The market finally caught into the much-awaited major profit booking and lost more than 400 points from its record high touched in the morning session on December 20 despite the positive mood at global counterparts.

The Nifty50 is likely to take support at around the psychological 21,000 mark in the profit booking, and 20,800 is expected to be a crucial support area, whereas it may face resistance at the 21,200-21,400 zone and 21,600 seems to be the top for the time being, expert said, adding overall, the market sentiment is still positive and remained consolidative unless it decisively breaks 20-day EMA (exponential moving average which is nearly 400 points away from Wednesday's closing).

On December 20, the BSE Sensex fell 931 points or 1.3 percent to 70,506, while the Nifty50 tanked 303 points or 1.4 percent and formed a large bearish candlestick pattern on the daily charts, in fact engulfing all the previous three candles.

"Momentum readings like the 14-day RSI (relative strength index) too have declined sharply from overbought levels indicating a loss of momentum. This is a negative signal for the near term and it also implies that the Nifty has now entered into a short-term downtrend," Subash Gangadharan, senior technical and derivative analyst at HDFC Securities said.

He believes that the Nifty could play down towards the next major supports at the 21,026-20,769 level in the coming sessions. Any pullback rallies could find resistance at 21,325, he feels.

Looking ahead, there might be a consolidation phase for the Nifty in the near term, Rupak De, senior technical analyst at LKP Securities said.

The broader markets hit badly with negative breadth. The Nifty Midcap 100 and Smallcap 100 indices corrected 3.3 percent and 3.6 percent, respectively.

The fear index, India VIX also jumped further, rising 4.20 percent to 14.45, from 13.87 levels, which made the bulls uncomfortable at higher levels.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

The pivot point calculator indicates that the Nifty is likely to see immediate resistance at 21,470 followed by 21,589 and 21,783 levels, while on the lower side, it can take support at 21,084 followed by 20,964 and 20,771 levels.

On December 20, the Bank Nifty also traded similarly to Nifty50 and lost more than 700 points from the day's high of 48,166. The index closed within the strong positive gap created on December 14 at 47,445, down 426 points and formed a long bearish candlestick pattern on the daily timeframe

"The immediate resistance for the index is situated at the 47,600-47,700 zone, and a breakthrough above this level could pave the way for further upside, targeting 48,000," Kunal Shah, senior technical & derivative analyst at LKP Securities said.

However, the overall sentiment remains bearish, suggesting a cautious approach with a preference for selling on any upward movements, he feels.

As per the pivot point calculator, the Bank Nifty is expected to see resistance at 47,973, followed by 48,200 and 48,568, while on the lower side, it may take support at 47,237, followed by 47,009 and 46,641.

On the weekly options front, the maximum Call open interest remained at 21,500 strike with 1.71 crore contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 21,600 strike, which had 1.34 crore contracts, while the 22,000 strike had 1.19 crore contracts.

Meaningful Call writing was at the 21,300 strike, which added 78.51 lakh contracts followed by 21,200 and 21,600 strikes, which added 66.21 lakh and 65.11 lakh contracts.

The maximum Call unwinding was at the 20,800 strike, which shed 8.94 lakh contracts followed by 22,200 and 20,700 strikes, which shed 3.09 lakh and 1.45 lakh contracts.

On the Put front, the 21,000 strike owned the maximum open interest, which can act as a key support area for the Nifty with 84.16 lakh contracts. It was followed by 20,500 strike comprising 61.22 lakh contracts and 20,800 strike with 59.92 lakh contracts.

Meaningful Put writing was at 21,000 strike, which added 25.81 lakh contracts followed by 20,700 strike and 20,900 strike, which added 19.74 lakh contracts and 14.15 lakh contracts.

Put unwinding was at 21,400 strike, which shed 84.80 lakh contracts followed by 21,300 strike, which shed 40.62 lakh contracts and 21,500 strike which shed 20.79 lakh contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Cholamandalam Investment and Finance, Pidilite Industries, Larsen & Toubro, Godrej Consumer Products, and Hindustan Unilever saw the highest delivery among the F&O stocks.

A long build-up was seen in 6 stocks, which included HDFC AMC, Britannia Industries, AU Small Finance Bank, Tata Consumer Products, and ONGC. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 119 stocks saw long unwinding, including IRCTC, Mphasis, Exide Industries, Indus Towers, and Piramal Enterprises. A decline in OI and price indicates long unwinding.

