Knee replacement surgeries may soon get much cheaper with the Indian drug price regulator the National Pharmaceutical Pricing Authority (NPPA) capping the prices of ortho knee implants citing public interest.

The prices of ortho knee implants used in knee replacement surgeries will get cheaper from 30 percent to 78 percent on an average depending on the type and material of implants.

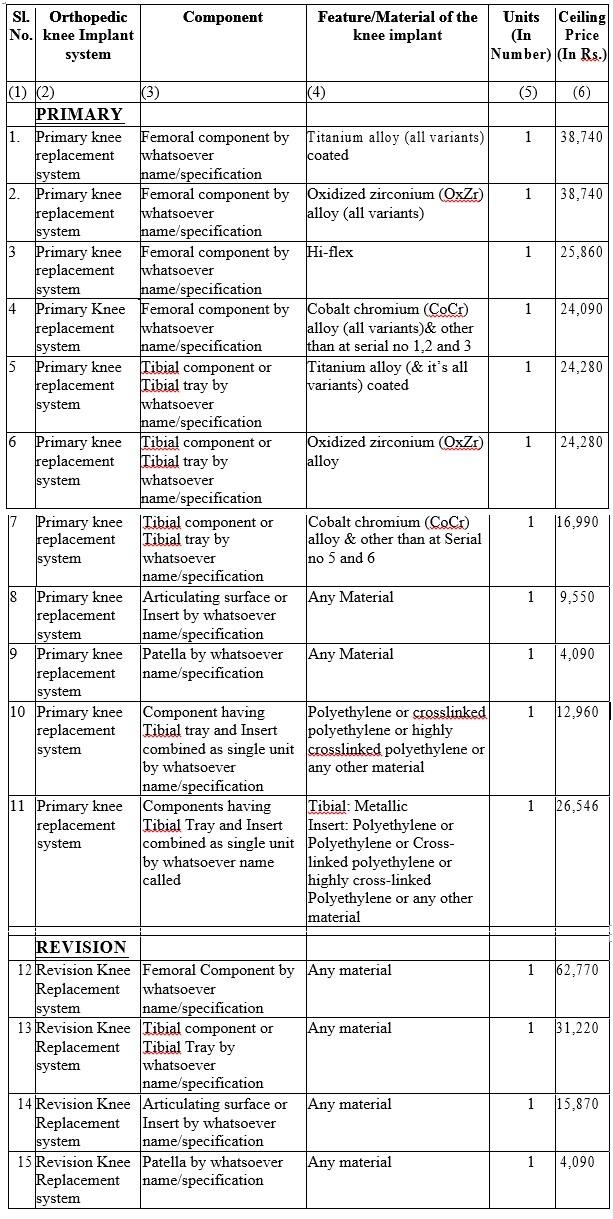

As per the NPPA notification - ortho implants that include prices of femoral components whose maximum retail price (MRP) that used to range from Rs 74,875 to Rs 267,000 are now capped at Rs 62,770. Tibial component that ranged between Rs 51,000 and Rs 165,000 is now fixed Rs 31,220, while inserts that was priced Rs 25,041 – Rs 57,583 is now clamped at Rs 15,870. The price of Patella was fixed at the lower end of MRP at Rs 4090 – it was priced between Rs 4,000 and Rs 20,000 earlier.

The new prices will come into immediate effect.

NPPA said it held meeting on the matter from August 10 - 14, 2017 after duly examining in detail, deliberating and considering all available information and viewpoints and all relevant options for price fixation of orthopedic knee implants

“Under present extraordinary circumstances of a failed and exploitative market because of information asymmetry between the patient and healthcare delivery system, (NPPA) has decided that it is necessary to control the excessive trade margins for fixing ceiling price of orthopedic knee implants which is fair and reasonable based on its intrinsic value of the implants with rational margins to protect public interest,” said NPPA in its notification issued under its chairman Bhupendra Singh.

“It is noticed that orthopedic-knee implants are having unjustified, unreasonable and irrational high trade margins leading to their exorbitant prices which affects the out of pocket expenses of patients and lakhs of patients are not able to pay for arthroplasty procedures because of these exorbitant prices and suffering in pain,” NPPA added.

NPPA estimates patients requiring arthroplasty intervention, both diagnosed and undiagnosed, is about 1.5 to 2 crores out of which only about 1 lakh plus well off patients are in a position to pay for it every year.

“Osteoarthritis is likely to become fourth leading cause of disability by year 2020’ as per the W.H.O and India is likely to be one of the leading countries of such immobilized citizens in terms of numbers; and whereas preventing such a scenario is essential in individual as well as national interest,” NPPA noted.

NPPA asked hospitals utilizing knee implants to specifically and separately mention the cost of the knee implant component-wise along with its brand name, name of the manufacturer, batch no. specifications and other details in the final bills to patients and their representatives.

NPPA asked manufacturers to ensure the availability of all the brands of implants and ensure that no disruption is caused in the supply chain because of printing new MRPs

NPPA has earlier found that importers, distributors and hospitals involved in ortho knee implants were enjoying substantial trade margins. The importers enjoy an average, healthy 29 per cent to 76 per cent margin, which is followed by 120 per cent to a full-figured 163 per cent margin for the distributor and hospital. The total trade margin on five implant components used in the knee range between 211 per cent and 449 per cent.

Medical Technology Association of India (MTaI), an association of research-based medical technology companies said it reviewing the Order from the NPPA.

"We need to balance affordable health care today with the importance of incentivizing investment in innovation that can transform health tomorrow," MTaI earlier said.

It is estimated that over two lakh replacement surgeries are conducted in India and the market is growing at an estimated 26-30 per cent annually.

The government earlier has capped the prices of coronary stents, reducing the prices by 85 percent in a major relief to the patients after similar exercise that found exorbitant trade margins.

According to consulting firm Sathguru Indian orthopedic devices market is around USD 375 M or Rs 2,400 crores growing at around 20% every year for the next decade to reach USD 2.5 billion or Rs 16,000 crores by 2030.

Knee replacement implants will alone be little over half that market.

About 80% of the joint replacement implants used by Indian surgeons are imported.

The knee segment is dominated by multinationals such as Zimmer Biomet, Depuy Synthes, Stryker and Smith & Nephew. Domestic companies which are active in this space include Meril, Inor, Biorad Medisys, TTK and Sharma Orthopedics.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!