The highest paid executive in the Ola Electric universe in FY24 was not its founder-chairman Bhavish Aggarwal, neither was it the chief financial officer or the chief technology and product officer or the head of vehicle engineering.

Hyun Shik Park, a battery manufacturing specialist who spent more than 36 years in South Korean conglomerate LG, had the biggest compensation package in the Ola Electric universe in the last financial year.

Park, who joined the IPO-bound electric vehicle maker last year, is in-charge of the operations at Ola’s Gigafactory to ensure mass-production of cells, which are joined to form batteries.

Spread across 110 acres in Tamil Nadu’s Krishnagiri district, the Ola Gigafactory has commenced operations with an initial full capacity of 5 GWh (Gigawatt hours). The plan is to scale it up to 100 GWh in phases, while $100 million (over Rs 800 crore) has already been invested in the first phase of the ambitious project helmed by Park.

“The cell is absolutely the heart of the EV even in terms of cost, with the cell contributing to one-third of the overall cost of any typical EV. So as we bring that into India and make it ourselves, it kind of further improves our modules,” Ola chief Aggarwal said on July 30.

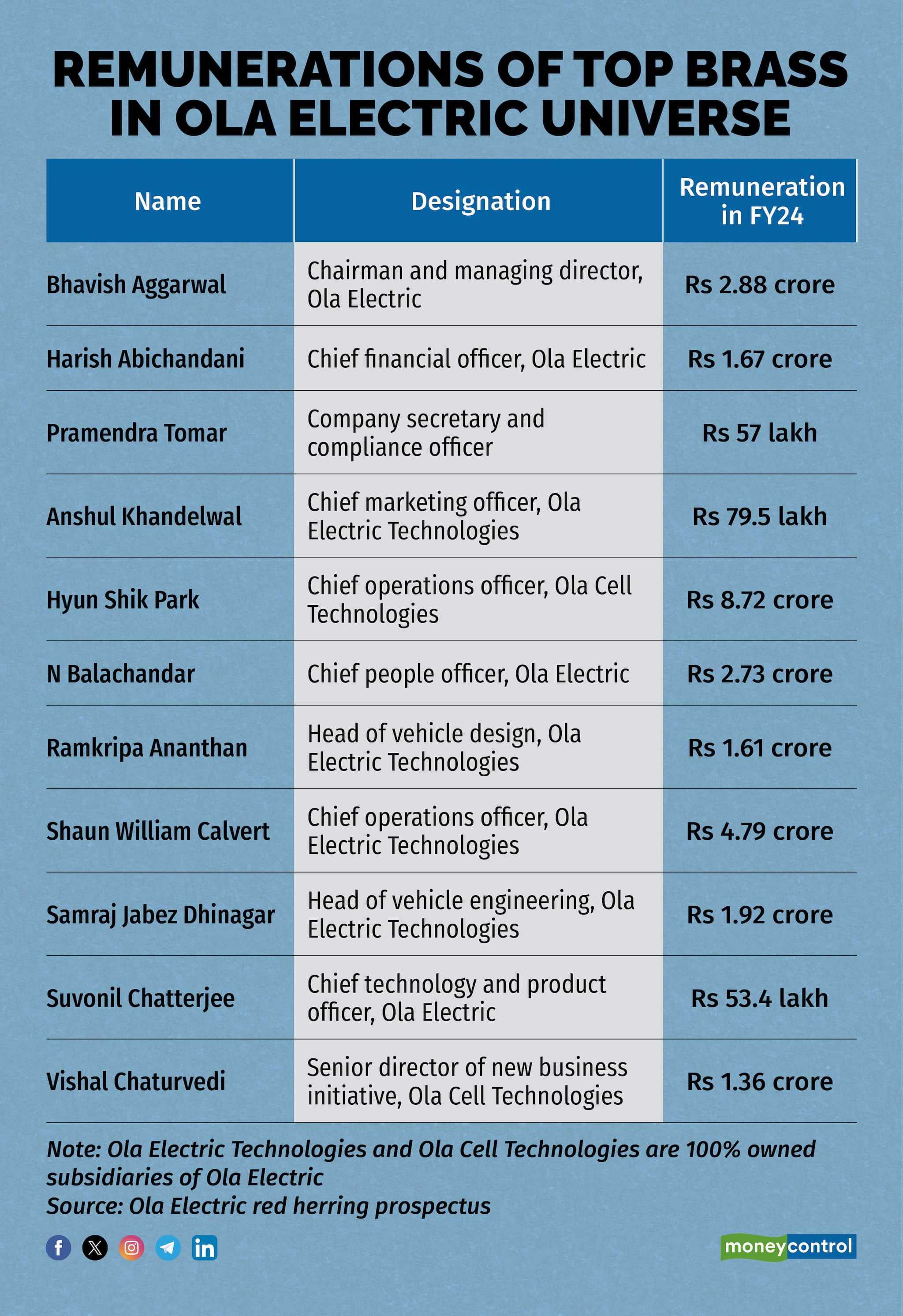

It is not surprising then that Park, who is overseeing the company’s cell segment, took home a pay of Rs 8.7 crore in FY24. It was more than any other senior management personnel in the mobility technology unicorn and its subsidiaries, the initial public offer (IPO) bound company’s red herring prospectus revealed.

Moreover, Park was granted 17.3 lakh shares in Ola Electric during the fiscal which could be worth more than Rs 13 crore after the IPO. However, it is important to note that stock options granted to employees typically can only be exercised in parts over a period of 4-5 years.

His formal designation is chief operations officer of Ola Cell Technologies, a 100 percent owned subsidiary of Ola Electric.

Cheongju to China

After getting a bachelor’s degree of science in chemistry from Pusan National University of South Korea, he started working at LG in Cheongju as a production engineer in 1987, according to his LinkedIn profile. Park rose through the ranks to become the head of automotive battery for LG Energy Solution by 2006.

He then spent 6 years in Nanjing, China, managing the electronics conglomerate's battery manufacturing facility there which supplied to customers like Apple, Motorola, Nokia, HP, Dell and Lenovo. By 2013, Park got back to South Korea as a senior vice-president and head of the mobile battery division where he helped build a platform for growth by attracting Chinese mobile makers like Huawei and Xiaomi.

