BUSINESS

Banking Central | Insulating co-operative banks from politicians

The collapse of corporate governance at many co-operative banks, which triggered a crackdown by the RBI, has shaken the trust of depositors. The regulator needs to restore the faith of people who have seen a series of crises such as the recent one at the PMC Bank that has left thousands waiting to get back their hard-earned money

BUSINESS

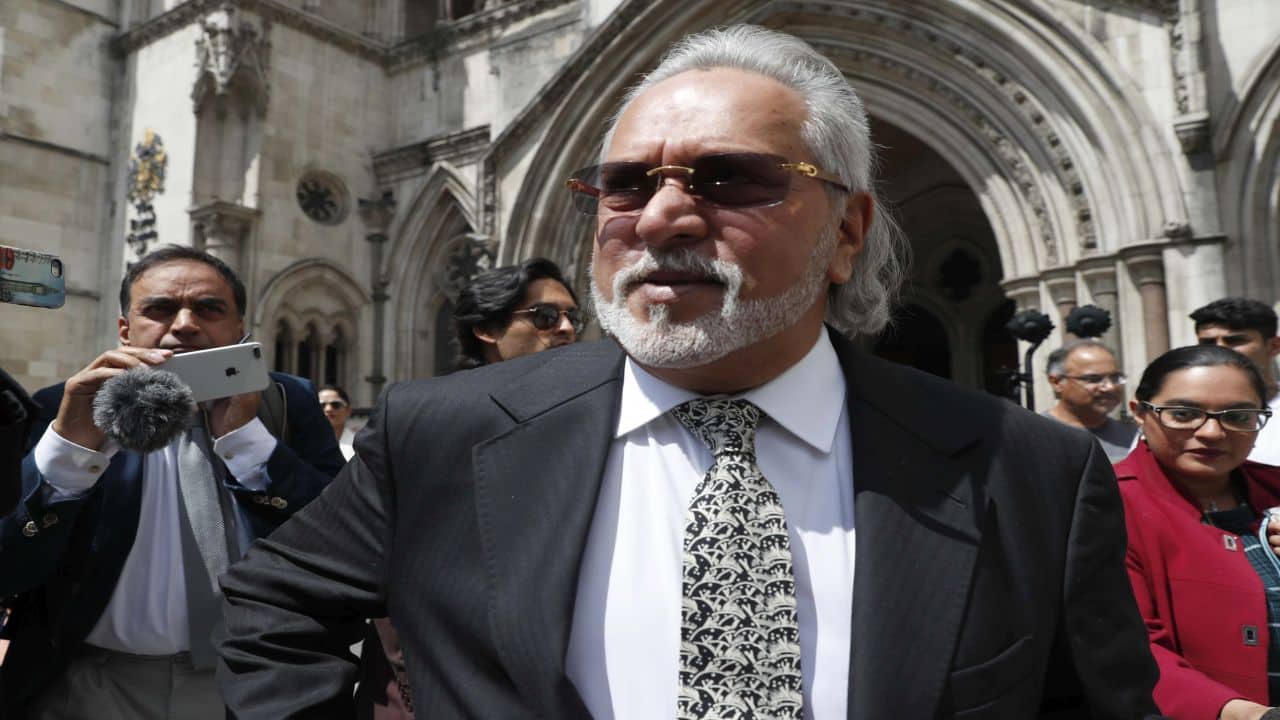

SBI, others have the last laugh in Kingfisher-Vijay Mallya saga

Why didn't banks go ahead and sell the shares before? That's because there was a court stay that prohibited banks from selling the securities in Mallya's name. Also, there was ED attachment on these assets.

BUSINESS

RBI's third party audit of HDFC Bank's IT systems over, await regulator's decision, says MD&CEO Sashidhar Jagdishan

In December last year, the RBI had banned HDFC Bank from new digital launches, including issuing new credit cards and proceeding with the so-called Digital 2.0 plan following a series of technical glitches reported over the last two years.

BUSINESS

Can Tamil Nadu’s dream team of economists make a difference?

Populist politicians rarely listen to their hired economists. To be sure, Tamil Nadu isn’t the first state to appoint global economists as advisers. That credit goes to Kerala, which appointed Gita Gopinath, now Chief Economist IMF, as adviser in 2016. It was an experiment, which had turned out to be a farce

BUSINESS

Explainer| Swiss Bank accounts: What's attracting the rich to these banks?

