Nitin Agrawal

Moneycontrol Research

As a lighting solutions provider to automobiles, Lumax Industries (Lumax) has market leadership, marquee clients in its kitty. With its focus on developing technologically advanced products and adoption of LED-based products, it has improved earnings visibility, too.

While unaffected by EV disruption, Lumax is trading at reasonable valuations and, therefore, beckons investors' attention.

The business – provides end-to-end lighting solutions

Lumax has a major presence in the end-to-end lighting solutions that cater to almost all major two-wheelers, commercial and passenger vehicle manufacturers in India and overseas. The company has a leadership position in the space with 60 percent share. Major products include head lamps and tail lamps, auxiliary lamps and other related products. The companies’ products have been well received by both OEMs and after-market.

Strong clientele

The company, being the leader in automotive lighting space, boasts of having marquee clients in its kitty. It services almost 90 percent of OEMs (original equipment manufacturers) in India. Apart from this, the company’s products have been well accepted in foreign markets.

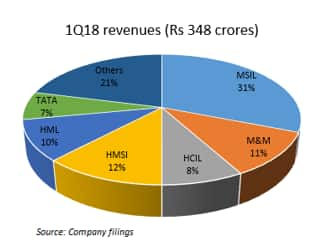

In terms of percentage of total revenues, Maruti is the largest client with 31 percent share followed by Honda Motorcycle and Scooter India (HMSI) with 12 percent share. Top 7 customers generate around 79 percent of the total revenues.

Ahead of competition

Lumax has a strong financial and technical collaboration with Stanley Electric Company (Stanley), Japan, which is a world leader in vehicle lighting and illumination products for automobiles. Stanley Electric is the only global auto lighting company to manufacture LEDs worldwide.

The collaboration with Stanley has been over three decades old and the Lumax gets strong cutting-edge technology from them that keeps Lumax ahead of the competition. Apart from that, the company also has in-house research and development facilities and a design studio that help it in working on innovative products.

LED – a game changer

The increasing adoption of LEDs by the original manufacturers would offer great opportunities for Lumax as LEDs require technical expertise and Lumax gets desired support from Stanley.

As per the management, LED products are expensive compared to the conventional products and are high margin products for the company. The wider adoption of LEDs unlocks huge potential for the company both in terms of sales growth and margin expansion. The management indicated that despite higher prices, the OEMs are willing to shift to these products as these are more efficient products and improve the styling appearance of vehicles.

Moreover, the government’s decision to make ‘automatic headlamp on (AHO)’ in two-wheelers from 2017 would provide an additional kick to the growth. Also, BS-VI norms to be implemented by 2020 would require the vehicles to be more energy-efficient which would lead to the adoption of LEDs as a lot of energy would be saved by those lighting products.

The management in the last conference call mentioned that they are aggressively focusing on LED products and they had around 25 percent of revenues coming from LEDs in 1Q18, up from 5 percent at the end of FY17. The management believes that they will bring the share of LED-based product to 40-50 percent of total revenues by 2020.

Industry tailwinds, unaffected by move towards EV

Auto companies had a bumpy ride in FY17, as demonetization and BS-IV implementation impacted sales. Now GST-led de-stocking affected the companies. Things are returning to normalcy and re-stocking has started as is evident from the auto sales monthly numbers for the last two months. This will augur well for Lumax, being the largest player in the auto-lighting space.

Moreover, Lumax is unaffected by the EV disruption, going forward, as the products it makes are immune to EV adoption.

Robust growth in SL Lumax

SL Lumax is an associated company of Lumax's with 21.28 percent holding. SL Lumax provides high margin products such as lamps, chassis parts, mirrors and gear shifters mainly to its largest client Hyundai. SL Lumax has recently got an increase of contracts aggregating Rs 15 crore from Hyundai, which will strengthen its revenues and margin further.

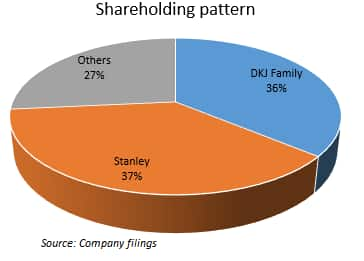

Ownership – lends comfort

Promoters have their skin in the game and hold 73.5 percent of the total shares in the company and the remaining is held by the public. In promoters, DKJ family holds 36 percent and Stanley holds 37.5 percent. High promoter stake lends comfort to the investors.

