Funding rounds within growth and late-stage Indian startups more than doubled in April from the year-ago month, as venture capital and private equity investments across new-age tech companies showed signs of recovery.

The Indian startup ecosystem recorded 10 late-stage funding deals in April, over four deals in the year-ago period, data from analytics firm Venture Intelligence showed. The amount of funding in the stage also almost quadrupled to $410 million from $109 million in April last year.

In addition, growth stage deals that plummeted over the last year have also flourished in April. In 19 deals, startups raised $159 million in private equity and venture capital funding in April, compared to $62 million in eight deals in the same month of 2023..

Stage-wise VC funding to Indian startups in April

Stage-wise VC funding to Indian startups in AprilThis comes after the ecosystem witnessed intermittent improvements in funding announcements across stages in the first three months of 2024. While January recorded high early-stage deals, February saw an uptick in funding across the stages. In March, however, the funding sentiments remained muted despite a slight uptick in the late stages.

“This year has been fairly kind compared to last year when there was still a little bit of sting left in the tail as far as the funding winter goes. But the first four months of this calendar year have been better both in terms of pipeline and the deal announcements quarter-on-quarter,” Chintan Antani, VP, Seed and Acceleration at IIMA Ventures, told Moneycontrol.

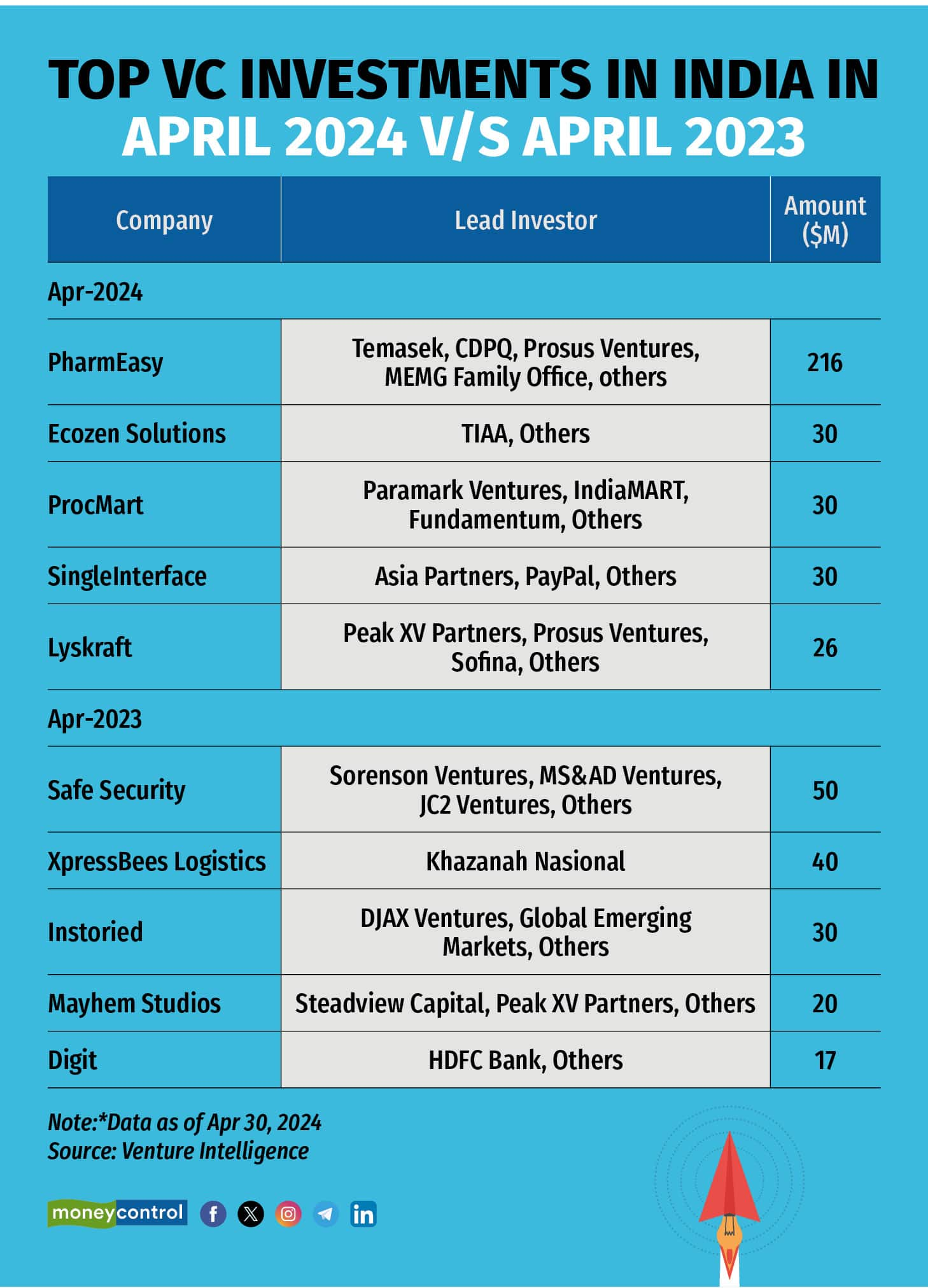

Top VC Deals in Indian startupsWhat drives the funding cheer?

