Indian markets hit a fresh record closing high to sign off the week on a bullish note. The index rose 0.27 percent for the week ended January 5. The Nifty made a small bullish candle on the daily candlestick charts and a Hanging Man kind of patterns on the weekly charts.

The index broke out of its narrow trading range witnessed throughout this week. It bounced back after hitting a low 10,404.65 recorded earlier in the week on January 2. Traders are advised to stay long with a stop below 10,500 levels.

Riding on strong global cues, Nifty surged to a fresh record high of 10,566.10 along with Nifty Bank index which also recorded fresh lifetimes high.

Almost all the sectoral indices participated in the rally wherein midcap and smallcap counters attracted maximum buying interest.

The Nifty which opened at 10,534 slipped marginally to hit its intraday low of 10,520. The bulls soon took control over D-Street to touch its fresh record high of 10,566.10. The index finally closed 54 points higher at 10,558.

Investors are advised to stay long on the index with a trailing stop loss below 10,500 levels.

“Finally Nifty appears to have witnessed a breakout with new lifetime highs as it signed off the last trading session of the week with a small bullish candle,” Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory, Chartviewindia.in told Moneycontrol.

“However, the pattern on weekly charts is not that impressive as it is looking like a Hanging Man with a long lower shadow which yet times results in either a pause or correction. Hence, it looks imperative for bulls to sustain above 10566 levels,” he said.

Mohammad further added that based on a channel breakout witnessed some time back on December 18, 2017, we can project a target close to 10690 levels. “Traders are advised to remain cautiously optimistic and maintain a tight stop below 10500 on a closing basis,” he said.

India VIX fell down by 2.29 percent at 13.11. VIX has to hold below 13-12.50 zones to support the fresh leg of the rally with a smooth ride in the market.

We have collated the top fifteen data points to help you spot profitable trade:

Key Support & Resistance Level for Nifty

The Nifty closed at 10,558.8 on Friday. According to Pivot charts, the key support level is placed at 10,530.57, followed by 10,502.33. If the index starts to move higher, key resistance levels to watch out are 10,576.57 and 10,594.33.

Nifty Bank

The Nifty Bank closed at 25,601.8. Important Pivot level, which will act as crucial support for the index, is placed at 25,519.84, followed by 25,437.87. On the upside, key resistance levels are 25,663.54, followed by 25,725.27.

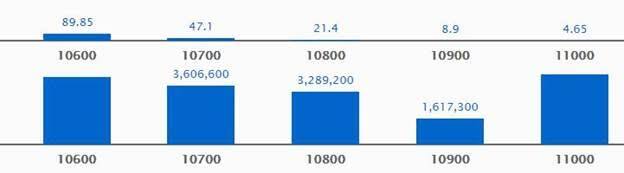

Call Options Data

Maximum Call open interest (OI) of 43.36 lakh contracts stands at strike price 11,000, which will act as a crucial resistance level for the index in the January series, followed by 10,600, which now holds 41.37 lakh contracts in open interest, and 10,700, which has accumulated 36.06 lakh contracts in OI.

Call writing was seen at a strike price of 10,600, which saw the addition of 5.76 lakh contracts, followed by 10,800, which saw the addition of 1.7 lakh contracts and 10,900, which saw the addition of 1.22 lakh contracts.

Call unwinding was seen at strike prices of 10,500, which saw 2.22 lakh contracts being shed, followed by 10,400, which shed 1.14 lakh contracts and 10,200, which shed 0.86 lakh contracts.

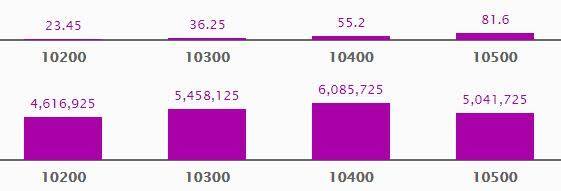

Put Options Data

Maximum put OI of 60.85 lakh contracts was seen at strike price 10,400, which will act as a crucial base for the index in January series; followed by 10,300, which now holds 54.58 lakh contracts and 10,500 which has now accumulated 50.41 lakh contracts in open interest.

Put writing seen at 10,500, which saw the addition of 13.88 lakh contracts, followed by 6.83 lakh contracts at the strike price of 10,400 and 10,600, which saw the addition of 3.90 lakh contracts.

Put unwinding was seen at the strike price of 10,100, which saw shedding of 3.27 lakh contracts.

