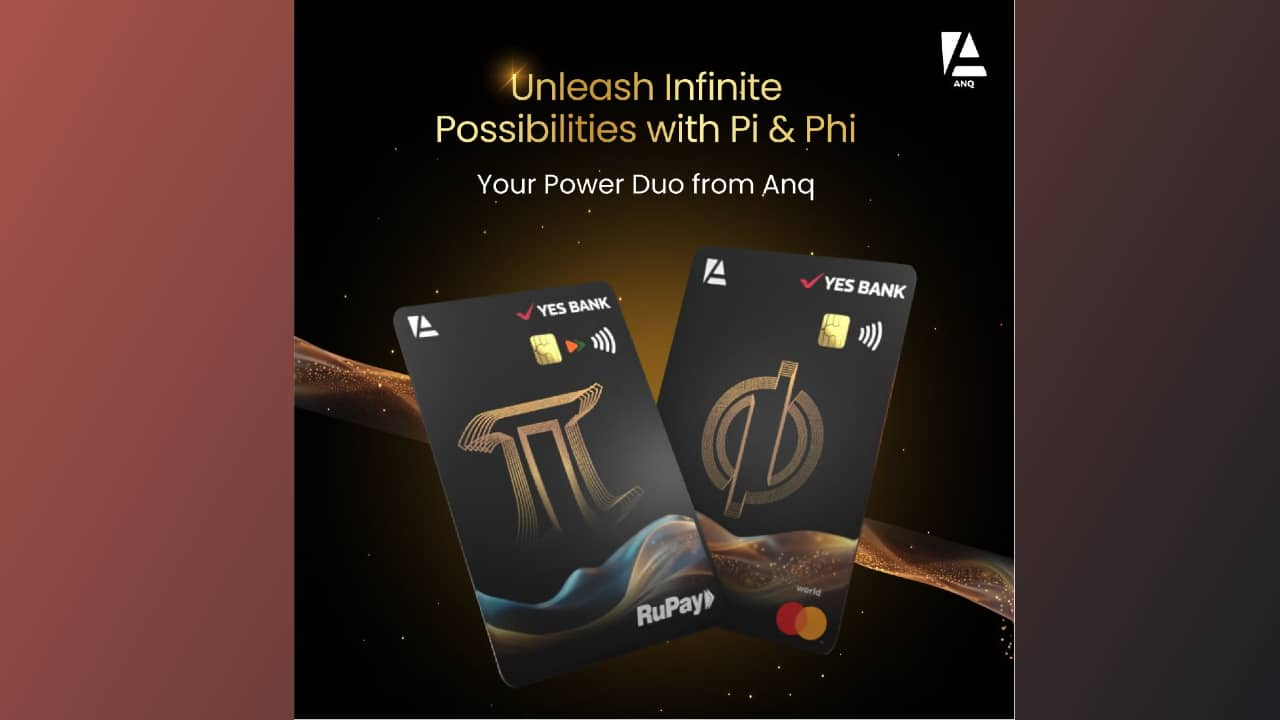

New credit card allows you to spend on Mastercard, UPI-linked Rupay. A Moneycontrol review

YES Bank and Anq have launched a co-branded card that gives you a physical card based on Mastercard and a complimentary, virtual add-on card on Rupay network. You can earn and accumulate gold based on the reward points you accrue.

BUSINESS

Corporate FDs offer up to 8.60 % interest. Do you have any?

Corporate fixed deposits offer higher interest rates compared to public sector banks and major private sector banks. However, low-rated deposits carry the risk of default. So, depositors should carefully study the ratings assigned by rating agencies while zeroing in on such fixed deposits.