Swiss Banks are known for their unwavering commitment to client confidentiality and the secrecy of transactions. Why do the global rich prefer these banks over others? What makes these entities different? Here's an explainer.

BUSINESS

Banking Central | A tough task awaits Centrum-BharatPe at PMC Bank

PMC Bank's failure isn’t just another case of a co-operative bank going bust because inefficient management left finances weak, the problems run deep and are manifold.

BUSINESS

PMC Bank depositors plan to move Bombay High Court seeking early refund, merger with a running bank

Several PMC Bank depositors Moneycontrol spoke to also said the RBI move is welcome for the depositors but expressed concerns over the lack of clarity on a time frame to refund the depositors.

BUSINESS

RBI in-principle nod for Centrum: PMC Bank depositors relieved, but ask by when will they get their money back

PMC Bank has faced a trust deficit over the last one-and-a-half years and has been struggling with weak financials. For the new owners, regaining customer trust will be the main challenge.

BUSINESS

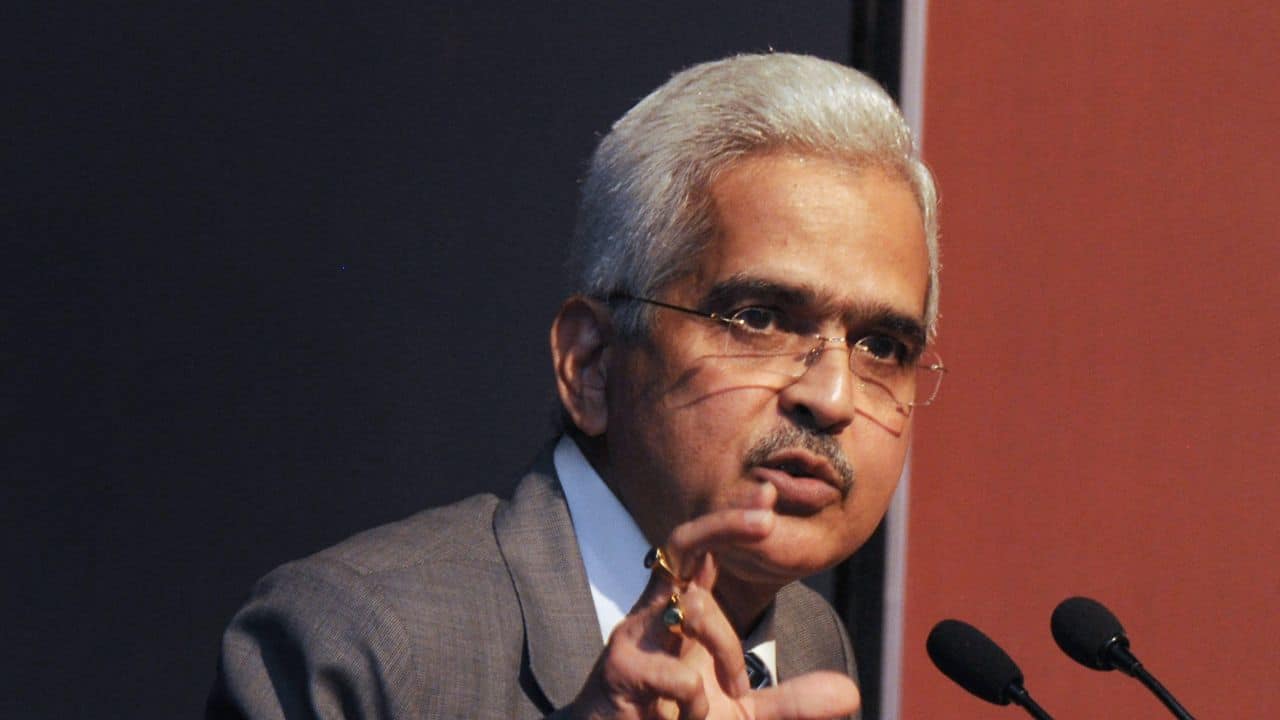

MPC comments suggest continuation of 'dovish' stance; growth remains a worry

The MPC retained the repo rate at 4 percent at its recent policy meeting and said the growth-supportive accommodative stance will continue as long as necessary till growth is revived.