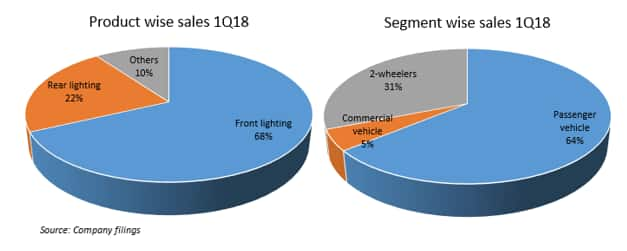

Product and segment mix

Lumax generates most of its revenues from front lighting (68 percent of total) and from passenger vehicle segment (64 percent of total). After GST hangover, passenger vehicle segment is posting healthy numbers, which is expected to get reflected in the current quarter numbers of Lumax.

Financial performance

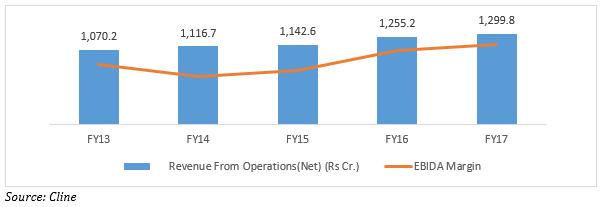

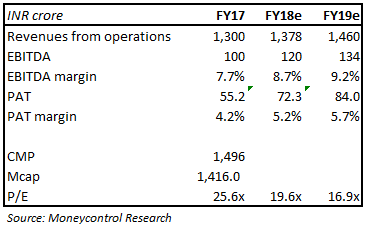

From the financial perspective, though the revenues from operations (net) have posted a growth of 5 percent compounded annually over FY13-17, EBITDA margins have expanded 197bps over the same period on the back of operational efficiencies. Going forward, with LED-based higher margin products having around 40-50 percent portion of revenues, the margin is expected to expand further.

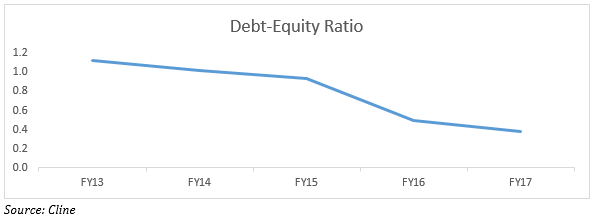

Moreover, the company has consistently reduced debt and debt-to-equity ratio has come down to 0.38 in FY17 from 1.13 in FY13.

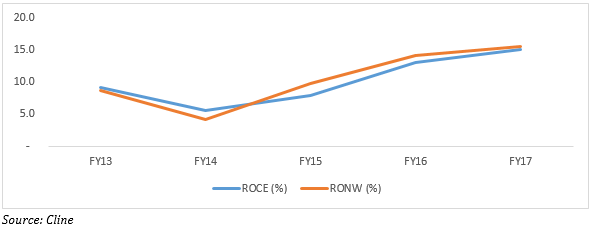

In terms of return ratios, the company has been witnessing an upward trend in both on the back of operational efficiencies and reduction in debt.

In terms of valuation, the company is trading at 19.6 and 16.9 times FY18 and FY19 projected earnings.

Peer analysis

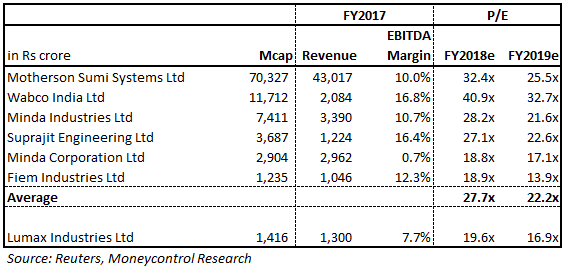

Peer analysis suggests that the Lumax is currently trading at a discount compared to the average multiple of its peers.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.