BUSINESS

Exclusive Interview | It hurts when something like this happens, says Samit Ghosh, Founder Ujjivan, on minority shareholders rejecting his appointment as MD & CEO

The veteran banker says it is a lesson that they should not have taken their eyes off the ball and should have maintained relations with their investors. `At the end of the day, being a holding company, we cannot directly intervene in the bank’s operations. But definitely, I will be actively in touch with the investors,' says the Non-Executive Chairman of Ujjivan Financial Services

BUSINESS

Ujjivan Financial Services' minority shareholders reject special resolution to appoint Samit Ghosh as MD&CEO

Ghosh, who will continue as the chairman of the company, told Moneycontrol that minority shareholders were probably upset with the share price performance during the COVID period.

BUSINESS

After NBFCs, MFIs raise alarm on COVID second wave, seek fresh liquidity support

In a letter to the FM, Sa-Dhan said the second wave of COVID pandemic has begun hurting the operations of microlenders.

BUSINESS

Explained | How new RBI rules change the way auditors function in banks

The role of auditors has been questioned repeatedly whenever bank frauds have happened in the past, including during the infamous PNB fraud and YES Bank, IL&FS episodes.

BUSINESS

Can big private banks’ aggressive retail bet go wrong?

Banks are aggressively shifting to retail loans, which makes sense at this point. But, the bet could boomerang if COVID second wave gets prolonged and vaccination drive doesn’t progress as planned.

BUSINESS

Axis Bank receives Rs 3,004 crore worth loan recast requests under COVID framework, implements Rs 623 crore so far

The bank expects some near-term impact from COVID-19 second wave but will look for growth opportunities in both secured and unsecured book, the management said.

BUSINESS

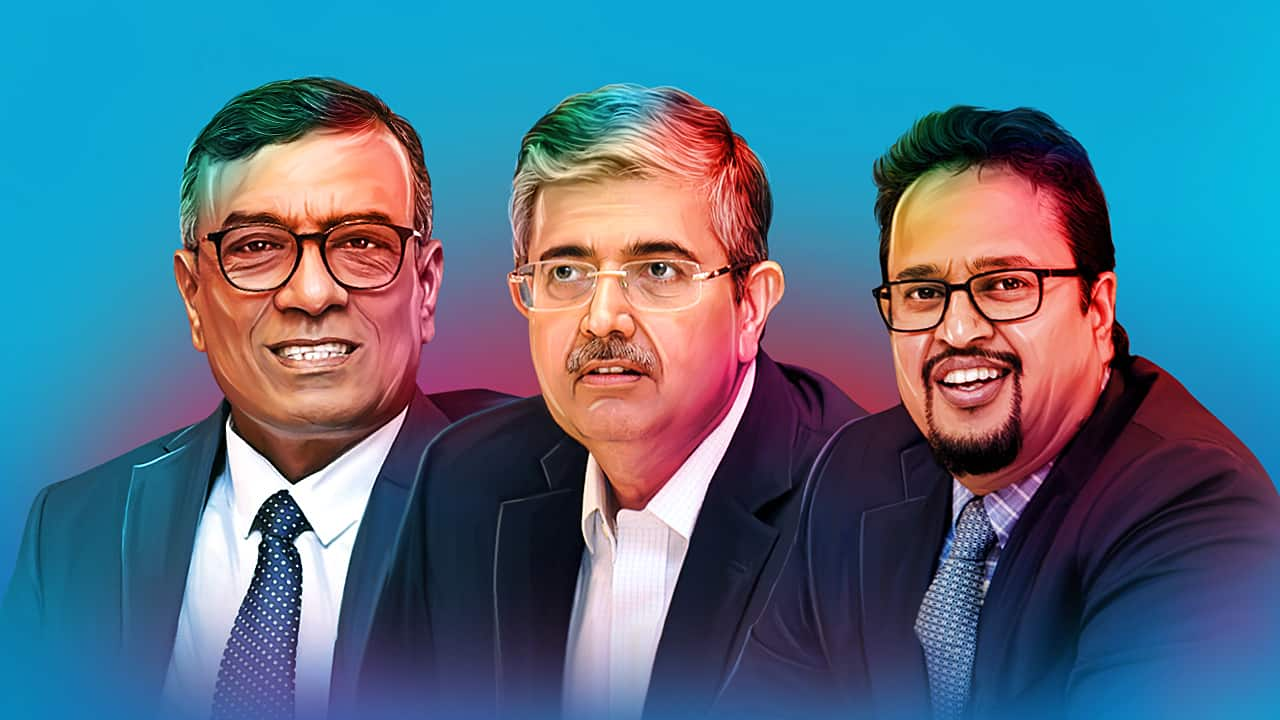

RBI’s 15-year tenure cap: These are the CEOs who will be impacted

Among those who will be affected by the new rule, though not immediately, are Kotak Mahindra Bank’s Uday Kotak, Bandhan Bank’s Chandra Shekhar Ghosh and AU Small Finance Bank's Sanjay Agarwal. How exactly will the new rules affect their tenures? Read on to find out

BUSINESS

Will new RBI rules on promoter-CEO tenure impact Uday Kotak?

