The Reserve Bank of India (RBI) may have to announce yet another round of loan moratorium scheme or similar relief measures for stressed borrowers if the lockdowns announced by various state governments in the wake of COVID second wave prolongs beyond the immediate future, a section of senior banking industry officials said.

“Some measures like moratorium, or exactly moratorium, may be necessary, given the partial lockdowns declared by states. The intensity and the spread of the disease is higher in the second phase," said Suresh Khatanhar, Deputy Managing Director at IDBI Bank.

"Vulnerability could be high in MSME (micro, small and medium enterprises) and retail segments, to begin with. A large workforce is under treatment and unfortunately the graph of disease is not showing any respite," Khatanhar added.

Most states, like Maharashtra, Delhi and Karnataka, have announced partial lockdowns or other restrictions in the face of increasing COVID infections. This has started to affect businesses, especially in the services sector. Such a scenario could eventually lead to loan defaults as the repayment ability of borrowers may get affected.

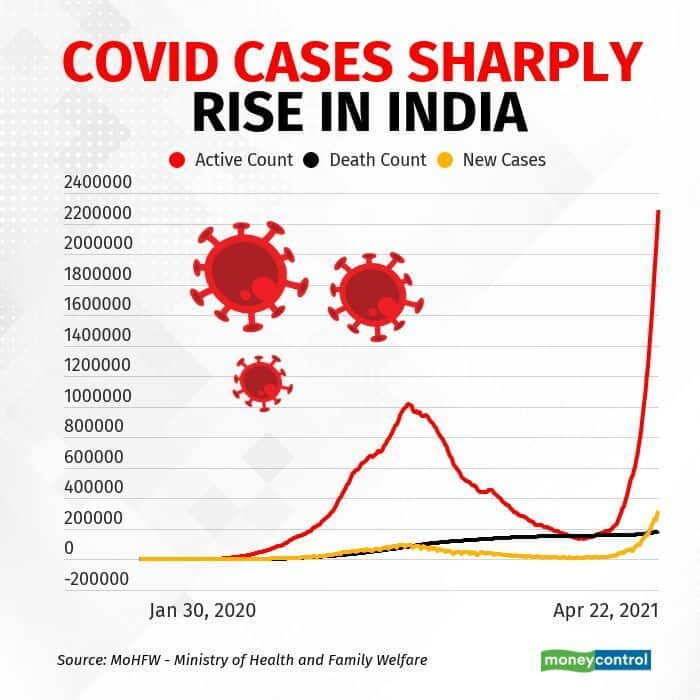

India reported a record number of daily COVID-19 cases on Thursday. There were 314,835 new cases over a 24-hour period, according to government data. That surpassed the world’s previous highest single-day increase in cases held by the United States. There were 2,104 reported deaths.

“If the COVID scenario continues like this, industries, especially MSME, will get impacted and that segment may require some assistance," said former SBI Deputy Managing Director B V Chaubal.

Relief measures

Last year, the impact of the lockdown was not seen on banks’ earnings because of the emergency measures announced by the central bank and the government. The RBI announced a six-month moratorium and a subsequent one-time restructuring facility for banks.

This helped banks to escape from a huge spike in their non-performing assets (NPAs). A loan becomes an NPA if there is no repayment of interest or principal for 90 days. Once a loan becomes an NPA, banks need to set aside money to cover the potential losses from such accounts. High provisions hurt banks’ profitability.

"If the lockdowns announced by different states continue beyond the immediate term, the RBI may have to announce moratorium for certain borrowers," said another senior banker, who spoke on condition of anonymity as he is not authorised to talk to the media.

Bankers anxious, but some optimistic..

There is a sense of uneasiness among bankers following the return of lockdowns in many states, including Maharashtra. One can’t blame them. In the last one year, the banking sector has gone through enormous stress due to the onset of COVID. The gross non-performing assets (NPAs) of most banks have shown a notable jump if one include the amount of stressed assets.

But not all are worried like last time. Some bankers are of the view that any big impact on asset quality is unlikely for big banks as they have already addressed much of the corporate bad loans. Also, the second wave of lockdowns are more calibrated. Hence, the impact on the asset quality will not be big, going by the comments of officials of large banks.