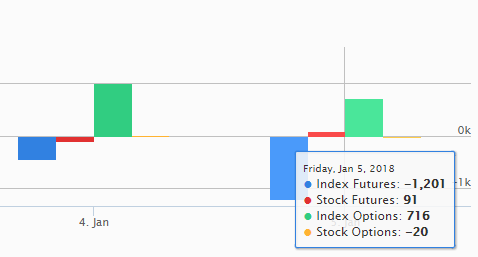

FII & DII Data

Foreign institutional investors (FIIs) bought shares worth Rs 581.43 crore, while domestic institutional investors bought shares worth Rs 243.13 crore in the Indian equity market on Friday, as per provisional data available on the NSE.

Fund Flow Picture:

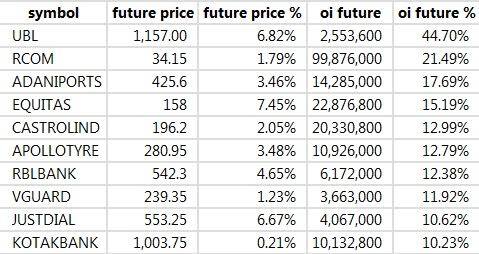

Stocks with high delivery percentage

High delivery percentage suggests that investors are accepting the delivery of the stock, which means that investors are bullish on the stock.

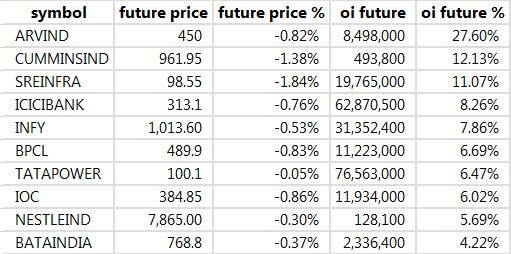

101 stocks saw long build-up

47 stocks saw short covering

A decrease in open interest along with an increase in price mostly indicates short covering.

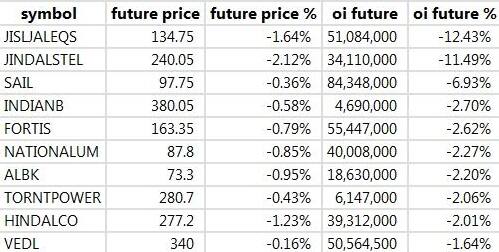

40 stocks saw short build-up

An increase in open interest along with a decrease in price mostly indicates short positions being built up.

23 stocks saw long unwinding

Long unwinding happens when there is a decrease in OI as well as in price.

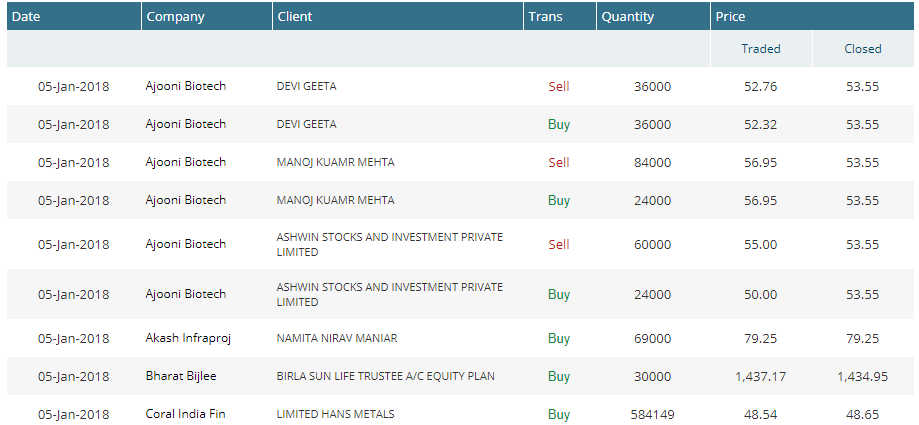

Bulk Deals

Equitas Holdings Limited: Credit Access Asia NV sold 22,90,000 shares at Rs 153.42 per share on the NSE.

Gitanjali Gems Limited: Macquarie Finance (India) Pvt Ltd sold 11,66,000 shares at Rs 74.30 per share on the NSE while Morgan Stanley France SAS bought 9,90,387 shares at Rs 74.07 per share .

GSS Infotech Limited: Saraswathi Madanlal sold 21,75,752 shares at Rs 32.50 per share on the NSE.

(For more bulk deals click here: https://goo.gl/qrXHCH)

Analyst, Board Meet/Briefings

Karma Capital Advisors met the management of Indian Hotels on January 5.

South Indian Bank has scheduled a conference call with analysts and investors on January 10, 2018.

Aarti Drugs Limited:

Aarti Drugs Ltd has informed BSE that a meeting of Board of Directors of the Company is scheduled to be held on January 08, 2018, to consider inter alia, proposal of buyback of the fully paid-up equity shares.

