Nitin AgrawalMoneycontrol Research

A strong clientele, strong industry tailwinds and robust financials make Rane Brake Linings Ltd (RBL) an attractive bet for investors.

The business

RBL is a part of the Rane Group of companies and is a leading manufacturer and marketer of safety critical friction material. Its products include brake linings, disc pads, clutch facings, clutch buttons, brake shoes and railway brake blocks for passenger cars, utility vehicles, commercial vehicles, two wheelers and railways. The technical and equity collaboration with Japan’s Nisshinbo Group has helped the company cement its position as a market leader in India and gain a foothold in the international markets.

We like the following about the company:

Ownership – lends comfort

Promoters own 66.5 percent of the company. Other prominent investors include insurance companies such as United India Insurance and General Insurance with stakes of 6.05 percent and 3.68 percent respectively.

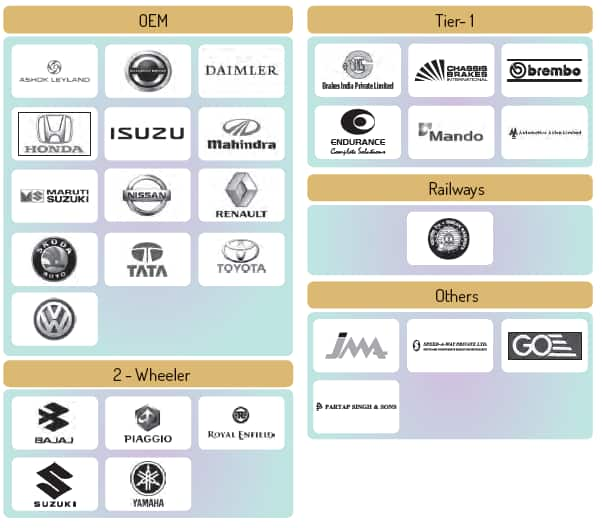

Strong Clientele

The company boasts of marquee clients across all segments.

Strong industry tailwinds

RBL generated 47 and 39 percent of its revenue in FY17 from passenger vehicles (PV) and commercial vehicle segments. Both of these segments are in a strong uptrend.

The commercial vehicle segment had a bumpy ride in FY17 as first demonetisation and then GST led de-stocking adversely affected sales. Restocking has now resumed as evident from the monthly sales numbers in the last two months. This is expected to augur well for RBL.

There are multiple triggers for the growth in the passenger vehicle segment as well. Rising per capita income, low penetration, and the government’s focus on increasing rural income are expected to drive demand for PVs.

In addition, there has been a gradual pick up in the replacement market as GST impact is waning.

Capacity expansion to meet growing demand

The company’s disc pad capacity utilisation is almost 90 percent currently and for brake linings, it is around 65 percent. The company has earmarked Rs 30 crore to invest primarily in capacity expansion for disc pads as the management is bullish on this segment.

Diversified products and customers mix

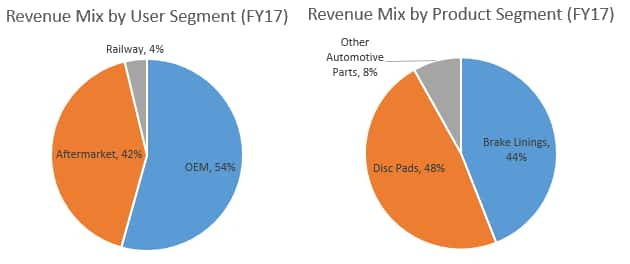

RBL has a diversified mix of products and as well as customers. The company generates 44 percent of its revenues from brake lining and 48 percent from disc pads.

In terms of customer mix, the company generates 54 percent of its revenues from OEMs and 42 percent from the replacement market, a high margin category. Remaining revenue is generated from Indian Railways.

Cost reduction initiatives

The company has been focusing on keeping costs under control. It slashed its wage bill through a voluntary retirement scheme and improved productivity. Commissioning of 2 MW solar plant helped lower power costs. Both measures were implemented during the fourth quarter of last fiscal, and the result of these are reflecting in the company’s bottom-line.

Immune to EV wave

Upcoming disruption coming from electric vehicles has the least impact on the products RBL manufactures as they are critical for the mobility of any type of vehicle.

Financial performance

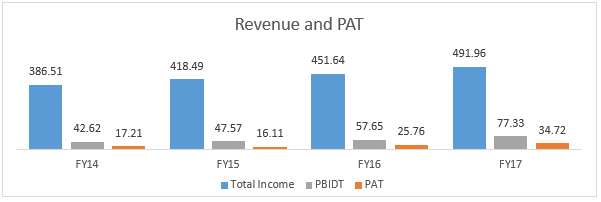

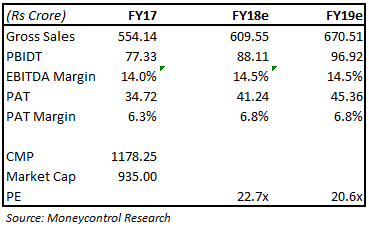

Net revenues have grown 8.4 percent compounded annually over FY14-17, and operating profits (earnings before interest, tax, depreciation and amortisation) is up 22 percent. EBITDA margin averages around 11.3 percent over the same period.

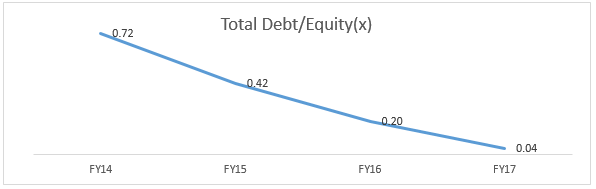

Moreover, RBL has consistently been focusing on reducing debt and is now virtually a debt-free company.

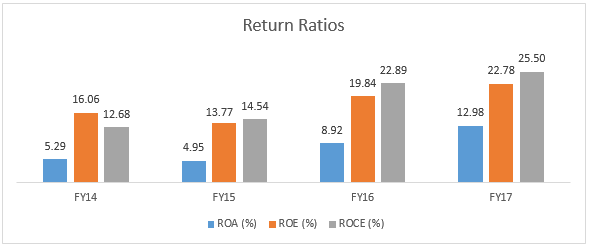

In terms of return ratios, average RoE and RoCE stood at 18.1 percent and 18.9 percent, respectively, over FY14-17.

In terms of valuation, the company is trading at 22.7 and 20.6 times FY18 and FY19 projected earnings.

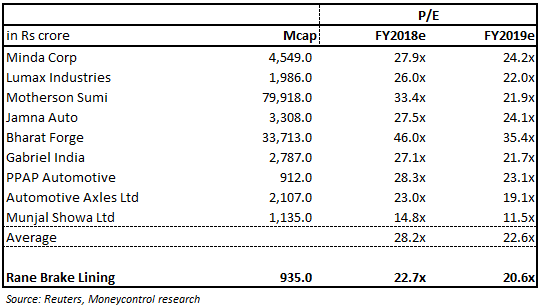

Peer analysis

Peer analysis suggests that the company is currently trading at a discount compared to the average multiple of its peers.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!