Vijay Kedia, who is known on Dalal Street for spotting multibaggers, says India is not just in a bull run, it is a revolution. The MD of Kedia Securities in an interview with Moneycontrol’s Kshitij Anand said that it looks like “equity investing is becoming a cult”.

You have seen many bulls and bear cycles of India markets. What do you think about the current bull run, we are riding on the big liquidity wave with much of earnings growth? Even the micro fundamentals are also giving a touch of concern with crude near USD 60/bbl?

It's not just a bull run. It's a revolution. FIIs had been dominating and minting money in the Indian stock market for the last 25 years.

Indian 'Janta' failed to make it big in equity markets largely because of their love for gold and fixed deposits (FDs), short vision and distrust on equity due to frequent scams in the capital market and lack of education and manipulation in the system.

Falling interest rates in fixed deposits, the fading shine of gold, black money exiting from real estate, better regulation of exchanges by market regulator SEBI and good performances by mutual funds (MFs) is attracting a never-before-kind of inflows into the stock market.

It looks like equity investing is becoming a cult.

Liquidity may hold the market till earnings in the majority of the sectors catch up. Having said that, there are still many sectors where even earnings are presently in their all-time highs. Even if oil spikes up to USD 70-75/bbl, I don't think it will hold there for long.

You have added Everest Industries to your portfolio. What were the reasons? Any other stock which is looking interesting?

Everest was added 3-month ago. The main reason for adding Everest was the product which the company produces.

It is used in villages, towns and metropolitan cities. It touches the lives of lower, middle and upper classes of the society.

However, they did a mistake 2-3 years ago by diversifying in a Gulf country which did not do well and impacted the balance sheet negatively. They have now closed down and shifted the plant to India. In my view, the worst is over for the company.

What is your advice to investors for the SAMVAT 2074 or till next Diwali? Will we be able to see higher earnings growth and bounceback in the economy in next 12 months?

Diwali comes once in a year, but market opens every day. Choose a strategy which works in Diwali, Holi, and Eid, and educate yourself about investing.

Here are a few rules which traders should follow:

1. Invest in credible management.

2. Invest only for long term.

3. Avoid bhangaarcap.

4. Be patient.

5. Practice yoga and meditation to keep a healthy body and pure mind.

All, these rules will bring permanent Diwali in your life.

Mid and smallcap stocks have caught the fancy of investors and fund managers for some time now. But, the risk is equally high. We saw that when market slipped in September, the broader market corrected much more than benchmark indices? What is your view on this space?

High-quality midcaps and smallcaps can give better returns compared to largecaps provided they are bought at reasonable valuations. Also, they don't need a burgeoning economy to grow as their sizes are comparatively small.

Of course, risk content is also high due to illiquidity and high volatility. But, so is the reward.

One needs to have the patience to wait for long-term and courage to face volatility while investing in mid and small caps. Remember, understanding yourself first is more important than understanding the market.

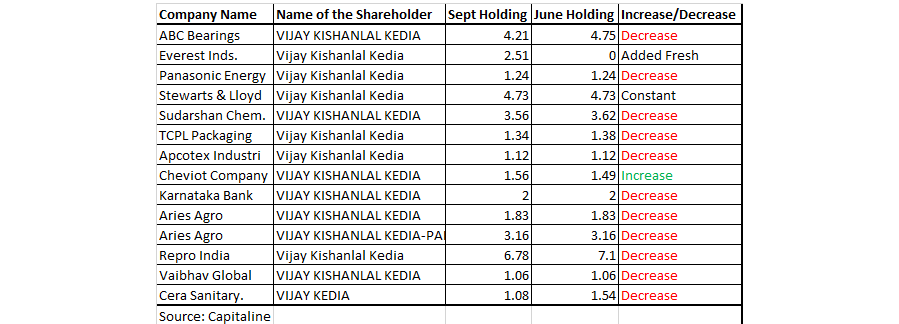

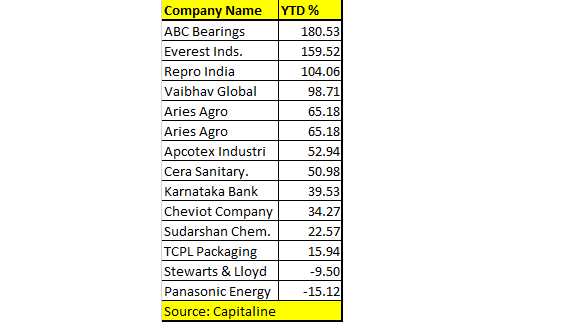

Everest Industries, ABC Bearings, Vaibhav Global have more than doubled in 2017. What makes you bullish on these names?

My cost price in Everest and Vaibhav is much lower than the currently quoted price. As on today, I intend to hold them for another 5 to 10 years and expect handsome returns. In my view, they both are turning around.

ABC is merging with Timken which is a multinational and a conglomerate, although it is a bit expensive.

PSU bank recapitalisation plan – do you give a thumbs-down or thumbs-up? And, can it lead to a rating upgrade?

In my view, it is another big reform after de-monetisation, GST, and RERA from the Modi government. Normally, rating agencies look at things from the rear-view mirror.

They upgrade in 2017 or 2019...it does not matter. Industrialists and economists have upgraded which is more important.

What is on your radar which you think could turn out to be multibaggers in the next few years and why?

I am an optimist. I think all my stocks would multiply manifold in the next few years. Because a majority of them are from the consumption theme. And, in my view, this theme, in general, will keep on flourishing for many decades to come.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.