The year 2020 marks the 75th year of end of World War II (WWII) which ended on September 2, 1945, with the surrender of Japanese forces. As the world was looking at reflecting on the lessons from WWII, Covid19 struck and everything else took a backseat. Some experts have even compared fighting Covid19 to fighting a war which is both misplaced and appropriate. It is misplaced as unlike war where the countries fight each other, here we have to collectively fight the pandemic (which tragically is not being done). It is appropriate as the authorities have to use the same intensity fighting the pandemic as they do in a war.

One such matter is the government finances. In both war and pandemics, one of the biggest casualties is government finances. The governments not just suffer from low tax revenues but are also pressed to increase their expenditure as both private investments and consumption have collapsed.

In the Wars, it is often seen that the governments spend aggressively by engaging in something called as deficit financing. Deficit financing means that the central bank directly finances the government. Not surprisingly, number of economists have argued that central banks should monetize government deficits during Covid19 as well. We have seen similar discussions of monetized deficits in India too.

In fact even during WWII, the British authorities not just pushed into the war but was also into deficit financing. In this piece, we discuss how the deficits were financed during WWII in British India.

War poses questions over its financingIn 1935, RBI was established and the function of banker to government was transferred from Imperial Bank to RBI. The RBI was obliged to hold cash deposits of the government, be the public debt manager and provide financial help to the Government via Ways and Means Advances (WMA). Just after a few years, this function of banker to the government was questioned due to WW-II.

The Indian Government was required to finance not just its own defense expenditure but also raise resources for the unending appetite of the colonial authorities. However, the government could not raise resources in a non-inflationary manner. This was because of ongoing fight for Indian independence and complete lack of preparation for the war.

The Colonial government agreed to share costs of the war which totaled Rs 1736 cr over the 1940-45 war period. The Indian government received Rs 1633 cr worth of payments but these were in pound sterling which could not be spent for buying goods in UK due to War. The Indian government thus parked these sterling reserves with RBI and got Rupee liquidity leading to deficit financing.

As the fund did not lead any real resources and the eventual outcome was inflation. Inflation increased to touch nearly 50% by 1942.

The Government was not worried about rising prices but RBI started showing concerns. The RBI Governor Sir James Taylor started to raise inflation concerns in the 1941 Shareholder meeting (RBI was a private bank from 1935-48). The Governor favored higher taxation to fund the war rather than take support from RBI.

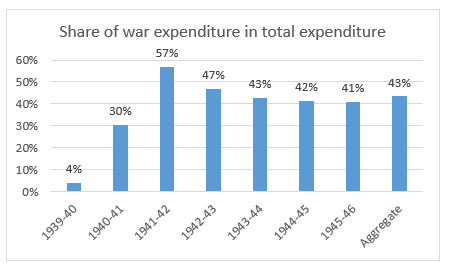

As Japan entered the Second World War in Dec-1941, the concerns over both intensity of war and scarcity of resources grew. The war expenditure rose to 57% of total expenditure in 1941-42 leading to money supply grew by 68% and inflation by 51% in 1942-43.

RBI Board Members and Professional Economists join the chorusThe high inflation led to several economists to write on the seriousness of the inflation problem. Professor Vakil in a pamphlet titled ‘Falling Rupee’ opined that the correct methods of financing the allied expenditure in India were: payment to India in durable assets and gold, raising of rupee loans in India and liquidation of British assets in India. In 1943, a group of economists issued a joint statement which said that the India’s inflation is mainly “deficit-induced, fiat-money inflation” and “it is the most disastrous type of inflation.” They suggested that the government should increase taxation and borrowing to fund its war expenses.

The RBI Board members also took interest and suggested measures to address the inflationary problems. Kasturbhai Lalbhai and BM Birla suggested buying British Assets in India from the Sterling balances. Sir Purshottamdas Thakurdas offered two suggestions. First was Sterling Balances should not be transferred to RBI and instead kept at India office who should negotiate a rupee loan to UK. Second was government should take loans at attractive rates and free of income tax.

RBI Governor Taylor added that most war efforts leads to inflation. Infact, the inflation via sterling securities is actually better than one created purely by rupee securities as former will reverse post-war but latter remains in the monetary system. So, the way to address inflation related problems is “to intensify governmental effort on the production of food and other necessaries of life and to draw up and pursue vigorously plans for promoting the rural development of the country.” Taylor was also happy to note how the Directors of the RBI Board most being business persons showed their concerns for inflation. The big businesses always support inflation compared to deflation and war cutting measures would cause the latter. This showed how the Directors put the national interest ahead of their business interests.