62 stocks see a short build-up

A short build-up was seen in 62 stocks, which were Hindustan Copper, India Cements, UPL, Abbott India, and Astral. An increase in OI along with a fall in price points to a build-up of short positions.

Based on the OI percentage, 1 stock - Voltas - was on the short-covering list. A decrease in OI along with a price increase is an indication of short-covering.

![]()

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, dropped sharply to 0.68 on December 20, from 1.13 levels in the previous session. The below 1 PCR indicates that the traders are buying more Calls options than Puts, which generally indicates an increase in bullish sentiment.

For more bulk deals, click here

Stocks in the news

Inox India (INOXCVA): The cryogenic tanks manufacturing company is set to list its equity shares on the BSE and NSE. The final issue price has been fixed at Rs 660 per share. Analysts expect the listing premium in the range of 75-80 percent over the issue price.

Mazagon Dock Shipbuilders: The state-owned shipbuilding company has signed a contract worth Rs 1,600 crore with the acquisition wing of the Ministry of Defence for the construction and delivery of six next-generation offshore patrol vessels (NGOPVs) for the Indian Coast Guard (ICG).

Cochin Shipyard: The public sector undertaking company has signed a contract worth Rs 488.25 crore with the Ministry of Defence (MoD). The work package includes repair and maintenance of the equipment and systems onboard the naval vessel.

UltraTech Cement: The country's largest cement company has entered into a share subscription and shareholders agreement to acquire 26 percent equity shares of Clean Max Terra, for Rs 20.25 crore. Clean Max Terra is engaged in the generation and transmission of renewable energy.

BSE: The SEBI has granted its approval for the appointment of Pramod Agrawal as Chairman of the Governing Board of the stock exchange with effect from January 17, 2024. S S Mundra, Chairman and Public Interest Director will be ending his term on January 16, 2024.

ICICI Bank: The Reserve Bank of India has approved the reappointment of Sandeep Batra as Executive Director of the bank with effect from December 23, 2023 to December 22, 2025. This renewed term of two years is within the five-year term as previously approved by the shareholders.

Karur Vysya Bank: Rajesh E T, the current Chief of Internal Vigilance, has been transferred to the Inspection and Audit Department to manage and develop the department's software applications effective from January 3, 2024. Hence, Ajin Raj will take charge as Chief of Internal Vigilance of the bank effective from January 3, 2024. Further, the bank has decided to surrender its Certificate of Registration as a merchant banker.

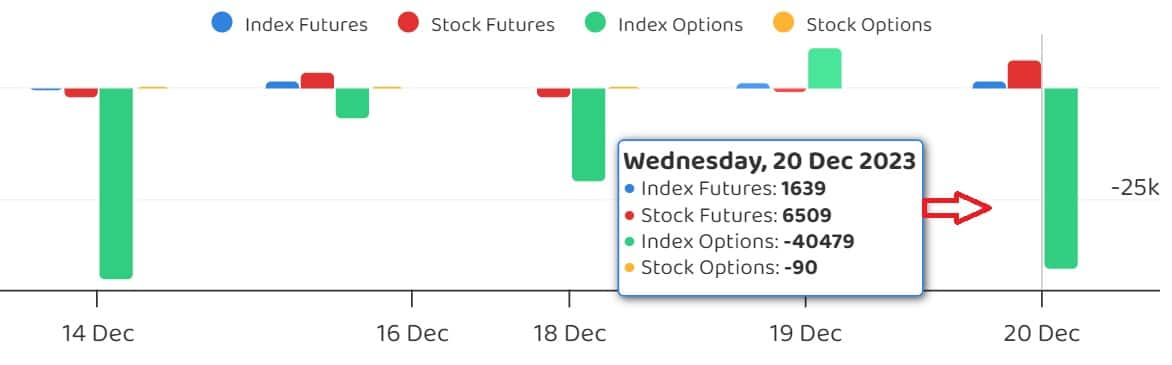

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) net sold shares worth Rs 1,322.08 crore, while domestic institutional investors (DIIs) bought Rs 4,754.34 crore worth of stocks on December 20, provisional data from the National Stock Exchange (NSE) showed.

Stock under F&O ban on NSE

The NSE has added Ashok Leyland, and India Cements to its F&O ban list for December 21, while retaining Balrampur Chini Mills, Delta Corp, Indus Towers, Manappuram Finance, National Aluminium Company, Piramal Enterprises, RBL Bank, and SAIL in the list. Zee Entertainment Enterprises and IRCTC were removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.