WeWork co-founder Adam Neumann’s redemption story has begun, according to Silicon Valley legend Marc Andreessen. His venture-capital firm has poured $350 million into Neumann’s residential real-estate startup Flow, citing the entrepreneur’s “lessons learned” — an understatement considering WeWork’s rollercoaster ride from $47 billion flexible-office giant to its near-collapse.

Perhaps unsurprisingly, there’s no mention of a smaller investment that is also a redemption of sorts: Neumann’s championing of tokenized carbon credits via a startup called Flowcarbon, which is apparently unaffiliated with Flow though both are backed by Andreessen Horowitz.

While the $70 million in funds Flowcarbon raised in May make it less significant, the firm’s recent delay of its cryptocurrency launch looks like a cautionary tale. As frothy moonshot investing moves from We to Web3, blockchains are too often proffered as a solution to many problems: excessive jargon covers confusion about viable use cases and retail crypto-traders are vulnerable to getting fleeced.

The idea behind FlowCarbon is predictably noble and utopian: Help fight climate change by fixing the opaque and fragmented market for voluntary carbon credits issued by companies to buff their green credentials. “Goddess Nature Tokens” — $38 million of which were reportedly sold as part of the fundraising – would bundle together tokenized credits registered by projects like reforestation and find buyers looking to offset their own carbon footprint. Or, as Neumann said last year, make money while helping the environment.

But sticking a blockchain into the trading process looks a lot like a hammer in search of a nail. The problem with the carbon-credit market is a lack of oversight and rules that have seen poor-quality credits get sold and re-sold without reducing any carbon dioxide in the atmosphere. Blockchains record, they don’t filter for garbage: As carbon-offset program Gold Standard has put it, poorly-managed tokenization of carbon credits could end up either a waste of energy or a “scam.”

This isn’t a new criticism of crypto, but it’s a glaring one as VC money pours into Web3 with vague and heady techno-optimism. Some $267 million was poured into climate or carbon-related crypto deals in 2021 and another $156 million this year through early July, according to data cited by the Wall Street Journal. Explaining why creating an intangible crypto-asset out of an already-intangible carbon asset will “incentivize climate-positive behaviors” — as Andreessen Horowitz put it when announcing its investment in Flowcarbon — is starting to sound as confusing as Neumann’s famous description of the We brand as “elevating the world’s consciousness.”

Existing tokenized carbon projects haven’t exactly incentivized behaviors of the positive kind. The Dayingjiang III hydropower dam in China’s Yunnan province recently sold millions of carbon credits to anonymous entities via crypto platform Toucan, according to Bloomberg News, even though it’s been running since 2006 — not a big help for the environment. The scope for abuse has become so obvious that countries are cracking down on offset deals, while Verra — a carbon-credit project register — has announced a halt to tokenizations pending new rules.

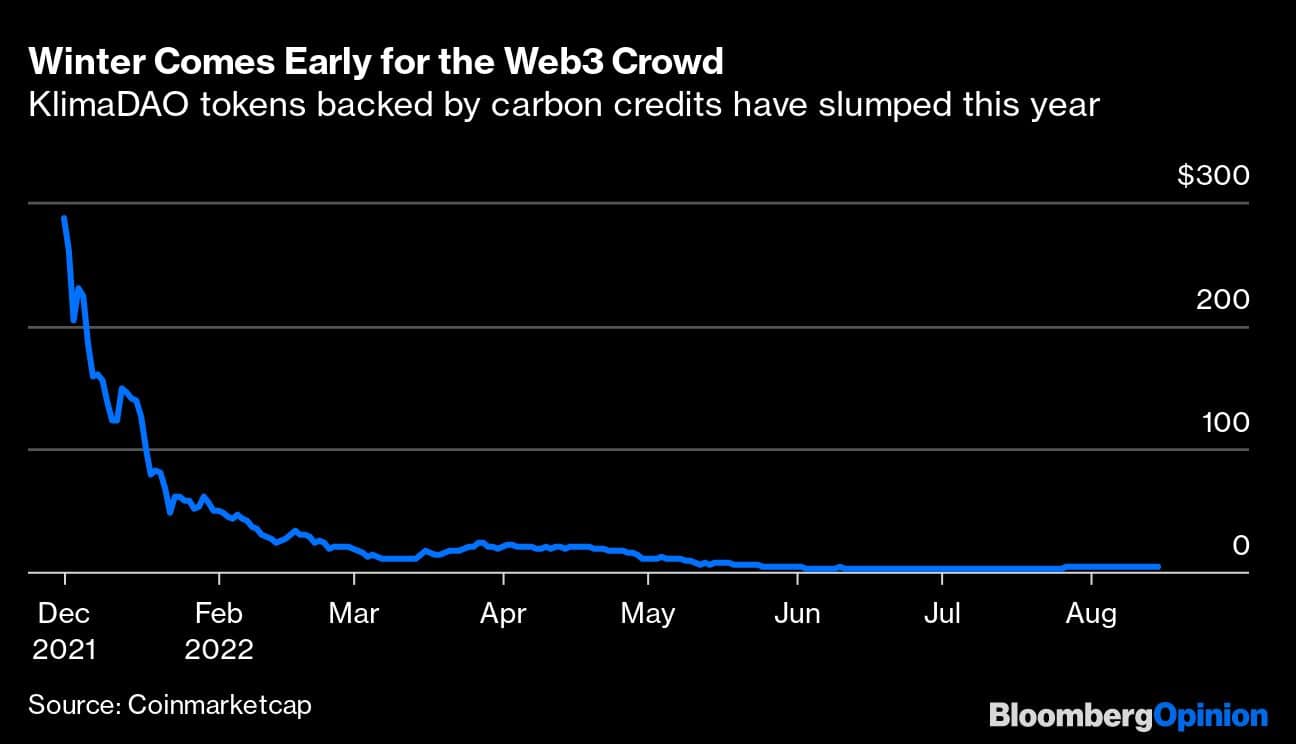

While Flowcarbon claims to have a more discerning approach to bundling assets, it looks on paper like more complexity and opacity rather than less. There’s no evidence that tradable carbon tokens behave any more sensibly than the many other speculative coins out there. As the below price chart of one project, Klima DAO, shows, being “backed” by carbon credits is no protection against the bursting of a speculative bubble — and also suggests retail investors are being taken for a potentially dangerous ride.

Clearly, there is potential in cleaning up the inefficiencies of the carbon-credit market. But it’s not clear yet why this is a problem that has to be solved by this specific platform rather than other institutions like banks, which are building solutions of their own via the Carbonplace platform. It’s rather ironic that the one obvious demand crypto firms might have for credits, namely to offset wasteful crypto-mining, is rarely mentioned.

So while attention shifts to Neumann’s return to an apparently more grounded and bricks-and-mortar world, complete with the narrative of “lessons learned,” it’s worth keeping an eye on the Goddess Nature Token as an indicator of where the VC-powered cult of We ends up next.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.