His second stint in China was for two years from 2017 when he became a representative of LG Chemical in China (including Taiwan and Hong Kong), managing and supporting 14 subsidiaries in the country, building government relations, etc.

Before joining Ola in August 2023, Park also dabbled in management coaching and building up a training programme for local engineers and operators for LG Energy Solution in Poland.

Given the veteran executive’s vast experience in the battery industry, he is one of the key personnel in Ola’s ambitions in green mobility over the next few years.

Biggest paycheques in Ola Electric

While Ola Electric founder Bhavish Aggarwal got a compensation package of Rs 2.88 crore in FY24, the company’s Board approved a new salary structure in December last year which provides for him to take home up to Rs 9 crore (including variable pay) for the next five years.

This means Aggarwal may trump Park in terms of compensation in FY25, if the latter is not given a hike.

Another foreigner who is taking home a big paycheque in the group is Shaun William Calvert, who is designated as the chief operations officer of Ola Electric Technologies, a 100 percent subsidiary of Ola Electric which provides services across the electric vehicles value-chain.

Calvert was paid Rs 4.79 crore in FY24. Prior to joining the IPO-bound company, he was the deputy CEO of Vietnamese EV major Vinfast for 5 years, according to his LinkedIn profile. He also spent almost 2 decades in General Motors as a manufacturing engineer and a senior supply chain manager.

Ola Electric’s chief financial officer Harish Abichandani took home Rs 1.67 crore in FY24. He also received an employee stock option grant of 25.3 lakh shares which may be worth over Rs 18 crore in the upcoming IPO.

At the upper end of the price band of Rs 72-76 per share, Ola Electric's valuation would be about $4 billion (Rs 33,500 crore) in the IPO, down 25.8 percent from $ 5.4 billion in September.

The lower valuation is due to a global correction in tech stocks and Ola's strategy to boost wider investor participation. The IPO, which opens for subscription on August 2, has come at a time when the Indian market is trading at record highs.

The IPO comprises a fresh issue of Rs 5,500 crore and an offer for sale (OFS) of up to 84.94 million. At the upper end of the price band, OFS comes at Rs 645.96 crore. The total size of the issue, which closes August 6, amounts to Rs 6145.96 crore.

Ola Electric had a 35 percent market share in the electric two-wheeler (E2W) segment at the end of fiscal 2024, up from 21 percent in the previous year.

The company reported consolidated revenue of Rs 2,782 crore up nearly 510 percent in the financial year ended March 2023 (FY23) even as its net loss widened to Rs 1,472 crore.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.