Artificial intelligence was supposed to be about ideas, models that could write poems, drive cars, and (ahem!) achieve artificial general intelligence, or AGI. But in 2025, the hottest AI story isn't about breakthroughs in code. It's about money: a trillion-dollar loop of investments, chip orders, and data-centre deals.

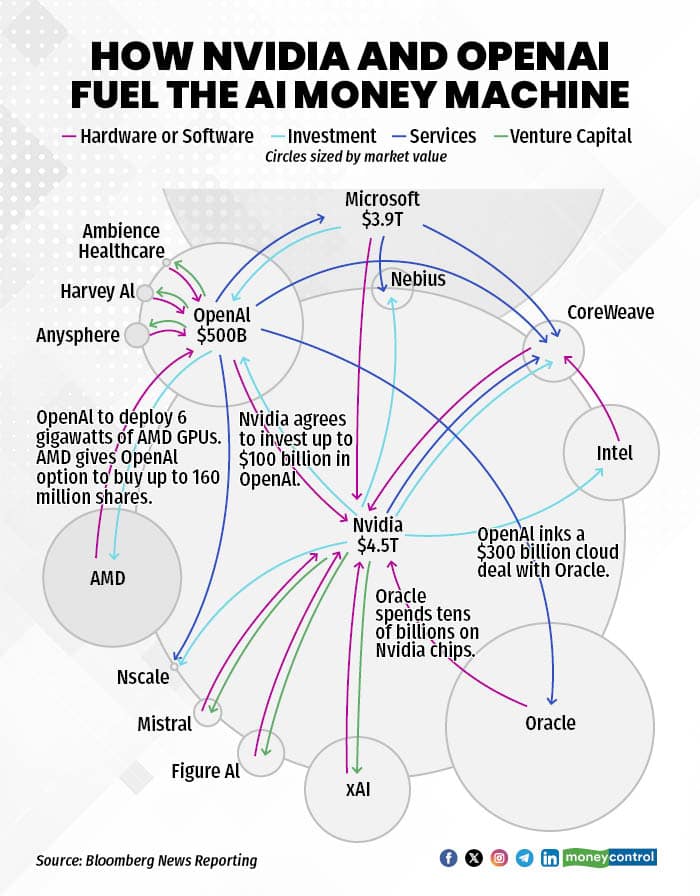

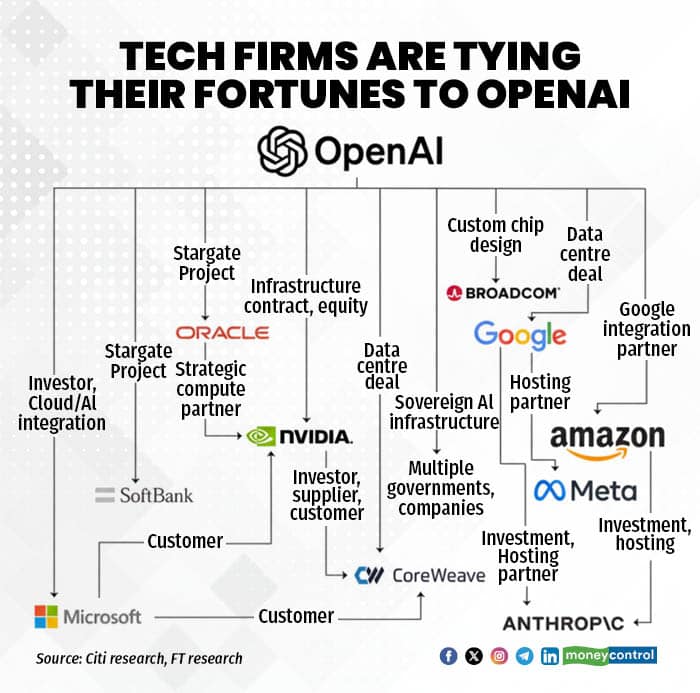

At the centre of it all is OpenAI, which has stitched together a network of mega-partnerships with Nvidia, AMD, Oracle and CoreWeave. Each transaction is designed to fuel the AI boom, but many circle back on themselves, with companies funding each other to buy one another's products.

A $100-billion spark

Two weeks ago, Nvidia agreed to invest up to $100 billion in OpenAI. On paper, it was a vote of confidence. In practice, much of that money will come straight back to Nvidia.

How, you ask?

OpenAI has committed to buying millions of Nvidia’s graphics processing units (GPUs) for its data-centre buildout.