These concerns led to several exchanges between India Office, London Office and RBI. The Government rejected most claims saying they were more about potential inflation but thus had not translated into actual inflation! They also declared the economists pamphlets and open letters as a political propaganda to destroy confidence in the currency. However, they did agree to sale gold/silver in India to suck the excess liquidity and also made more efforts towards borrowing. The government also imposed price and distribution controls

In 1944, RBI Board led by Mr Lalbhai proposed another interesting proposal to fix a ceiling of Rs 1200 cr to currency in circulation (it was Rs 981 cr at that time). This was obviously ruled out by the government.

Rise of CD DeshmukhThe WW-II period also saw changes at RBI’s helm. Governor Taylor passed away on Feb 17 1943 while serving office leading to Mr. CD Deshmukh serving as Governor from 22-Feb-1943 to 10-Aug-1943 and then being appointed as a Governor from 11-Aug-1943 onwards. Deshmukh’s rise to RBI’s top position was not without drama as it meant an Indian was to head the central bank, something which the British would not approve so easily. Deshmukh while acting as Governor noted that antisocial activities rise during inflationary times and one can only regulate these activities by providing supply of essential goods and measures to promote savings.

Deshmukh also rejected both suggestions to increase or decrease interest rates. As a result, the government could finance most of its new loans at around 3% which was quite low given the inflation. Another proposal of raising resources via lotteries was dismissed by Deshmukh on account of speculation. In his history of RBI, E.P.W. da Costa says it was surprising that Deshmukh did not prefer raising interest rates during this time. The result was people rushed to buy shares of companies such as Hindustan Motors. It is interesting how views change over how monetary policy should be done during crises. Deshmukh not wanting to increase the interest rates was looked upon earlier but will be appreciated today.

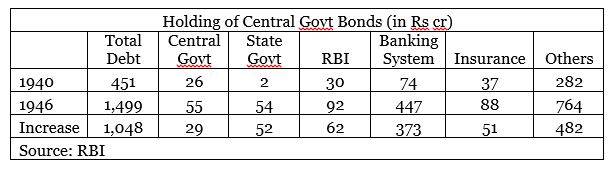

RBI’s OMOs and WMAEven if RBI was not willing to lower interest rates, it supported the borrowing program by doing Open Market Operations. RBI increased its holding of government securities by Rs 62 cr in the war period. However, bulk of the funding came from the banking system, insurance and even from Princely States.

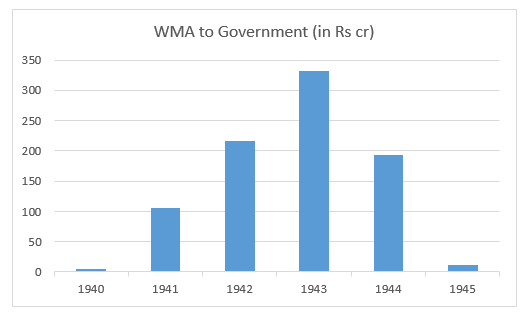

Section 17 (5) mandated RBI to provide Ways and Means Advances to the government (Centre and Provincial) for strictly short-term period of 3 months and should not be renewed automatically. The Government wanted RBI to provide WMA more liberally to finance war but RBI did not agree. Despite RBI’s disagreement, RBI’s credit to the government increased from Rs 4 cr in 1939 to Rs 332 cr in 1943 before declining to Rs 11 cr in 1945.

The experiences of deficit financing in WWII had predictable outcomes. In the period 1940-46, government could raise only 55% of the total resources (general functioning plus war) via taxes and borrowings. The remaining 45% was done via deficit financing leading to rise in money supply by nearly 500% and price index by 200%. The impact on inflation was lesser due to price controls. The monetary expansion in UK and US was lower at 180% and 150% respectively and rise in price index was 74% and 40% respectively.

However, compared to today, the times have changed dramatically as major parts of the world are facing deflationary trends and low interest rates. Thus the government can spend without worrying about high inflation and interest rates and is actually welcome. The same cannot be said for India whose inflation fortunes keep changing. The several experts are divided over whether the increased government expenditure will lead to higher or muted inflation. This history with inflation is perhaps a reason that both the government and RBI have been cautionary and not really engaged in a large scale stimulus despite large demands from the businesses. Whether one should be worried over inflation during such crises times is a questions which needs to be discussed widely.

Sources:

Da Costa E.P.W. (1985), Reserve Bank of India Fifty Years (1935-85), Printrite, Bombay

Deshmukh C.D. (1948), Central Banking in India - A Retrospective, R.R. Kale Memorial Lecture, Gokhale Institute of Politics and Economics

RBI Annual Reports (1935-45)

RBI (1970), History of Reserve Bank of India (1935-51), Times of India Press, Bombay.

Amol Agrawal is faculty at Ahmedabad University. Views are personal.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.