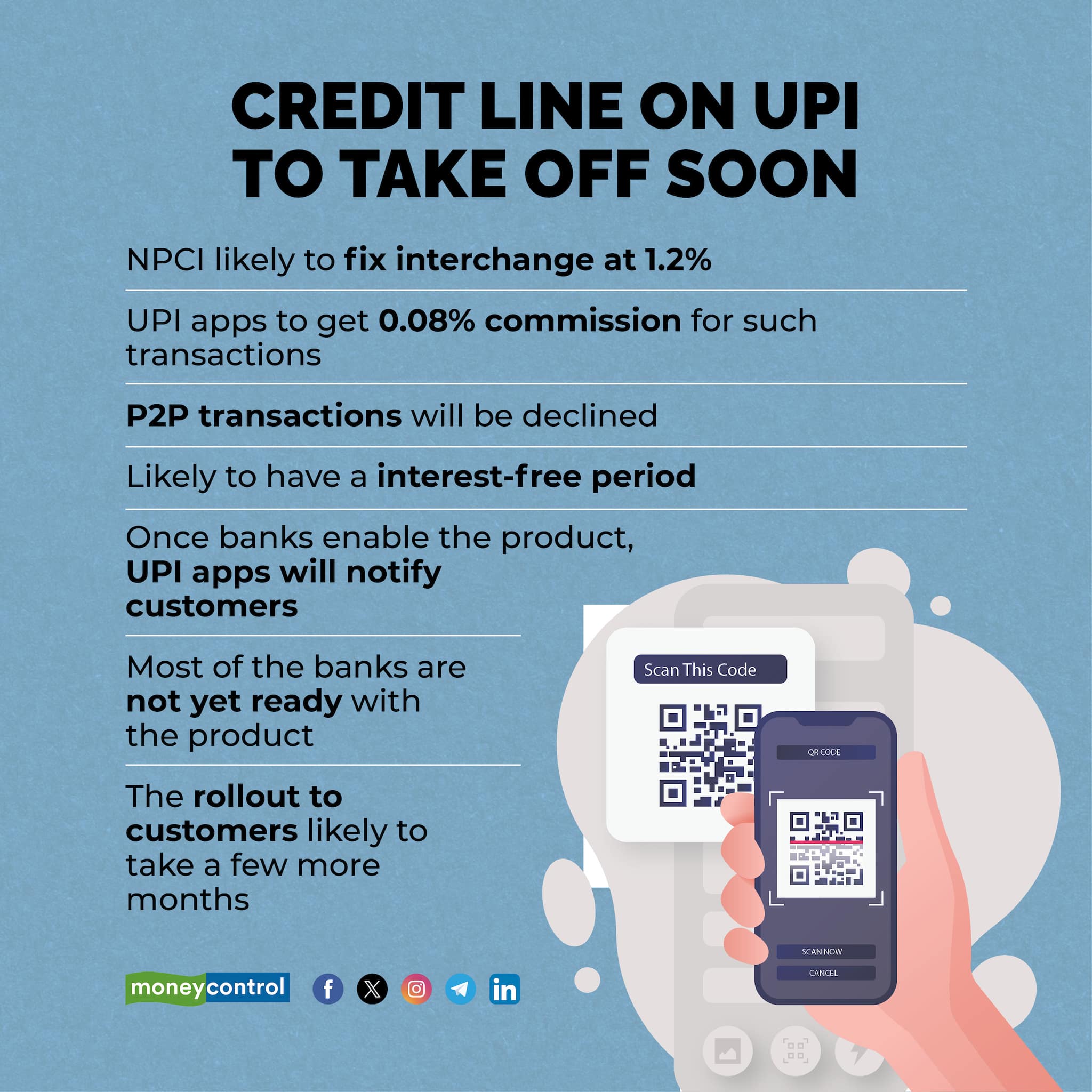

The National Payments Corporation of India (NPCI) is likely to announce an interchange of 1.2 percent for credit line on UPI transactions, according to multiple sources participating in discussions over the proposal.

NPCI, which runs the popular mobile payments platform Unified Payments Interface (UPI), is likely to issue a circular next week.

Interchange is the commission that the merchants pay to the credit issuer for every transaction. It makes up 90 percent of the merchant discount rate (MDR) that the merchants pay the banks for facilitating the transaction. The credit issuer get 100 percent of the interchange, while others get some 5-15 basis points. Others include card networks, customer bank account, merchant bank and NPCI. Interchange partly pays for the risk and interest for the capital deployed by the credit issuer. The consumer does not pay any fee in this transaction.

Also read: Why credit line on UPI has not taken off yet

The negotiations are still on between NPCI, banks and UPI apps over each partner’s share in the revenue. The third-party apps, also known as TPAPs, like PhonePe, Google Pay and Paytm will likely get 0.08 percent or 8 basis points commission for every transaction.

However, the discussions are not final and the rates could change, the sources added. The payment service provider (PSP) bank that powers the UPI function for TPAPs is also likely to get around 8 bps as commission for the transaction.

The credit line on UPI was announced around nine months ago but has not taken off. The lack of a strong business case for any of the participants in the ecosystem meant that none of them was keen to take the product to the market.

A credit line on UPI is nothing but a pre-sanctioned loan for the customer using a bank account, which is linked to the customer's UPI account. Credit line on UPI is likely to see multiple products from participating banks.

One version of the product will have an interest-free period for the credit availed by the customer, similar to credit cards and the other version where the interest will have to be paid from day one, much like how overdraft loans function.

“However, both types of variants will likely have the same interchange to avoid operational complexities,” said a digital banker aware of the discussions.

The credit line will not be available for person-to-person, also called peer-to-peer (P2P) in industry parlance, money transfers since there will not be any interchange. Such transactions will be declined. So, if a shopkeeper is using his personal savings account, such transactions will not go through.

Since credit is mostly the discretion of the banks and comes with a risk, the product is issuer-led. However, banks have been reluctant as the early adopters of the technology could be the well-heeled, upwardly mobile customers who are most likely to be its existing or potential credit card customers.

Credit cards have a much higher MDR of around 2 percent and are more profitable. Hence banks are afraid that credit line on UPI will likely undercut their card business.

However, NPCI circulars on UPI, often mandate banks to compulsorily participate in new products to ensure mass adoption among consumers.

“The success in this case will be determined by the UPI apps that will nudge the customers to try a new credit product. Rupay credit cards on UPI have been a great success. This should work too given the major irritant has now been addressed,” said a founder of fintech that works on the UPI platform.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.