The yield or rate on Indian debt instruments such as Commercial Paper, Certificates of Deposit (CDs), and corporate bonds have eased in the last few weeks by 10 to 30 basis points (bps) in the aftermath of a banking crisis in global markets, a Moneycontrol analysis showed. One basis point is one-hundredth of a percentage point.

The fall in yield on debt instruments followed a sharp reduction in US Treasury yields as most US investors moved to the safety investments like treasury bonds after the Silicon Valley Bank (SVB) failure and Credit Suisse crisis last month, dealers said.

The US banking sector was rocked by the collapse of California-based SVB, which was followed by the sale of Credit Suisse to UBS at the behest of the Swiss central bank.

“India’s government bond yields went south in line with US treasury yields, which fell sharply in March post-SVB and Credit Suisse crises as US investors moved to the safety of investments like treasury bonds,” said Venkatakrishnan Srinivasan, founder and managing partner of Rockfort Fincorp.

SVB was shut down by regulators and its assets seized, the Federal Deposit Insurance Corporation (FDIC) said on March 10. The collapse was followed by the failure of two more banks: Signature Bank and Silvergate Corporation.

Credit Suisse bank collapsed after Saudi National Bank ruled out any more cash injections into the troubled Swiss bank.

Also read: Unclaimed deposits with Indian banks fell by Rs 13,250 crore in a year, shows govt data

Rate movement

A Moneycontrol analysis shows that the yield on CP issued by NBFCs has eased 20-40 basis points and that on debt issued by manufacturing companies by 30-35 basis points.

Similarly, the yield on CDs issued by banks has fallen 32-35 basis points since March 10 after the collapse of SVB.

On the longer end, the yield on corporate bonds eased by 11-27 basis points across 3-year, 5-year and 10-year tenures in the secondary market.

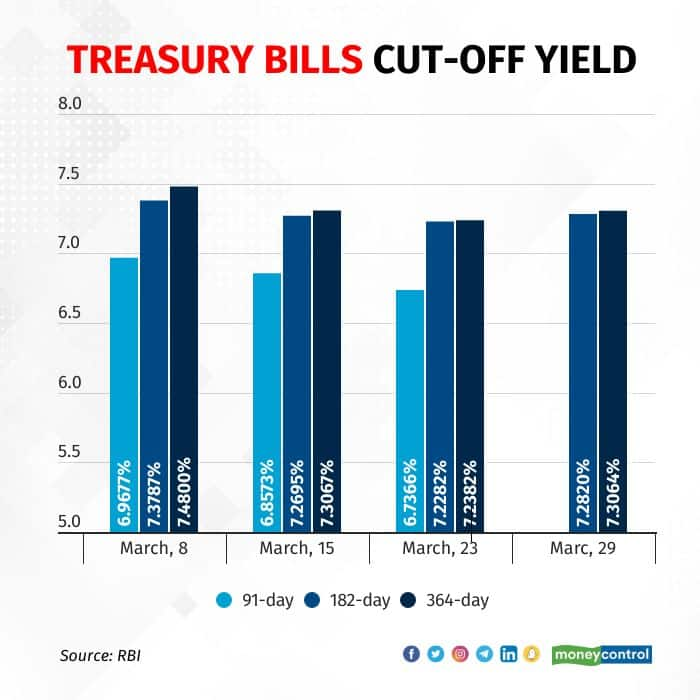

The Treasury Bill cut-off yield also eased 15-25 basis points across tenures between March 8 and March 23. An uptick in the cut-off yield was seen on March 29 after the Reserve Bank of India (RBI) did not accept any bids for 91-day T-Bills after nearly seven years.

On April 3, the yield on debt instruments inched up after Brent crude oil prices rose in the international market.

RBI’s Monetary Policy Committee is meeting this week, to be followed by the announcement on April 6 of the first policy announcement of FY 24.

The market is divided over whether the MPC will opt for a pause in interest rate hikes or a token hike, said Ajay Manglunia, Managing Director of JM Financial.

“…fear of hikes is driving the yields a bit higher now and may stabilize in next week,” he said.

Liquidity

Liquidity in the banking system was negative for most of March; despite this, the yield on Indian debt instruments fell because of investor appetite.

Before the banking crisis in the US, liquidity was surplus to the tune of around Rs 51,360.87 crore on March 9, and it turned negative to the tune of Rs 49,796.13 crore. After this, it remained negative until March 27, before turning positive.

Liquidity turned negative due to advance tax payments, goods and services tax payments, and outflows related to weekly bond auctions.

To manage deficit liquidity, the central bank infused liquidity in the banking system twice in March. On March 10, the RBI infused Rs 82,650 crore through a 14-day variable rate repo auction and Rs 55,858 crore on March 24 through a five-day variable rate repo auction.

Currently, liquidity in the banking system is estimated to be in surplus to the tune of around Rs 1.04 lakh crore.

Banking crisis

The US banking regulators on March 10 announced the closure of SVB and seized its assets to protect depositors’ money.

Earlier in March, depositors started pulling out their money and to meet that demand, the bank had to sell its investment in bonds whose value had declined because of rising interest rates.

SVB sold its $21-billion bond portfolio consisting of US Treasuries and mortgage-backed securities at a loss of $1.8 billion.

The bank had invested heavily in Mortgage-backed securities and US Treasuries last year, using depositors’ money to earn higher returns. The bank had seen a huge influx of deposits but struggled to find enough credit demand to deploy that money at desired yields.

Over 95 percent of these mortgage-backed securities were over 10 years in duration, with a weighted average yield of 1.56 percent.

The crisis at Credit Suisse had been brewing for quite some time. The bank lost a sizeable chunk of its customer business in recent years and several key executives left the bank.

The bank also faced the domino effect of the collapse of SVB, which resulted in a major sell-off of its shares. The crisis was aggravated by the Saudi National Bank’s denial of any fresh infusion of money into the lender because of regulatory constraints.

Credit Suisse, in a statement on March 15, said it was exercising an option to borrow up to 50 billion Swiss francs ($54 billion) from Swiss National Bank and planned to buy back 3 billion Swiss francs ($3.2 billion) worth of debt.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.