The RBI rules allow Uday Kotak to continue till January 1, 2024 . However, the regulator has given a signal to the bank to plan the transition process.

BUSINESS

New RBI rules: Aditya Puri’s record as bank CEO with longest reign will now be unbroken

After a 26-year long tenure, former HDFC Bank boss Aditya Puri stepped down last year handing over the baton to Sashidhar Jagdishan.

BUSINESS

Banking Central: How reliable is MPC’s forward guidance?

The efficacy of MPC’s forward guidance has been questioned repeatedly, with some members saying that it should have the agility to respond adequately to surprises new data brings.

BUSINESS

Race For Citi India assets: HDFC Bank may join long list of suitors

In India, the US based financial powerhouse had about 30 lakh customers in retail, 22 lakh credit cards and 12 lakh bank accounts, as of March 2020.

BUSINESS

Analysis | ICICI Bank Q4 earnings show asset quality is under control, but COVID uncertainty looms ahead

During the call with reporters post the Q4 result announcement, ICICI Bank suggested there could be some impact due to COVID going ahead but it has a war chest ready to face the uncertainty.

BUSINESS

ICICI Bank says provided Rs 175 crore for compound interest refund

On April 7, the RBI had issued a circular which mandated all lending institutions to immediately put in place a Board-approved policy to refund/adjust the ‘interest on interest’ charged to the borrowers during the moratorium period, i.e. March 1, 2020 to August 31, 2020 in conformity with the Supreme Court judgement.

BUSINESS

After Citigroup, Africa's FirstRand to cut presence in India: Why the country is a minefield for foreign banks

Foreign banks have struggled in India to compete with the local rivals. The Indian central bank has strict rules for foreign banks to operate in the country including local incorporation and PSL

BUSINESS

Will COVID second wave force RBI to announce loan moratorium again?

Bankers are silently watching how states are reacting, but there is no panic seen as in last time. Some bankers are of the view that any big impact on asset quality is unlikely for big banks as they have already addressed much of the corporate bad loans.

BUSINESS

Exclusive | RBI to cancel fraud-hit Sambandh Finserve licence; issues show cause notice

The Managing Director and CEO of Sambandh, Deepak Kindo, who was allegedly the main perpetrator of the fraud has been arrested by Economic Offence Wing, Chennai

BUSINESS

Four months after ban, HDFC Bank still awaits RBI's green signal for new digital launches

HDFC Bank has initiated a technology transformation plan under new CEO Sashidhar Jagdishan. The bank wants to address the fundamental problems in the IT infrastructure

BUSINESS

DBS, other rivals may be taking a closer look at Citi's India retail assets

A group of institutions including HSBC, Kotak and ICICI Bank have shown preliminary interest in Citi’s assets in India, according to people in the know. But, these are early stage enquiries.

BUSINESS

Why did Citibank exit India consumer business?

For foreign banks, retail is a tough game in this country. It has always been so. Over the years, the US multinational has been facing challenges from local competitors in the retail business, steadily but surely, losing its share

BUSINESS

HDFC Bank CEO Sashidhar Jagdishan writes to staff on tech issues, says working with regulator to overcome “the current situation”

HDFC Bank has suffered from multiple technology glitches in the recent past, inviting RBI’s attention.

BUSINESS

HDFC Bank provides Rs 500 crore to refund interest-on-interest on moratorium loans

On April 7, the Reserve Bank of India (RBI) had issued a circular which mandated all lending institutions to immediately put in place a Board-approved policy to refund/adjust the ‘interest on interest’ charged to the borrowers during the moratorium period, i.e. March 1, 2020 to August 31, 2020 in conformity with the Supreme Court judgement.

BUSINESS

Nirav Modi a step closer to extradition to India: Key questions answered on the case

Modi is believed to have left India in January 2018 while PNB announced the scam a month later, in February. In March 2019, Modi was arrested in London.

BUSINESS

What does CitiBank's exit from retail business mean for its rivals in India?

Even CitiBank India employees do not have much clue on why the global management decided to exit the consumer business, something Citi was well connected with for over a century.

BUSINESS

Is the RBI failing in its mission to manage the 10-year G-sec yield?

The RBI wants to artificially suppress yields in the face of opposing pressures such as wholesale inflation rising to an eight-year high and the uptick in interest rates globally. Its plan hasn’t worked so far, and some economists say the monetary authority may have to eventually bow to the market forces.