Nitin AgrawalMoneycontrol Research

In a bid to expedite Air India disinvestment the government, in a significant move, has allowed foreign investment up to 49 percent in Air India through approval route. This decision can expand the universe of bidders for the debt-laden national carrier, and thus make divestment faster, and probably in FY19 itself.

Privatisation Plan

The government wants to privatise Air India and five of its subsidiaries — Air India Engineering Services, Air India Air Transport Services, Air India Charter Limited, Airline Allied Services and Hotel Corporation of India. Subsidiaries are expected to be hived off separately, which will help reduce consolidated debt.

What changed?

As per extant norms, foreign investors were allowed to invest up to 49 percent of the paid-up capital in the Indian air transport services excluding Air India. In a significant step, the Cabinet has eased the norms and has approved investment up to 49 percent (directly or indirectly) in Air India through approval route. This, however, is based on the condition that substantial ownership and effective control of Air India shall continue to be vested with India.

How does this benefit Air India?

The national carrier has been struggling on the back of operational inefficiencies, high employee costs and high level of net-debt (Rs 54,715 crore) and has been incurring losses for long.

Since, the company has mammoth debt in its books, it is difficult for any Indian player to bid for the entire company. Relaxing the norms would help find an overseas strategic partner who can join hands with Indian entity to invest in the company. This will not only expedite the process of disinvestment but also help widen the universe of bidders and fetch a better valuation.

Several Indian players have expressed interest in acquiring the national carrier. IndiGo, one of the major contenders, has expressed its intention to acquire international operations of Air India and Air India Express.

Why would a potential suitor be interested?

We believe that Indian aviation industry is in sweet spot, clocking double-digit growth in domestic passenger for last 40 months and the trend continued with the industry witnessing 16.9 percent (YoY) growth in November 2017. This is expected to generate lot of interest from foreign players.

Currently, Air India has domestic passenger market share of around 13.5 percent and around 44 percent international traffic share. Acquiring the airline would give immediate access to high-growth Indian markets and would also provide access to the various restricted and closed foreign markets. Air India will strengthen its partners’ reach and give access to highly coveted prime slots on the foreign soil.

How much can Air India fetch?

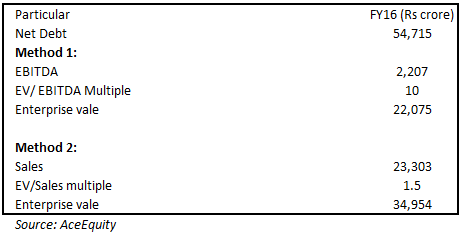

Our back-of-the-envelope calculations indicated that if Air India is valued using EV/ EBITDA multiple of 10x and EV/ sales multiple of 1.5x (both discount to that of IndiGo), the company will fetch Rs 22,075 crore and Rs 34,954 crore, respectively. The average of the two works out to Rs 28,500 crore. However, after adjusting for net-debt, which is Rs 54,715 crore, there is no value left for the equity shareholder. This would warrant substantial haircut to be taken by the lenders to leave something on the table for the upcoming equity shareholders.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.