How things have changed in the past one year! The same time last year, the media was rife with discussions on recommendations by the Bimal Jalan committee. The committee was formed amidst enormous drama in the economy.

The year 2019 saw several friction points between the Reserve Bank of India (RBI) and the government leading to resignation of the RBI Governor. One point of friction was the government wanting a larger share of the RBI surpluses and reserves.

The new RBI Governor immediately set up a committee under former RBI Governor Bimal Jalan to review the contentious matter. The committee took almost eight months to submit its report amidst several disagreements between committee members. As per the committee, the RBI transferred Rs 1759 billion in 2019, of which Rs 1230 billion was on account of dividends, and Rs 530 billion via the suggestions of the committee. There was huge criticism that the government is increasingly relying on the RBI to manage its fiscal position.

Fast forward to 2020, and we have an opposite situation. Given how the pandemic has created a hole in the fisc, there were talks of the RBI once again giving a large dividend transfer to the government. Such a transfer might even have been acceptable as one has seen even the most fiscally conservative economists agree to the RBI monetisation of government deficits. The transfer of dividends would be like hitting two birds with a stone: eases government fisc and eases the pressure to monetise deficits.

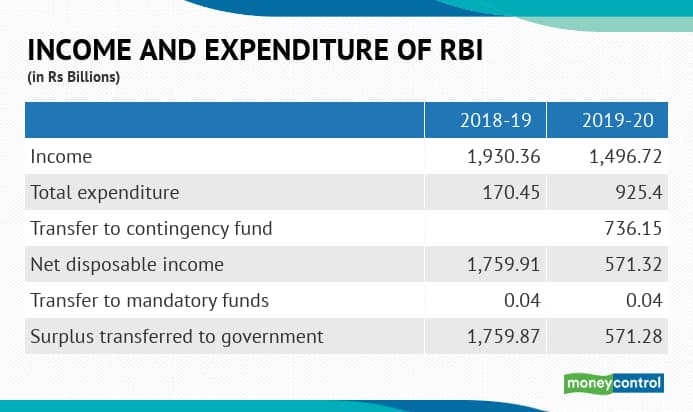

However, nothing of this sort has happened. The RBI transferred Rs 571 billion to the government and instead chose to transfer extra profits of Rs 736 billion to its contingency fund.

One recommendation of the Jalan committee was to maintain the contingency fund at 5.5-6.5 percent of the RBI balance sheet. As per the committee, the contingency fund is for “the country’s savings for a ‘rainy day’ (a financial stability crisis) which has been consciously maintained with RBI in view of its role as Lender of Last Resort (LoLR).” In 2019, the RBI agreed to keep the contingency fund at 5.5 percent and transfer the excessive to the government.

The RBI balance sheet expanded by 30 percent from Rs 41,029 billion in 2018-19 to Rs 53,347 billion in 2019-20. Thus, in order to keep the contingency fund at 5.5 percent, the amount under the fund had to be increased. This led the RBI to transfer Rs 736 billion to the contingency fund increasing the fund from Rs 1,963 billion in 2018-19 to Rs 2,600 billion.

The Jalan committee ended up doing the opposite of what it was initially speculated to do. The earlier speculations were that the committee will make it easier for the government to get a constant source of funds from the RBI. However, what it has done is the opposite. Now there is a rule which ensures that once the RBI balance sheet expands, the contingency fund will expand as well to protect the balance-sheet. This is like the countercyclical buffer which implies that when the balance sheet is expanding one is also adding to the risk buffers so that these funds can be used if there is a financial stability crisis in the future.

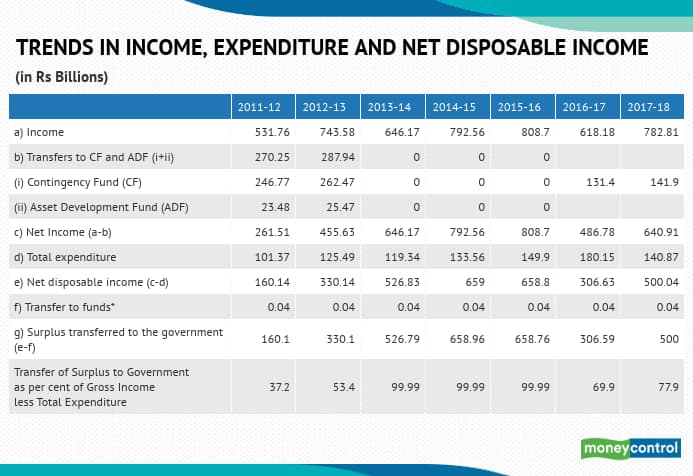

Before the committee, the RBI was not really rule bound in transferring income towards reserves. For instance, in 2011-13, it transferred large amounts towards the contingency fund and asset development fund. In 2013-16, during the tenure of Raghuram Rajan, the entire profits were transferred to the government.

In his last speech as RBI Governor in September 2016, Rajan explained the rationale for this complete transfer. He said that the RBI’s then equity position of around Rs 1000 billion was enough and the RBI “therefore has paid out the entire surplus generated to the government" amounting to Rs 660 billion each year "without holding anything back.” He added that that in his three years at the RBI, the central bank “paid almost as much dividend to the government as in the entire previous decade”.

However, in the next two years, once again the RBI transferred funds towards the contingency fund. The Jalan committee has framed a rule for such transfers which is welcome.

The pandemic has pushed central banks worldwide to a corner and the case of the RBI is no different. Even before the pandemic, the RBI faced a lot of flak for losing its autonomy and bowing to the government. The recent dividend transfer decision shows things are not all that bad. It also shows the importance of having the rules which do away with discretion and uncertainty.

Amol Agrawal is faculty at Ahmedabad University. Views are personal.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.