Kaustubh Belapurkar Morningstar Investment Adviser India

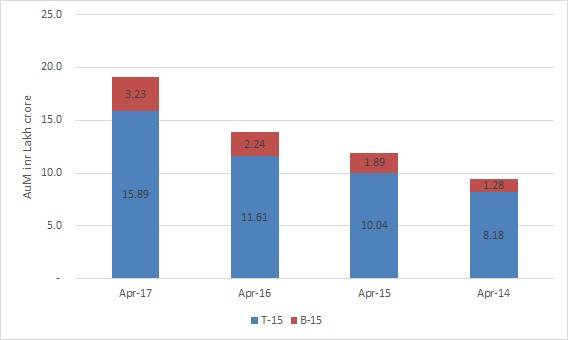

The Indian mutual fund industry is going through a very exciting growth phase with the industry assets having doubled over the last three years from Rs 9.45 lakh crore in April 2014 to Rs 19.11 lakh crore in April 2017.

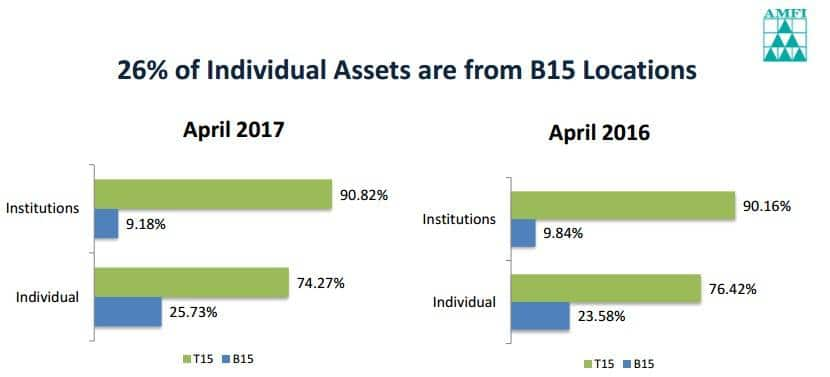

The other encouraging trend emerging is the growing contribution of smaller cities (termed as B-15 cities by AMFI) in this growth phase. The share of B-15 cities has increased from 13.5 percent to 17 percent over the last 3 years.

Assets from B15 locations have increased from Rs 2.24 lakh crore in April 2016 to Rs 3.23 lakh crore in April 2017. The rate of growth in assets for B15 locations was 43.7 percent (38 percent for the industry as a whole during the same period), AMFI data showed.

Cities such as Ludhiana, Nagpur, Indore, Patna, Bhubaneshwar, Cochin, Rajkot, Guwahati, Coimbatore & Nashik amongst others have witnessed a surge in investors and assets.

Steps taken by Securities and Exchange Board of India (SEB) to increase penetration of mutual funds in smaller cities such as the additional 30 bps expense and 2 bps towards investor education are paying rich dividends.

This has resulted in increasing investor awareness and many first time investors from smaller cities are investing in mutual funds. Campaigns such as the one AMFI carried out “Mutual Funds hi Sahi hain” seem to have hit the right notes and definitely gained from being aired during the primetime IPL broadcasts.

Asset Management Companies (AMCs) have also been making further inroads into these smaller cities, by increasing their feet on the street in these cities.

These factors coupled with the fact that markets are doing well as well as increasing coverage by the media on Mutual fund investing has only further boosted interest in Mutual Funds.

Equity, ELSS and Balanced Funds have received inflows of ~INR 76,500 crore in the period Nov’16- Apr’17 (as per AMFI data). It may be too early to attribute this entirely to post-demonetization effect.

But, one interesting trend is that unlike earlier market corrections, in the market correction of Nov’16, significant flows came into equity funds and continued to come in through the months.

This can be attributed to increasing awareness and maturity levels of investors. While Large cap funds received the largest absolute inflows, midcap and Balanced funds received disproportionately large inflows.

Balanced funds have gained immense popularity over the last couple of years, whereby many first-time investors, as well as conservative investors, are taking equity exposure through Balanced funds.

Systematic investment plans (SIPs) have been the preferred route for many investors with the SIP book increasing quite substantially over the last few years, contributing to Rs4,300 crore of inflows every month.

While this growth is exciting, Mutual Funds still form a minuscule portion of investor’s savings. The opportunity is immense and smaller cities could be the growth engine to drive this growth.

Disclaimer: The author is Director of Fund Research at Morningstar Investment Adviser India. The views and investment tips expressed by investment experts on Moneycontrol are their own and not that of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.