“This time, the lockdown is not as severe. It is more calibrated. Demand collapse may not be as strong this time around as last time. Impact on the services sector may not be as bad as this time,” said SBI Managing director Ashwani Bhatia in an interview with ET Now on Thursday.

Raters caution

A few days ago, ratings agency Moody’s, too, had similar views. It, too, flagged the risks to the economy on account of fresh COVID infections. “The second wave of infections presents a risk to our growth forecast as the reimposition of virus management measures will curb economic activity and could dampen market and consumer sentiment,” the rating agency said.

It cited Google mobility data to show that retail and recreation activity across India had dropped by 25 percent as of April 7 compared to February 24. “This was mirrored in the Reserve Bank of India’s March Consumer Confidence Survey, which showed a deterioration in perceptions of the economic situation and expectations of decreased spending on non-essential items,” Moody’s said.

"However, given the focus on `micro-containment zones’ to deal with the current wave of infections, as opposed to a nationwide lockdown, we expect the impact on economic activity to be less severe than that seen in 2020," the rating agency pointed out.

Last year, when the Centre announced a nationwide lockdown to fight COVID-19, banks had faced a major pressure on their asset quality and fresh business acquisition. But the actual impact on asset quality wasn’t much due to the timely intervention of the central bank to avert an immediate shock.

Early this month, S&P Global Ratings (a division of Standard and Poor Global), too, said systemic risk in Indian banks is likely to remain high in the wake of the second wave of COVID-19 and high proportion of weak loans.

S&P estimates the weak loans in banks at 11-12 percent of gross loans. "We forecast credit losses will decline to 2.2 percent of total loans in the year ending March 31, 2022, and 1.8 percent in fiscal 2023, after staying elevated at an average of 2.8 percent in 2016-2021," S&P predicted.

In the last round, banks had reported fewer requests for loan recasts as most companies had applied for loan moratorium. The government had put a freeze on fresh Insolvency and Bankruptcy Code (IBC) cases last year for 12 months to help stressed borrowers hit by COVID-19. This meant a sharp decline in fresh IBC cases, but that deadline expired on March 25.

According to a recent report from CARE rating agency, banks have already managed to recover around 40 percent of their dues in 12 large cases, of which 10 have reached the resolution stage. “Since the last two years, NPA levels have reduced (partly due to loan write-offs) and the challenge for banks continue in the current year due to the pandemic and nationwide lockdown, which has resulted in muted economic activities across the country,” the CARE report said.

Indian banks have seen a significant spike in NPAs after the RBI initiated early identification of stressed assets and Asset Quality Review (AQR) for banks. This forced banks to dig out the hidden dirt in their balance sheets. The exercise caused a sharp spike in reported NPAs. But NPAs started declining in the last two years due to significant loan write-offs and high provisioning. Provisions refer to the money set aside against NPA losses.

In absolute terms, the gross NPAs of scheduled commercial banks improved in FY19 and FY20 to Rs 9.4 lakh crore and Rs 8.9 lakh crore, respectively, after reaching a peak in FY18 (Rs 10.4 lakh crore), CARE said.

Small lenders may feel more pain

But smaller firms may face the impact of the COVID second wave, industry officials said. “We are yet to get the data from the field. But the second wave will likely have an impact on the livelihoods and on collections,” said P Satish, executive director of Sa-Dhan, an industry association of microfinance institutions.

Microlenders, as the name suggests, give small loans to low-income borrowers. MFIs typically borrow from banks and lend to borrowers at a margin of 10-12 percent over their borrowing costs.

According to a recent report of rating agency, Crisil, Maharashtra is also among the top five states in terms of microfinance loans, with assets under management (AUM) of around Rs 16,700 crore as on December 2020, which is tantamount to around 7 percent of all microfinance loans.

Non-banking finance company microfinanciers (NBFC-MFIs) account for 40 percent, or around Rs 6,700 crore, of this pie. Crisil said collection efficiency in Maharashtra has been relatively lower at around 85-90 percent even before the latest curbs because of previous extended lockdowns. The all-India average collection efficiency was 90-94 percent in December 2020.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!