Hit by a double whammy of rising crude prices and depreciating rupee, PK Goyal, director-finance, IOC, says the oil marketing company will face an under recovery of Rs 12800 cr for per unit rise in crude pirce and per unit fall in rupee level.

first published: Aug 28, 2013 01:00 pm

A collection of the most-viewed Moneycontrol videos.

The Tenant Diwali Special: From Mumbai Slums to Alibaug Villas: 2025 Recap

Nifty Snaps 6-Day Winning Streak As Markets Get In Consolidation Mode| Closing Bell Live

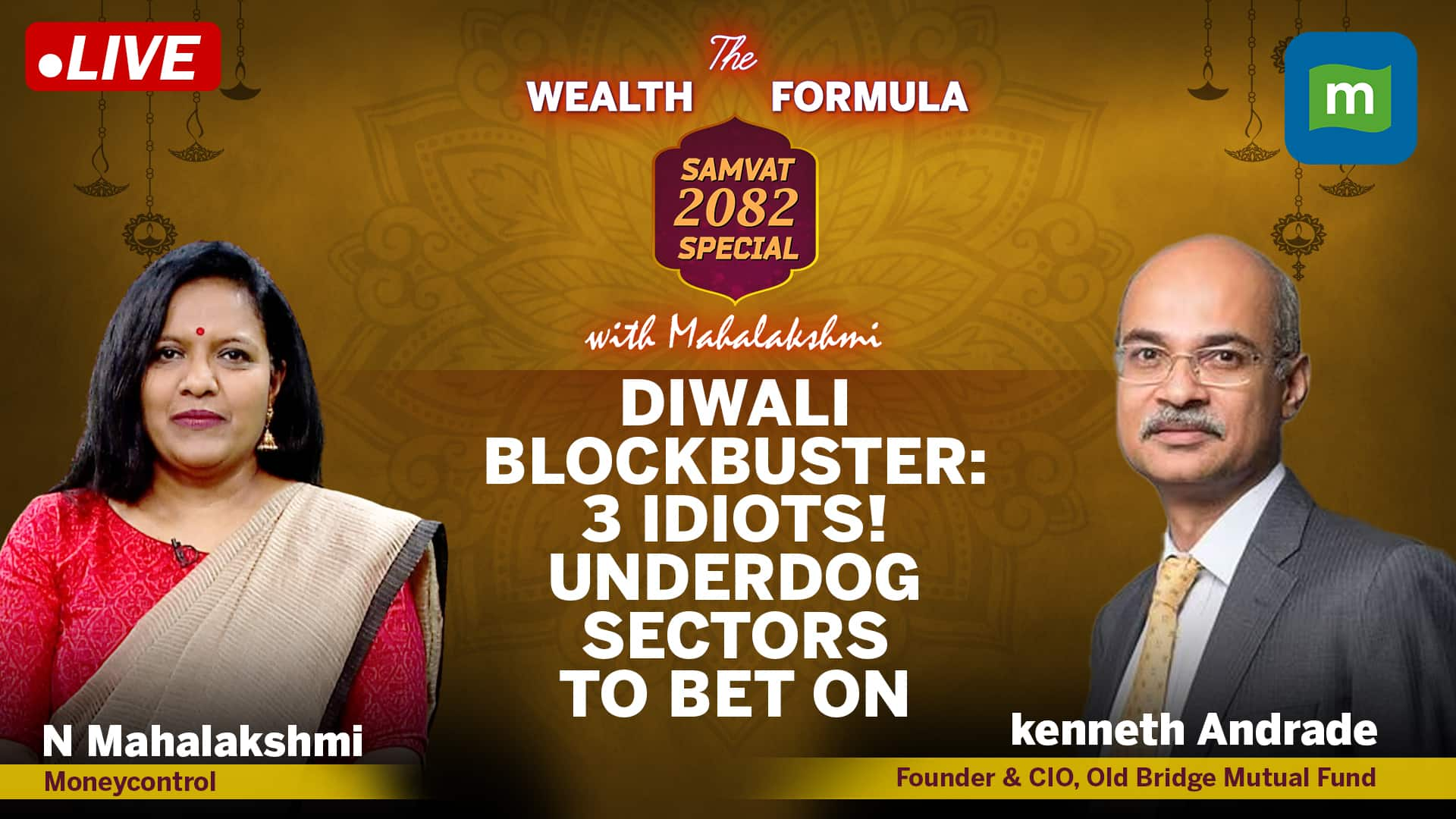

Kenneth Andrade picks three unusual, ignored sectors to bet on in Samvat 2082

Nifty Likely To Consolidate Until It Clears 26,000 Mark Decisively | Opening Bell Live

You are already a Moneycontrol Pro user.