Days later, OpenAI announced a similar tie-up with Nvidia’s rival AMD, involving tens of billions of dollars in chip purchases. The deal makes OpenAI one of AMD’s largest shareholders. And in September, Oracle announced a $300-billion partnership with OpenAI to construct AI data centres, equipped, of course, with Nvidia chips.

Data centre group CoreWeave, too, has disclosed computing deals with OpenAI worth more than $22 billion.

OpenAI’s 'nuclear' appetite

According to The Financial Times, OpenAI has signed close to $1 trillion in compute commitments this year alone. That translates to more than 20 gigawatts of capacity, the energy equivalent of 20 nuclear reactors. At current prices, each gigawatt costs about $50 billion to deploy.

The scale is staggering. Even tech giants such as Amazon and Alphabet have never invested capital at this level. For an AI startup that has yet to turn a profit, it’s unheard of.

“OpenAI is in no position to make any of these commitments,” Gil Luria, analyst at DA Davidson, told the London-based daily, adding it could lose about $10 billion this year.

Valued at $500 billion, OpenAI generated about $4.3 billion in sales in the first half of the year and burned $2.5 billion during the period, The Information reported in September.

How the circle works?

The arrangements between OpenAI, Nvidia, AMD and Oracle create a circular flow of capital.

The Nvidia loop

The AMD connection

The Oracle triangle

The CoreWeave connection

Even Elon Musk's xAI has joined the bandwagon. Nvidia is planning to invest up to $2 billion in equity tied to a financing round where xAI will use the money to buy Nvidia processors through a special purpose vehicle.

Independent tech expert Tanuj Bhojwani sees particular significance in the AMD arrangement. "Specifically, the AMD deal is one where you can see OpenAI extracting a lot of value from AMD. But AMD is betting the farm on OpenAI being an anchor customer making them relevant for everyone else," Bhojwani said.

Optimists' case

Inside the tech industry, executives insist these arrangements are necessary innovations to meet unprecedented demand. AMD CEO Lisa Su calls it a "virtuous, positive cycle". OpenAI president Greg Brockman argues it takes an "industry-wide effort" using the entire AI supply chain to meet immense computing demands.

In an interview to Bloomberg News, CoreWeave CEO Michael Intrator dismisses circular financing concerns, pointing to real customers. "When Microsoft comes to us to buy infrastructure to deliver to its clients who are consuming 365 or Copilot, I don't care what the narrative is about circular financing. They have end users that are consuming it," Intrator said.

Bubble concerns

These interconnected relationships have sparked comparisons to the dot-com bubble of 2000, which wiped out billions in market value.

“In the late 1990s, circular deals were often centred on advertising and cross-selling between startups, where companies bought each other’s services to inflate perceived growth,” Paulo Carvao, senior fellow at Harvard Kennedy School, told Bloomberg. “Today’s AI firms have tangible products and customers but their spending is still outpacing monetisation,” he added.

Internal documents revealed that Oracle's cloud business generated about $900 million in sales by renting Nvidia-powered servers but earned just 14 cents gross profit for every dollar in sales, the Information reported. The news dragged down Oracle stock.

Even Wall Street seems uneasy. Moody's has flagged how much of Oracle's future data centre business relies on OpenAI and its unproven path to profitability. If OpenAI falters, the ripple effects could spread across the entire ecosystem.

“The company (OpenAI) is in a far more capital-intensive business than Google or Microsoft ever was, and was born with no cost discipline,” a Silicon Valley investment veteran told The Financial Times.

When asked what would break first in the worst-case scenario, Bhojwani pointed not to balance sheets but sentiment: "What will break first is perception and investor sentiment. You can make the argument they are already unable to monetise, but that's not what's happening," he said.

"If the bet fails spectacularly there will be more compute than we know what to do with, so AI becomes cheaper than ever. If the bet is right-sized, OpenAI and associates capture more value than any other company in the world."

The bet everyone's making

Artificial intelligence is being pitched as the next industrial revolution. And now OpenAI’s trillion-dollar deals have locked chipmakers, cloud firms, and investors into a shared trajectory.

At its core, the whole system rests on one assumption: AI usage will keep growing exponentially. OpenAI and its expanding network of partners are betting that demand for AI services will justify infrastructure. If that bet pays off, today's circular financing will be reframed as visionary dealmaking.

But if AI growth plateaus or slows, the investor enthusiasm that has inflated share prices on the back of these deals could quickly evaporate.

For now, the merry-go-round keeps spinning, faster and more expensive. Whether it leads to success or failure will be the trillion-dollar question of the decade.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.