BUSINESS

Government’s cash balance is a jigsaw puzzle yet to be solved

The government has room to cut down its cash balances, given the rise in taxes and bond receipts. The release of the balances could lower interest rates whereas the additional borrowing pushes interest rates upwards

BUSINESS

15th Finance Commission: Largely status quo

The finance commission report is silent on the cracks in the cooperative aspect of fiscal federalism

BUSINESS

Do we need a new Development Financial Institution?

India’s inability to develop bond markets, which finance infrastructure worldwide, has again tilted the talks towards another DFI

MARKETS

Creative destruction in India’s stock markets will yield better results

One of the basic lessons of economics is that increase in competition leads to better market outcomes. Incumbents initially complain, but those who adopt the changes and fight new competition eventually grow as a firm. SEBI is trying to do the same in the MII sector

BUSINESS

Central Banking | The 2020s are increasingly looking like the 1920s

In the 1920s, central banks ignored Keynes’s advice, currently they have embraced the economist’s famous words: “In long run we are all dead”

BUSINESS

Two Goals, Two Lessons | What central bankers can learn from Diego Maradona

Diego Maradona’s first goal was akin to monetary policy of the earlier era where there was “mystery and mystique” associated with central banking. His second goal belonged to the modern central banking era

BUSINESS

RBI’s conflicting challenges in NBFC regulation

To make India less dependent on banks is one of the central goals of our financial regulators in the next decade

BUSINESS

A whistleblower policy every central bank could adopt

Central banks across the world should look at the European Central Bank whistleblower policy and bring themselves under a similar one. There are several benefits of such a policy

ECONOMY

Random portfolio rejigging of RBI deputy governors needs to stop

The responsibilities of RBI’s four deputy governors need to be defined and given proper titles and job roles. This will ensure that specialists are chosen for these roles, and will signal to the government that appointments need to be made in time as departments cannot be transferred that easily

BUSINESS

Banking troubles in old private sector banks

Earlier, the experts wrote that Indian banking is mainly about regulatory activism and near absence of shareholder activism. It is good to see emergence of shareholder activism in most unlikely of organisations: old private sector banks

WORLD

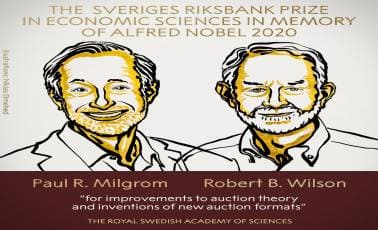

Economic Sciences Nobel | Auctions, they’re all around us

Robert Wilson’s and Paul Milgrom’s auction strategy was used for allocating radio spectrums to telecom operators in the US in in 1994. Since then, this strategy has been used across countries and across sectors such as electricity and natural gas

BUSINESS

The changing language of finance

Financial organisations have always welcomed new technologies as they are in the business of exchanging information. Now, in addition to the benefits from using technology, they will have to learn how to talk in technological terms

BUSINESS

Will chief compliance officers check misgovernance in banks?

One thing which the RBI could have paid more attention to is the tenure of appointment of a CCO. Compliance cultures need longer time periods, especially in the initial years. Ideally, the RBI should have specified the tenure length of any number above five years

BUSINESS

Should RBI follow the US Federal Reserve in targeting average inflation?

An AIT approach implies that when inflation is high, policy rates will remain tighter for a longer period of time as well

BUSINESS

The Bimal Jalan committee binds RBI transfers to the government

Now, once the RBI balance sheet expands, the contingency fund will expand as well to protect the balance-sheet. This is like the countercyclical buffer which implies that when the balance sheet is expanding one is also adding to the risk buffers

BUSINESS

RBI’s new MPC should be fit for new challenges

Now would be a good time for the government to address the issues the MPC is facing

BUSINESS

How did Japanification of economy become a bad word?

As the 2008 crisis struck, one problem developed countries faced was to avoid another Great Depression. They managed to duck it, but soon realised that they could resemble Japan

BUSINESS

At 90, can we expect BIS to reform and set a benchmark?

The reform of the BIS board will go a long way to make the BIS a truly global institution. It will also act as a benchmark for other global financial institutions.

BUSINESS

Pandemic adds fuel to the central bank digital currencies race

The spread of the virus has led to concerns over using physical cash for payments despite limited evidence of the cash being a carrier

BUSINESS

75 years of World War II and India’s deficit financing

WORLD

RBI should recruit climate economists and money futurists without delay

Climate change is clearly one of those future risks that could pose significant challenges to the world economy

BUSINESS

Credit guarantees of 1970s make a comeback

The impact of the COVID-19 crisis has been so acute that it has left the government with little choice but to consider measures often regarded as relics of the past

BUSINESS

Tryst with destiny, planning and deficit financing

The Indian government has been able to wean itself off its addiction to deficit financing from the central bank only after liberalisation. Will it now go back to monetising deficits?

WORLD

Tech | What to expect from Facebook’s Libra 2.0?

While the Libra Association has come out with a new digital currency, expect authorities running fiat currencies to continue their criticism