first published: Oct 22, 2012 01:57 pm

A collection of the most-viewed Moneycontrol videos.

Closing Bell: Profit-booking erodes gains; Sensex off 400 pts from day's high, Nifty under 24,800

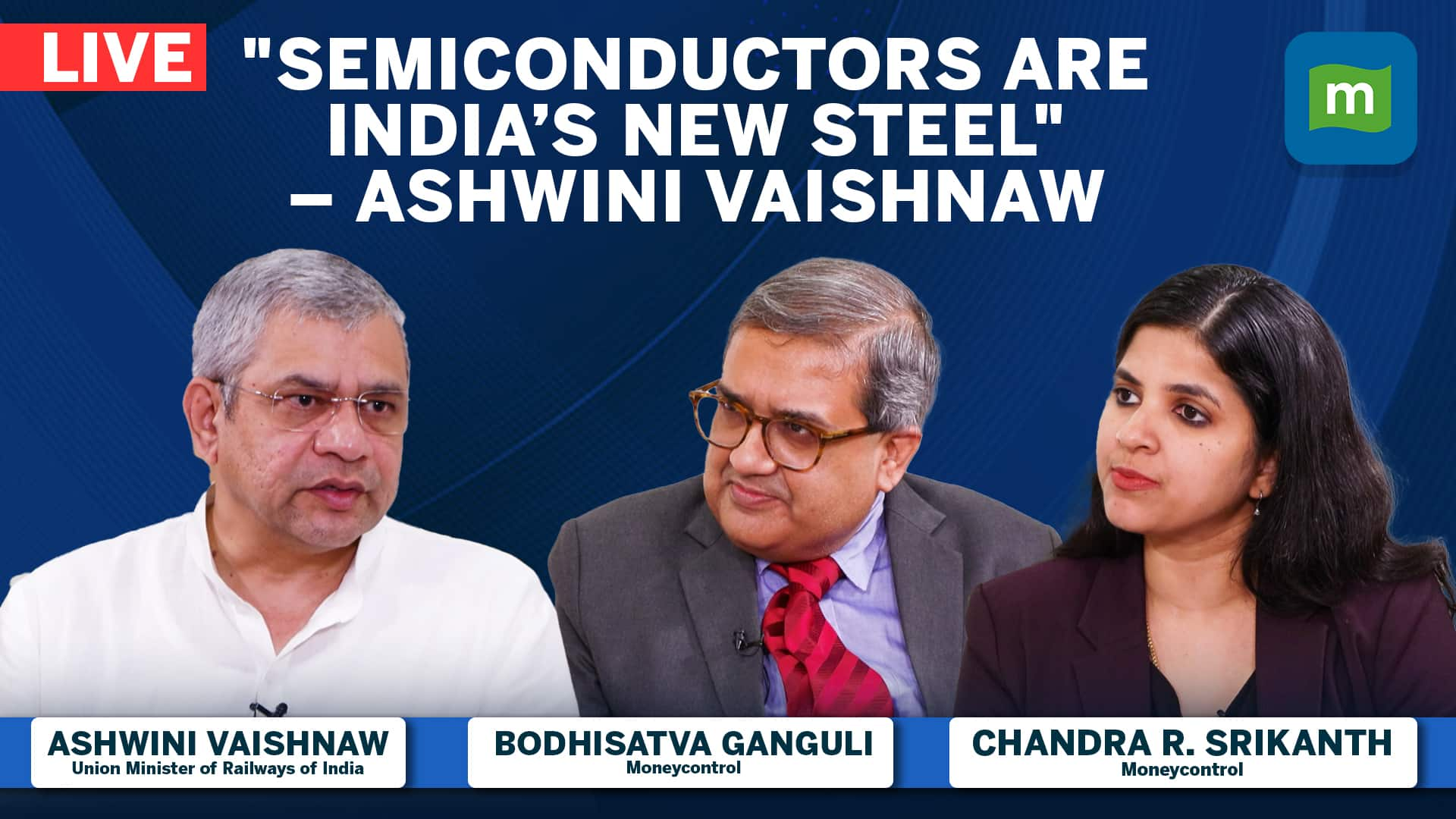

Ashwini Vaishnaw on India’s Semiconductor Growth, Trump’s IT Impact, and GST Reforms

Fake Aadhaars is not a big problem in India, Says CEO of UIDAI | Political Economy

Rajeev Thakkar on hyper-competition, cash holdings and finding value in US and China

You are already a Moneycontrol Pro user.