Top VC Deals in Indian startupsWhat drives the funding cheer?According to investors Moneycontrol spoke to, the funding cheer comes on the back of dormant deals finally coming to a closure and better agreement on valuation and funding amount between investors and founders, putting VCs back in the driving seat.

“It's been quite positive on rounds getting closed. There was a time when a lot of rounds were just being left open and never ended about six to eight months back,” said Maanav Sagar, partner at Bharat Founders Fund.

Antani agreed and said that while investors continued to evaluate startups throughout 2023, a majority of the deals did not close. “We were frozen in a wait and watch mode. Now we're getting back into the deployment cycle again,” he added.

To be sure, the impact of the same is apparent on the overall funding to new-age tech companies. In April, Indian startups recorded $726 million in 68 deals, from $298 million in 43 deals in April of 2023 - a spike of about 144 percent.

VC funding to Indian startups in April

VC funding to Indian startups in AprilNot to miss, the total size of investment in the early stages has also recorded a slight but noticeable boom with pre-seed and seed stage startups attracting $157 million from $127 million in April 2023.

“Shorter rounds of sub $500,000 are moving quite quickly which was not the case in the entire year of 2023 because even at that stage people were a bit reluctant. Now we are moving back towards wrapping such rounds in a couple of months from first call to disbursement,” Antani added.

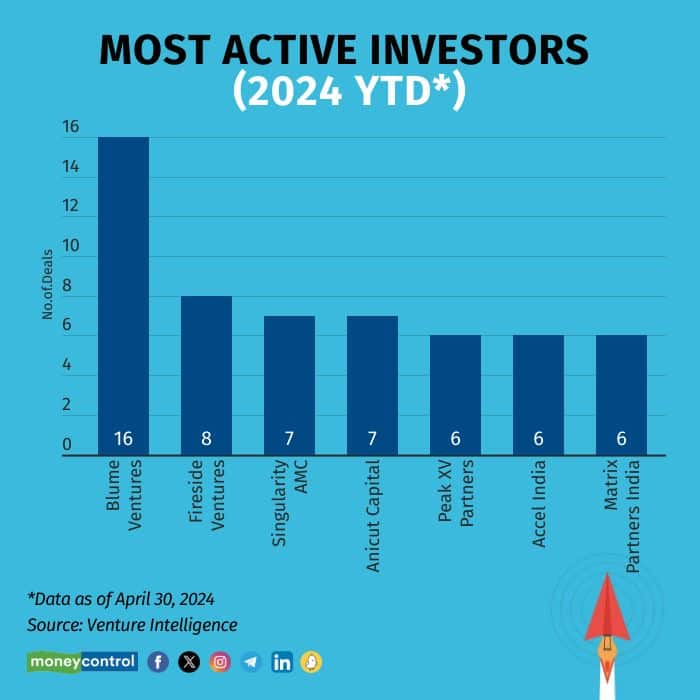

Investors like Blume Ventures, Fireside Ventures, Singularity AMC and Anicut Capital dominated the most active backer charts this month, closely followed by Matrix Partners India, Peak XV Partners and Accel India.

Most active investors in Indian startups

Most active investors in Indian startupsInvestors continue to believe that the improvement in funding levels is also majorly owed to founders being more open while negotiating valuations. “Founders have basically come to terms with whatever risk asset pricing is happening, be it closing rounds on convertibles, or decent valuations, which otherwise used to take a lot of time negotiating the final number,” said Antani.

Sagar said that the agreement also comes on the back of promoters finding it difficult to justify inflated valuations in the next round. This has given the autonomy back in the hands of investors, he added.

“We are having the luxury of time in our hands right now because rounds are getting stitched but slowly together. It's not like somebody’s looking over your back who will come and take your shot,” Sagar added.

Troubles far from overEven as things start to look up, investors caution that it is still a long way to go for the funding winter to turn to spring.

“The benchmark for investing in a series A company has gone up considerably high. Given that there are so many founders who were backed, out of which now firms have the ability to pick and choose based on which ones can have a sustainable growth and which ones can’t and then make that decision,” Sagar added.

Antani agreed and said that it is unlikely that the funding levels will reach the pre-covid levels soon. “The numbers will take a lot of time to catch up for sure. Are we going to see the pre COVID levels of funding anytime soon, our best understanding is that perhaps no,” he added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.