Scanpoint Geomatics:

The board of Directors of the Company is scheduled to be held on Monday, January 8, 2018, inter alia, to consider the followings: 1. To fix the issue price for the equity shares proposed to be issued on rights basis, 2) To fix the record date for the proposed Rights Issue, 3) To decide the Terms of Issue, and 4) To discuss any other matter incidental to the rights issue.

SJVN:

A Meeting of Board of Directors of the Company will be held on 08th day of January 2018 i.e., Monday at New Delhi, inter alia, to consider the proposal for Buyback of the fully paid-up equity shares of the Company.

Windsor Machines:

A meeting of the Board of Directors of the Company will be held on Tuesday, January 9, 2018, to allot 72,14,644 Share Warrants (Warrants) on preferential basis to those allottees.

Stocks in the News

Navkar Corporation: Appoints Deepa Gehani as Company Secretary and Compliance Officer.

Capital First: Makes interest payment on non-convertible debentures on January 5.

Banks request RBI to exempt all mark-to-market losses in December quarter

NACL Industries gets board approval to raise Rs 3,000 cr

Indian Bank likely to raise equity capital of upto Rs 7,000 cr

RCom says not paying interest on non-convertible debentures till rejig completion

Tata Steel FY18' Q3 production down marginally at 3.24 mt

Havells eyes Rs 100 crore business from water purifiers in 2018-19

SBI hints at revising downwards minimum balance amount, penalty

Lupin launches generic anti-infection capsules in US

GAIL India to consider dividend on January 12, 2018

On Monday, Goa Carbon is expected to react positively to its Q3 earnings. It has posted net profit at Rs 22.50 crore against net loss of Rs 0.93 crore in year-ago and revenue more than doubled to Rs 186.6 crore from Rs 82 crore YoY.

Uttam Galva Steels reported loss at Rs 179.96 crore for October-December quarter 2017 against loss of Rs 257.28 crore in year-ago and revenue declined sharply to Rs 666.90 crore from Rs 1,035.61 crore YoY.

Sobha during December quarter achieved new sales volume of 9.33 lakh square feet (valued at Rs 750.9 crore) with an average realisation of Rs 8,045 per square feet, which is the highest every quarterly sales performance in terms of value and average realisation. Sales volume increased 8.4 percent and sales value 11.2 percent QoQ; and 52 percent & 92 percent YoY.

Lanco Infratech's shareholding in subsidiary Lanco Kondapalli Power reduced to 28.15 percent from 58.91 percent and hence, lenders' controlling stake stood at 52.21 percent after strategic debt restructuring.

NBCC shares may also react positively as the company has received contract from Ecotourism Development Corporation of Uttarakhand, Dehradun for construction of Kotdwar-Ramnagar Kandi Road amounting Rs 2,000 crore.

Den Networks has entered into an agreement with cable TV distribution company VBS Digital Distribution Network (VBS) for acquiring 51 percent stake in VBS for Rs 2.64 crore.

Visa Steel is in discussion with SBI for settlement after the SBI filed an application with National Company Law Tribunal Kolkata to initiate corporate insolvency resolution process for the company under Insolvency & Bankruptcy Code.

Jaypee Infratech: Tata Housing and the Lodha Group have filed initial bids for debt-laden realtor and road builder Jaypee Infratech

Jaiprakash Associates: The Jaypee Group has restructured its outstanding foreign currency convertible bonds (FCCBs)

Sun Pharma: The US Food and Drug Administration is expected to begin inspection of Sun Pharma's manufacturing facility at Halol in the second week of February, sources told ET.

Sobha Ltd: Realty firm Sobha Ltd's sales bookings increased by 92 percent to Rs 750.9 crore during the third quarter this fiscal on higher volumes and better average realisation.

Jindal Steel and Power Ltd: Jindal Steel and Power Ltd (JSPL) will raise Rs 1,000 crore through qualified institutional placement (QIP) route in February, its chairman Naveen Jindal said here.

Aban Offshore: Promoters of Aban Offshore Ltd have offered to pay up to $600 million in a one-time settlement to 17 banks to which it collectively owes nearly $2 billion, Mint reported quoting two people who were aware of the development.

Brigade Enterprises: Bengaluru-based Brigade Enterprises Ltd, which is in the process of moving all its hotel assets into a separate unit, may consider listing the new entity as a real estate investment trust (REIT) or going public in the future, Mint reported.

9 stocks under ban period on NSE

Security in ban period for the next trade date under the F&O segment includes companies in which the security has crossed 95 percent of the market-wide position limit.

Securities which are banned for trading include names such as Fortis, GMR Infra, HDIL, IFCI, JP Associates, Jindal Steel, Jain Irrigation, JP Associates, Reliance Communications and Reliance Power.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.