BUSINESS

Exclusive| Ramdev’s brother, Balkrishna gave personal guarantees to SBI, others for loan to fund Patanjali's Ruchi Soya acquisition

If Ruchi Soya fails to repay the loan, lenders can invoke the personal guarantees and LoCs issued by Patanjali promoters, including Balkrishna. Ruchi Soya has to pay back around Rs 824 crore by the financial year 2025 and Rs 1,553 crore by 2029.

BUSINESS

NCLT examining Siva group-IDBI Bank loan settlement deal, next hearing likely on Friday

While it is not clear what exactly is the clarification sought by the NCLT from the lenders, there has been a debate of late on whether former promotes getting back control of their companies through out-of-court settlements will lead to dilution of the spirit of the Section 29 A.

BUSINESS

Exclusive | HDFC Bank refunding GPS device commission to auto loan customers following RBI direction

This brings an end to a controversy surrounding alleged misselling of GPS devices to HDFC Bank's auto loan customers during the term of former CEO, Aditya Puri.

BUSINESS

Analysis | Will high retail inflation force RBI to change its policy stance?

Former World bank chief economist Kaushik Basu calls it stagflation, others don't agree. But there is a consensus among majority that if inflation threats persists, the MPC may have to take a relook at the accommodative stance

BUSINESS

Analysis | New RBI proposals for MFIs: By scrapping interest rate cap, is the regulator taking undue risk?

MFIs are elated by the prospect of getting a level playing field with banks, but some questions arise at this point.

BUSINESS

HDFC Bank says faced temporary glitch in app, issue now resolved

HDFC Bank has said the issues in its mobile banking app have now been fixed. Earlier today, the bank had asked customers to switch to net banking for transactions as the app was facing some technical glitch.

BUSINESS

Banking Central: Which are the next pain points for banks?

The pain from the corporate sector may be limited this time, but the unforeseen stress could come from retail and contact-intensive sectors such as tourism and travel.

BUSINESS

Analysis l ED action against crypto exchange WazirX underscores RBI’s concerns on virtual currencies

The move highlights the importance of RBI caution on crypto and, at least partly explains the concerns raised by the central bank.

BUSINESS

For microfinance industry, life is not as tough in Covid second wave but pain persists

A large number of MFI borrowers and their families were ill, even in rural areas, when compared to last year's outbreak. Many MFIs reported normal collection levels in earlyApril but things worsened by May.

BUSINESS

Profile | Shyam Srinivasan, who adores ‘Rahul Dravid’, is ready for his new innings

Srinivasan is among the few foreign bankers who chose to move to smaller Indian banks after long, successful stints in foreign banks. In the ten years, Srinivasan headed the bank, Federal Bank has changed its image of an old-generation private lender to a digital friendly private bank with national focus.

BUSINESS

HDFC Bank plans big digital play even as it strives to come out of RBI ban

HDFC Bank, banned by the central bank from introducing new digital products and services because of frequent outages, wants to up its digital game under new CEO Sashidhar Jagdishan. Question is how soon the Reserve Bank will give it the go-ahead.

BUSINESS

Exclusive Interview | Morgan Stanley's Sumeet Kariwala says impaired loan formation will remain elevated in H1-F22; mid-sized banks, PSBs to see relatively higher impact

According to Morgan Stanley, job losses in the formal segment have been contained so far but relatively higher impacted segments are the self-employed retail and MSME segment. Commentary from banks highlight material drop in collection efficiency during the past month in retail, MSME, Kariwala said.

BUSINESS

Banking Central | Debate on RBI’s ‘forward guidance’ continues

MPC members like Jayanth Varma, had questioned the efficacy of RBI’s forward guidance in the previous policy review meetings

BUSINESS

Exclusive Interview | This once-in-a-century public health shock has no playbook to follow, says Axis Bank Chief Economist Saugata Bhattacharya

RBI’s response since March 2020 has been exceptionally dynamic and proactive, using large surplus system liquidity levels as a significant instrument to anchor short term rates at low levels.

BUSINESS

Analysis | It's crystal clear now - RBI doesn't endorse cryptocurrencies

RBI's repeated caution and reiteration that the central bank has concerns on cryptocurrencies is a strong message to investors about the high risk of dealing in crypto assets in the absence of clear regulations.